Thasunda Brown Duckett

President & CEO / TIAA

Thasunda Brown Duckett, President and CEO of TIAA, has strategically positioned her organization in 2026 to fight for a more secure and inclusive financial future for all Americans.

The Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA) was founded by Andrew Carnegie in 1918 to help educators achieve secure retirements.

Today, TIAA is a respected Fortune 500 company proudly carrying on its founder’s legacy. It supports over 5 million active and retired employees with services such as retirement planning, wealth building, and asset management. Its core clients are educators, researchers, healthcare professionals, and government employees.

A Transformative Leader

When Thasunda Brown Duckett became President and CEO of TIAA in May 2021, she joined a select group of Black women leading Fortune 500 companies, breaking barriers and setting new standards in executive leadership.

Before joining TIAA, she served for 17 years at JPMorgan Chase, holding key executive roles, including CEO of the Consumer Bank and Auto Finance. She also served as a Director of Emerging Markets at Fannie Mae.

Since becoming TIAA’s President and CEO, Duckett has received numerous accolades. In 2025, she was named No. 5 on The Most Powerful Women in Finance list. She was also named one of TIME’s 100 Most Influential People, ranked 34th on Forbes’ list of the World’s 100 Most Powerful Women and 16th on Fortune’s list of Most Powerful Women.

Under Duckett, TIAA has expanded its mission and grown its assets to over $1.4 trillion, aiming to help all Americans achieve a dignified and secure retirement.

“Many Americans retire without knowing how long they will live or how long their savings will really last. Even people with generous retirement plans at large companies often don’t have the security that comes with knowing they’ll have a monthly income that will last the rest of their lives.”

Delivering Reliable Returns

In December 2025, TIAA was identified as the third-largest and fastest-growing 529 plan manager in the United States. Additionally, TIAA and TIAA Life are among only three insurance groups to receive the highest ratings from three of the four leading rating agencies, including S&P and Fitch.

