Christopher Zimmer

President and CEO / Universal Stainless & Alloy Products, Inc.

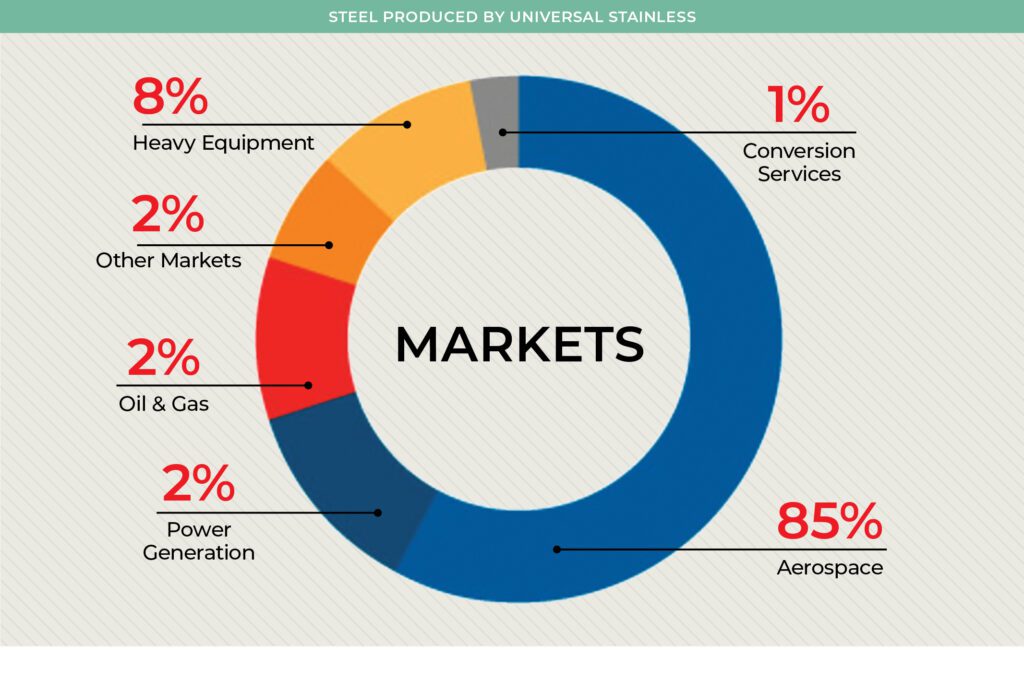

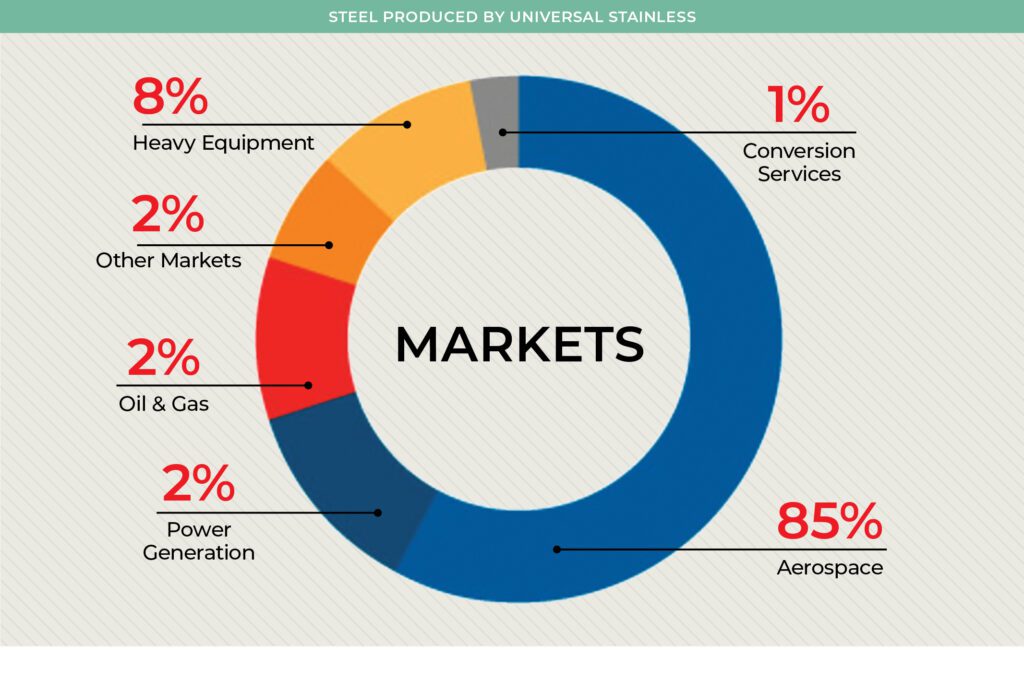

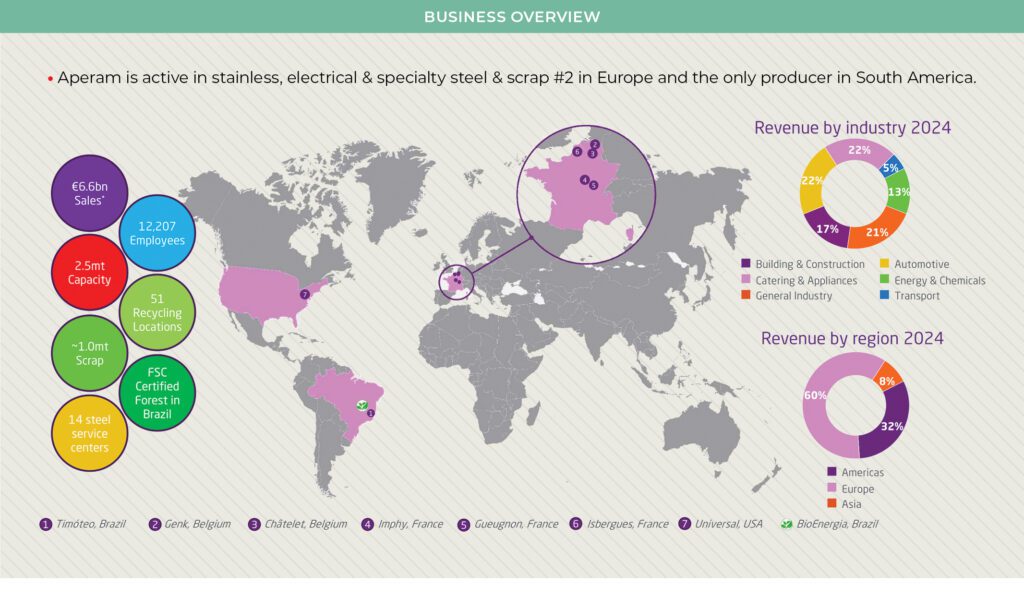

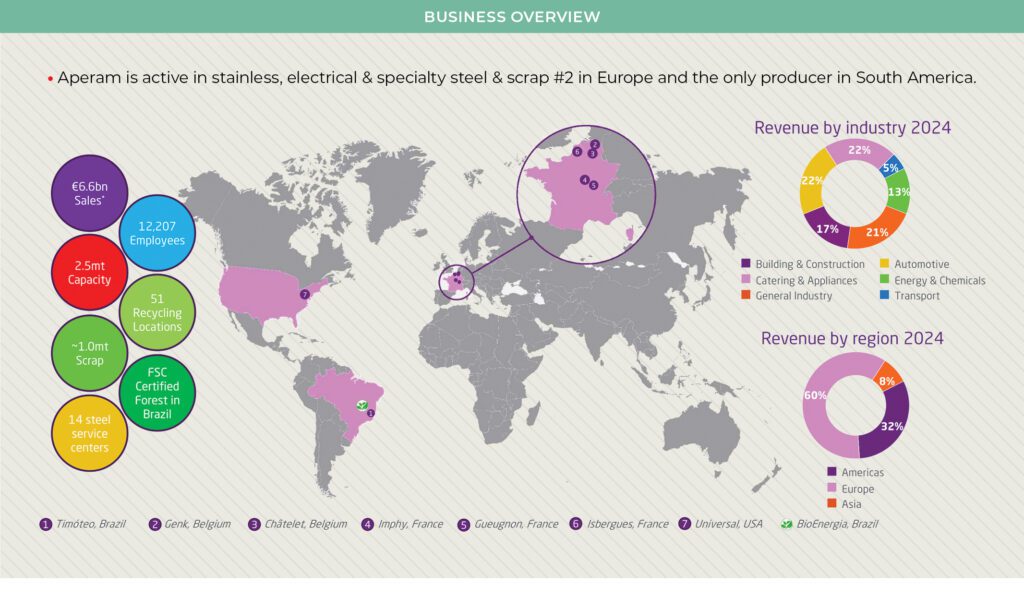

Universal Stainless and Alloy Products Inc. is counting on its January purchase by Luxembourg-based Aperam SA, one of the world’s leading stainless, electrical and specialty steel producers, to solidify and expand its role as a top U.S. supplier of high-quality alloy steels to the aerospace, power generation, oil & gas and heavy equipment industries.

For Christopher Zimmer, Chief Executive Officer of Universal Stainless and Alloy Products, Inc., the January purchase of his Bridgeville, Pennsylvania-based U.S. steelmaker by Aperam SA brought his three-decade career, in a way, back to its roots.

The steel business today bears little resemblance to what it was in the early 1990s. During Zimmer’s 18 years at Universal Stainless, he contributed to the industry’s transformation and restructuring, helping his company shift away from commodity-priced steel toward markets that demanded higher-quality and higher-margin steel inputs.

Before coming to Universal, Zimmer spent 12 years on the technical and commercial sides as a sales and marking executive for the North American distribution operations of a German-Swiss steel group.

