Rich Raffetto

Senior Executive Vice President & President of Commercial and Private Banking / Flagstar Bank, N.A.

Rich Raffetto, Senior Executive Vice President and President of Commercial and Private Banking, emphasizes that 2026 is a key year for Flagstar Bank, N.A., following the bank’s recent acquisitions and successful transformation, which has resulted in a bank that’s large enough to meet client needs effectively while remaining small enough to offer tailored and personalized service.

Flagstar Bank, N.A. (“Flagstar”) is one of the largest regional banks in the country, recognized for its strong performance and a customer-centric culture rooted in strong relationships.

The company, based in Hicksville, New York, operates approximately 360 locations across nine states. As of 9/30/25, Flagstar had assets totaling $91.7 billion, loans amounting to $63.2 billion, deposits of $69.2 billion, and stockholders’ equity of $8.1 billion.

Leadership with Experience

Rich Raffetto is deeply committed to his role leading Flagstar’s fast-growing Commercial & Corporate Banking and Private Banking & Wealth Management platforms. “I’m delighted to serve in this dynamic role. While I’ve been a banker for more than 35-years, I’ve never experienced such an entrepreneurial “build and scale” opportunity as what we have today at Flagstar.”

Rich tells CEO North America, “I spent 27 years at two different firms: 14 years at The Bank of New York, now BNY, and 13 years at U.S. Bank, one of the top five commercial banks in the United States.” More recently, he served for approximately four years as President and a member of the Board of Directors of City National Bank, the U.S. commercial and private banking arm of Royal Bank of Canada.

“I’ve been able to curate the scaling of our business by hiring mid-career bankers who have experience in different markets, segments of commercial banking and private banking and wealth and, curate that talent with people that I’ve gotten to know in the course of my 35-year career.”

Over his 35 years in the industry, Raffetto has discovered that more than numbers, it’s the relationships, people, and trustworthy, respected leaders who truly serve as the heart of the banking sector.

What initially attracted him to Flagstar in 2024 was an invitation from a longtime U.S. Bank senior colleague, Joseph Otting, now Flagstar’s Executive Chairman, President and CEO, to join an exciting new executive management team that was being assembled alongside a dedicated private investor group that had just invested just over $1.0 billion dollars of new capital into Flagstar.

Raffetto recounts that when Otting said he was transforming the company’s governance, installing new members on the board of directors, and bringing in new leaders, “I jumped at the chance to be part of this new executive management team at a bank that’s big enough to matter. Flagstar is just under $100 billion US dollars in total assets and has a presence in four major geographies across the country.”

His extensive knowledge of the banking industry enabled him to recognize the exciting potential of this new endeavor: “I think Flagstar is an incredibly unique opportunity,” Raffetto says.

“It’s not very often that you have a company of this size that’s getting a big capital injection and a significant makeover from a risk, governance, and growth perspective to really make a big impact. So that’s why it is super exciting.”

“Whether it’s a commercial or corporate client or a private banking and wealth client, we believe being a digitally enabled relationship bank is the path to success, with that client experience, client insights, and that advisor mentality as our real competitive advantage.”

Driving Long-Term Value

Raffetto notes that recent years have brought significant upheaval to the U.S. regional banking sector, with three major high-service banks, First Republic, Silicon Valley Bank, and Signature Bank, experiencing crises that led to their closures.

However, this turmoil, which affected many mid-sized banks, combined with several more recently announced bank mergers and acquisitions, has created a substantial opportunity for a similarly sized institution in that ZIP code to step in and fill the gap. Raffetto believes, “I know Flagstar is very well and uniquely positioned to do just that.”

Since the shakeup, Raffetto’s team at Flagstar has strategically positioned itself to address modern challenges and meet market needs. “Many of our high-net-worth business owners, C-suite executives and ultra-high-net-worth entrepreneurs are people who are running companies that are either privately held or publicly traded and have complex banking and financial advisory needs. They are looking for a high-touch bank that often can outhustle the larger institutions and provide a particular service.”

Raffetto believes Flagstar provides the kind of tailor-made service offering that spans the commercial and corporate banking requirements of these professionals, as well as their personal needs, including individual borrowing, wealth management, estate and succession planning, and family office needs. “Flagstar is big enough to handle all of those needs, but small enough to have them all covered under one organizational and client service infrastructure.”

