Cluster cities focus on producing hardware, software and medical devices.

Clusters depend on talent and venture capitalist firms that keep the engines running in search of returns.

You get better quality of life for half the cost,” says Simon Crosby, co-founder of computer security firm Bromium, as to why he moved from California to Seattle, according to The Economist. Bromium’s headquarters are in the Golden State’s town of Cupertino, of Apple fame, and Crosby regularly takes the “nerd bird” as the planes full of techies who live in Seattle and work in Silicon Valley has come to be known.

Venture capitalists often make the two-hour commute the other way. Most money invested in Seattle startups comes from California, and the Jet City in the Northwest is home to only a few venture capital firms, such as Ignition Partners and the Madrona Venture Group.

Why these two? Both Silicon Valley (the area south of San Francisco and around Mountain View, Santa Clara, Palo Alto and San Jose) and Seattle have become nodes for the development of industries such as technology, aerospace and biotech, among many others, where close com- petition has created and environment ripe for innovation.

“Clusters” says Michael E. Porter in his book Clusters and the new economics of competition “represent a kind of new spatial organizational form in between arm’s-length markets on the one hand and hierarchies, or vertical integration, on the other. A cluster, then, is an alternative way of organizing the value chain.”

These linked neighborhoods, Porter adds, include suppliers of specialized components, machinery and services. Clusters, he says, also extend downstream to channels and customers, allowing all members to benefit as if they had greater scale by gathering data in a meaningful way.

They can also drive people away as their desirability hikes up prices. San Francisco knows about it. In recent years, there’s been growing concern about skyrocketing housing prices fueled by the tech industry’s boom. It’s the most expensive rental market in the country, with the median one-bed- room apartment renting for over US$3,500, according to the report from real estate site Zumper.

Clusters have defined the way a city or a certain service works. Throughout the years, clusters in banking or in automotive production have determined the way an urban center builds itself; Detroit and New York are both an excellent example of cities running on the organizational reproduction of these businesses.

The Economist explains clustering as a means for small companies to enjoy some of the economies of scale, an isolated greenfield site in a depressed region where government grants are plentiful and open to bring a young company immediate benefits.

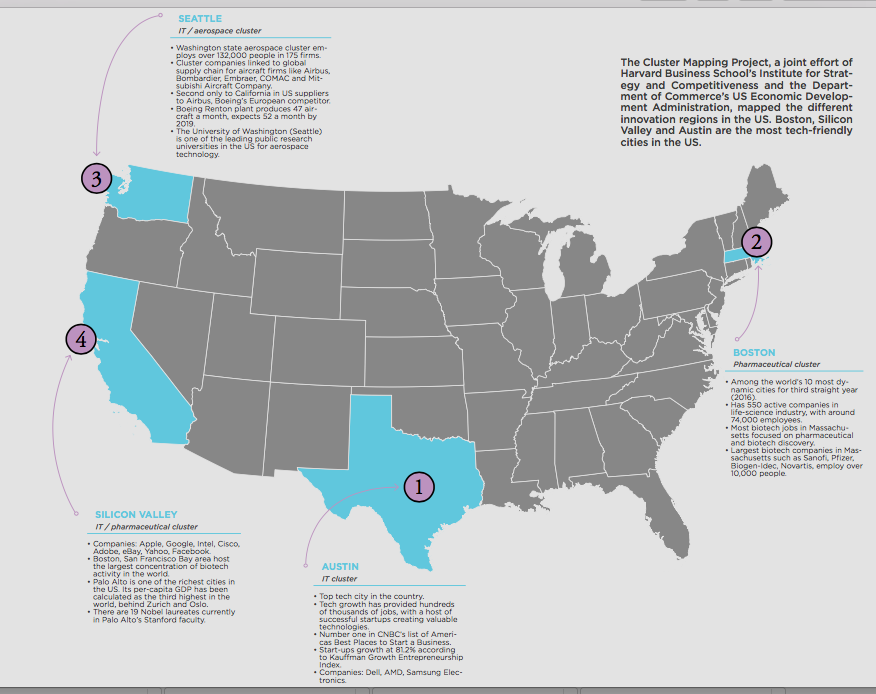

According to Jerome S. Engel in his lecture Global Clusters of Innovation: Lessons from Silicon Valley, it was not until the 1990 decade that innovation-centered business clusters began to gain more attention, when the Boston and Silicon Valley markets where emerging and a new form of commercializing was gaining power. At that same time universities where planning expansion and an integration of new disciplines.

Clusters “represent a kind of new spatial organizational form in between arm’s-length markets on the one hand and hierarchies, or vertical integration, on the other”

Coordination, expertise and effective partnerships are all in hand in the cluster universe, a pool of specialized knowledge powering opportunities. The blend of government, universities and entrepreneurs also help build the important muscle giving birth to the modern powerhouses of invention that develop the greatest gadgets and data able to influence markets of all types: military, medical, social, space, business, education, and much more.

At one point, one-third of all venture capital in the US was deployed in Silicon Valley, Engel says, proving the importance of cementing future clusters, fulfilling the demand of local industries independent of the size of the local market, leveraging the areas economic growth and prosperity.