“It’s been rewarding to see the company transform throughout the years as we’ve shifted it from what I would characterize as a relatively simple commodity type of a business to one that is focused on high-end products,” he said.

“I think our business is not just about price. Sometimes people can get confused with what is the thing that differentiates a steel producer. Right now, we see that price can have some short-term impacts on buying decisions, but ultimately, they’re not sustainable.”

Global Horizons

Now, the purchase of Universal Stainless by Luxembourg-based Aperam is reconnecting him with Europe as the industry faces a new round of global steel reorganization in the wake of geo-political tension and rising tariffs around the world. This has not only increased the incentives for foreign-based steelmakers to seek production in the United States but also for U.S. steelmakers to seek new opportunities abroad, Zimmer explained.

Aperam, which has stainless and alloy-steel operations in Europe and Brazil, has been moving in a similar direction toward higher-value, non-commodity alloy steels since being spun off from the ArcelorMittal Group in 2011.

“Aperam has been expanding its footprint into India and into Asia,” Zimmer said. “I think that the marriage was very good because they also wanted to have a larger North American industrial footprint.”

“I try to make sure that I create an environment here where people are not afraid to fail because I feel that that stifles innovation.”

“Universal has a very strong presence with Boeing, Lockheed and Bell Helicopter,” he continued. “Expansion into the European supply chain with Aperam and our colleagues there really give us an opportunity to accelerate in a more meaningful way with people like Airbus and Leonardo SpA.”

Investment Opportunities

And with Russia’s invasion of Ukraine and its increasingly hostile acts against former Soviet satellites that are now part of the European Union and NATO, the demand for high-quality steel from defense contractors in Europe is likely to rise as European nations re-equip their armed forces after years of post-Cold War disarmament.

“Europe is going to have to redefine who they are as a defense industry,” he said. “How this industry gets built as Europe buys more fighter jets and helicopters and all of those different things, there’s going to be an opportunity for us.” he added.

Meanwhile, Universal Stainless is counting on its new position as part of a larger international specialty steel group to expand and modernize its four U.S. facilities.