“It’s a privilege to partner with Flagstar Bank to support their growth initiatives in Commercial and Private Banking. RelPro is providing actionable intelligence and workflow efficiencies that enable bankers to build informed and lasting relationships with companies and business decision-makers.”

Martin Wise / CEO and Founder of RelPro

According to Raffetto, Flagstar’s approach to commercial, corporate and private banking differentiates the company in the marketplace from a client-coverage perspective because “we can serve that entrepreneur’s needs, whether they’re business or personal.”

Building the Right Team

In 2026, Raffetto shares that one of his main focuses will be continuing to expand his team. “I’ve had the privilege, over the past 18 months that I’ve been on board, to recruit more than 250 new professionals to Flagstar as we look to scale the commercial, corporate and private banking business lines here at Flagstar, and it’s one of the most exciting things I’ve been involved in throughout my long banking career.”

He explains that the best way to scale the enterprise with people isn’t through executive search firms or headhunters. Instead, it’s about reaching out to industry contacts he and his team have known for many years and selecting the top talent as the organization rapidly grows.

“This is probably the fastest growing commercial, corporate and private banking organization in the US right now, because we’re starting from a relatively low base because our legacy bank was more of a commercial real estate focused lender and a real estate bank than a commercial and private bank.” Raffetto proudly admits, “We have this unique opportunity to grab talent in the industry and fill that void that that opened up when those three banks went away.”

“Chatham is honored to partner with Flagstar Bank in advancing its digital transformation and prioritizing the success of its clients. Our technology brings clarity to complexity, enabling Flagstar to deliver optimal capital markets outcomes. It is a privilege to support Flagstar as it harnesses the future of financial technology and advisory.”

Amol Dhargalkar / Chairman and Managing Partner, Chatham Financial

Harnessing the Latest Technology

The other area Raffetto’s team will focus on in 2026 is improving efficiency and harnessing technology to enhance the client experience. “We have the opportunity to drive the client experience with leading-edge technology and serving clients, not just with great people, but with technology infrastructure that leverages the power of recent innovations.”

Today, Raffetto and the company’s CTO, Chris Higgins, are consolidating legacy technology infrastructure with the goal of equipping Flagstar’s bankers with comprehensive information about their customers and clients, ensuring they understand the full scope of their relationships.

“We’re introducing a best-in-class CRM platform so that we have bankers who are enabled with the right technology.” “We’re going to be introducing AI into the infrastructure so that, through our CRM platform, those bankers will have an platform that leverages data to suggest, for example, which client might need the next best action or touch from a new business development perspective or an advisory perspective.”

Raffetto says Flagstar is also adopting and upgrading its internal capabilities very quickly as part of its transformation, for example, to combat cyber risk and fraud risk – key areas of concern across the banking industry.