Zimmer could not provide many specifics, but they will almost certainly bring major changes to its mills in Bridgeville, North Jackson, Ohio, Titusville, Pennsylvania and Dunkirk, New York. Universal Stainless, founded in 1991, was formed around a core of reorganizing and transforming legacy steelmaking facilities. That process now needs to be reinforced.

Automation And Quality

One area of investment will be automation to boost safety, increase quality control and deal with the increasing cost of hiring, training and retaining an increasingly itinerant and fickle manufacturing workforce.

“I think modernization and automation is a critical focus of ours,” he explained. “It’s an industry that has had a lot of very talented people, what I would call craftsmen. These are people who understood the equipment and the processes very well.”

“The industry,” he continued, “has had a crash course through COVID with the retirements that we’ve had. We’ve learned that while we’ve got a lot of very talented, intelligent people coming into the business, that craft and that knowledge was lost.”

“And innovation can be the big home run, or it can be a way of just modernizing the way that we do things to be able to move forward. Productivity is absolutely key.”

Zimmer feels that the young labor pool available to replace those older, retiring craftsmen and women lacks enough people willing to commit to a single company or industry like their parents and grandparents did. This leads to rapid turnover. Workers, he said, rarely stay in one place more than two to five years.

Changing Labor Force

“If I can be a bit cynical, I think the day of employees – and I’m talking generally on the blue-collar side about the people that are out there making the product – coming in and saying, ‘Ok, what a great day. I’m here to begin my 30-year career’ is over.”

The company is looking to more robotics on the shop floor to smelt, forge, bash, roll and shape steel and the use of artificial intelligence (AI) driven metering and analysis technology to carry out difficult but sensitive tasks related to safety, quality-control and operational management too. “This is everything from basic-level automation, all the way up through how we implement AI in the way that we run our organizations,” Zimmer said.

“Sometimes AI is not the high-end fancy things that are born of movies but really being able to take tasks that are done on a repetitive basis, making sure that they’re done properly the same way every time,” he added. “These are applications where the material can’t fail.”