A Client-Focused Culture and Future

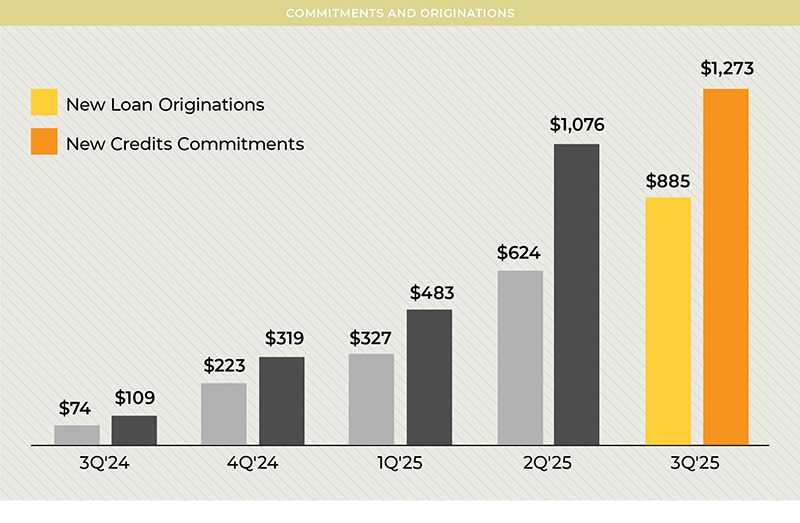

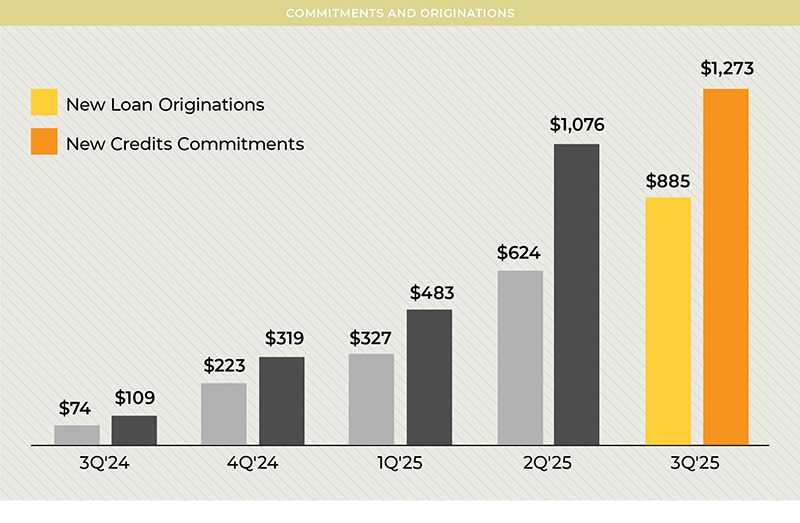

Raffetto highlights that beyond 2026, in the next 3 to 5 years, there are plenty of exciting opportunities ahead for the bank. “We have between $10 and $20 billion of fresh credit capital to put to work in our commercial, corporate and private banking businesses, which is really an amazing opportunity for us to become more relevant to corporate clients, business owners and high-net-worth individuals.”

According to Raffetto, the bank’s fresh capital and the experienced bankers that Flagstar is recruiting onto the platform present Flagstar with “an incredible growth opportunity and growth platform” not only to build out Flagstar’s own platform but also to serve clients and fill the void left by the disappearance of those three mid-sized banks in the U.S. that failed, as well as serve those whose bank may be distracted by a recent or pending merger or acquisition.

The Senior Executive Vice President and President of Commercial and Private Banking says there are several key areas where Flagstar competes very effectively. “We can compete on product capabilities. We can compete on efficiency and/or on service and client experience. We really believe that our competitive advantage is delivering on all four of those critical metrics.”

“We’re a very transformational company that’s undergoing a lot of change and a lot of positive growth very quickly.”

Raffetto also highlights the longevity of his plan to build a high-quality team. “We really want to compete on our service and on the fact that we are putting very experienced advisory bankers in front of our clients. And those bankers bring value-add to the equation every day, leveraging technology and ideas, not just capital, for the benefit of our clients.”

“Being an ideas-first and client-service-first organization, we believe, will be how we continue to win in the marketplace and will set us apart from our competitors.”

In the long run, Raffetto’s primary goal is to inspire his team to create meaningful value for clients, communities, and shareholders, while fostering a positive, collaborative environment and culture.

His vision for Flagstar is simple: “What we’re trying to build, and what we are building, is a top-tier digitally enabled relationship bank that is large enough to meet our clients’ needs yet small enough to provide personalized care.”

“Whether it’s a credit solution or a capital market solution, we will leverage tools, including AI, as part of how we deliver and conduct credit analysis and other analytical work that helps us deliver capital to our clients.”

Flagstar’s Key Business Message

“The first key message I would love for investors and partners to know about Flagstar externally is that we are a dynamic company undergoing significant transformation and growth,” Raffetto proudly tells CEO North America.

He acknowledges that this is a “unique arena” because Flagstar operates within a very mature industry. “Thanks to the new executive management team and significant private equity influence, including ownership and board representation, we are a company that’s moving very quickly in our transformation journey. I find this especially unique and exhilarating in the banking sector, which often tends to be bureaucratic and slow,” he explains.

“We benefit from having a very active board that wants us to be nimble and move very quickly with our strategic initiatives, while still being prudent and best-in-class in all areas of risk management. And I find that, frankly, as somebody who’s very experienced in the industry, to be very refreshing and also very unusual.”

Another integral part of Flagstar’s journey that Raffetto wants to acknowledge is its technology transformation. “While we’re not the first mover from a technology and process perspective, we’re going to get the benefit of today’s innovation, including AI, as we scale and build.”

“We want to be a company that’s viewed as a technology-first organization and one that remains laser-focused on the client experience as well.”