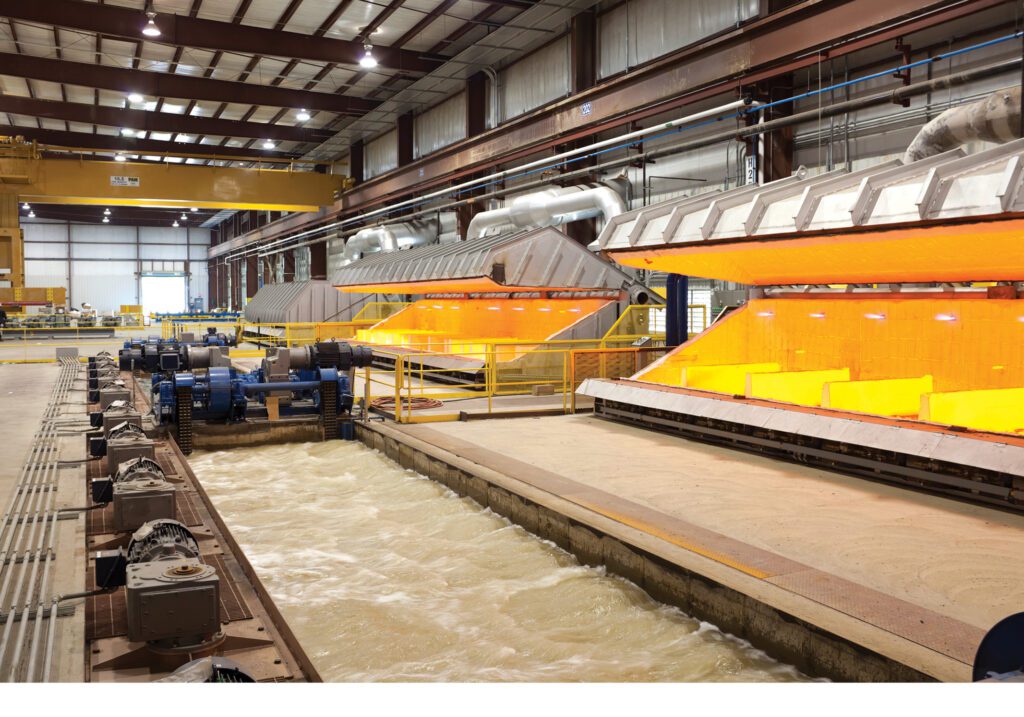

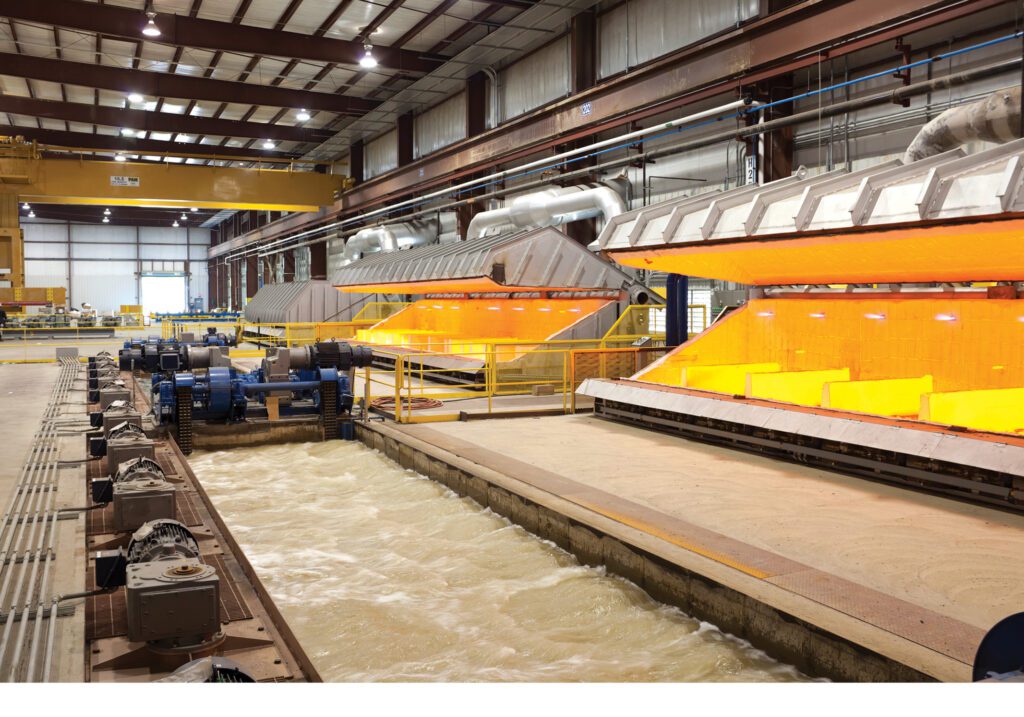

Making steel is a science, Zimmer says, and new technology and upgrades to make the company’s legacy mill infrastructure function more efficiently and autonomously is essential to meet the increasingly high standards of quality control required by major Universal Stainless clients.

Limits Of Change

At the same time, however, Zimmer says he is very aware that automation and AI can only go so far, and that in a time of higher and higher turnover in the industry as a whole, getting the human portion of the equation right is also essential.

The stainless and alloy steel business may require more and more automation and technology, but it’s also still a big, loud, capital intensive, infrastructure-intensive industry that depends on continent and world-spanning transportation and supply chains to operate.

Good business, he believes, is not just about price in such an environment but about relationships too. Short-term thinking can lead to long-term pain.

“We’ve aimed to position ourselves with suppliers and customers that have a common long-term objective so that our mutual success keeps us on track. So, when things do go wrong, when the modernization, when the dysfunction happens, we have the ability to work closely with these customers and continue to stay on track,” he said.