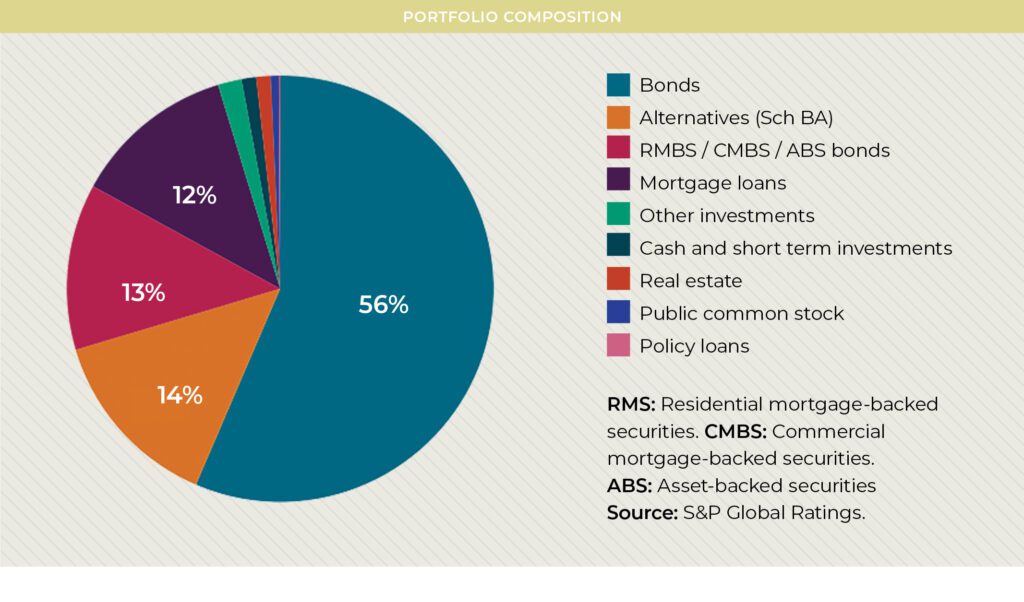

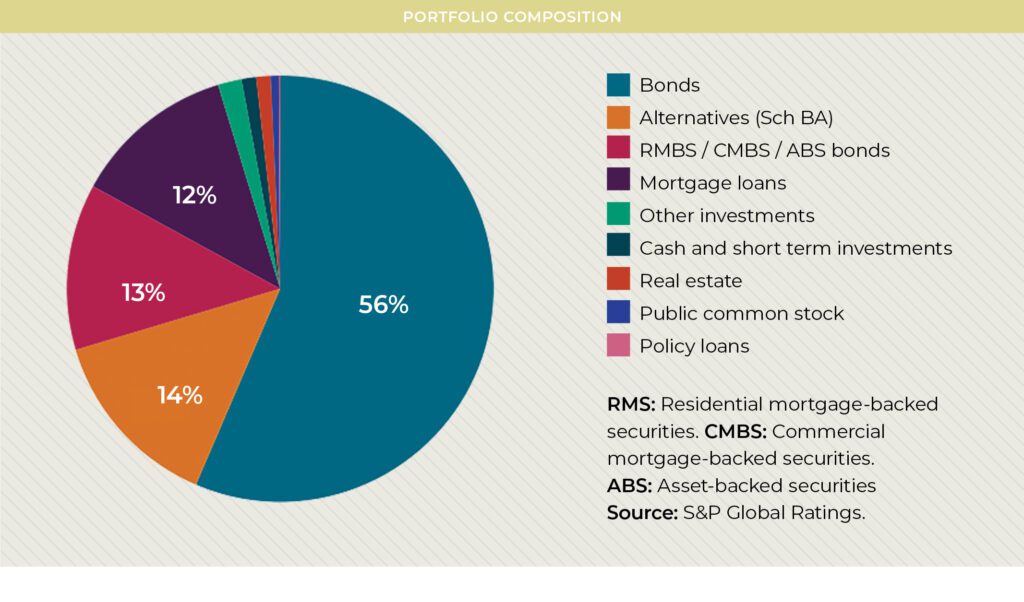

Despite her philosophy that not everything in financial services is about crunching numbers, TIAA has grown on a massive scale under Duckett’s leadership. By the end of 2025, the company’s General Account grew to $300.4 billion in carefully diversified assets, with 47% in public fixed income, 36% in private fixed income, and 17% in other assets, including real estate and private equity.

In its most recent annual report, TIAA announced that its capital and surplus had grown to $48.4 billion. Furthermore, TIAA’s liquidity ratio stood at about 606%. In November 2025, S&P Global highlighted that TIAA is likely to maintain its strong position in the U.S. higher education pension market, supported by its reputation for quality service and advice. The report also emphasized a 99.99% confidence level in the company. “TIAA has a nonprofit heritage, and we have a favorable view of the company’s long-term focus on sharing profits with its contract holders; its low-risk product portfolio; its earnings stability; and the overall success of the business model.”

“About 45 percent of American households will run short of money in retirement… Americans urgently need to put secure lifetime income back at the center of retirement planning.”

A Leader Who Listens

In 2026, Duckett’s rare blend of empathy and strategic vision reinforces that prioritizing employees drives business success. The CEO frequently hosts small group meetings, which she calls her “Coffee and T” sessions, to gather honest feedback and promote a culture of inclusion and innovation. Recently, Duckett shared with CNBC that she has a favorite question she “always” asks employees to encourage conversation: “What would be the one thing that you’d change if you were CEO?”

By asking that question, Duckett said “It allows me to never forget what’s on the mind of everyday employees.”

Campaigning for Fairness

A hallmark of Duckett’s leadership is her conviction that financial services should serve a greater social good, and her passion for closing America’s $4 trillion retirement savings gap sets her apart from other leaders in the industry. “We’re very serious about making sure that more people have a dignified retirement.”

“I think that it’s important that when we are in positions of power, that we understand the platform and that we understand that it’s more than just delivering on the financial results,” Duckett stated. “It is about shaping a culture, it is about using our voice to make real progress in our country, and I think that’s good for business, it’s good for community, but it’s also, for me, why I believe I’m in this seat.”

Recently, she joined Senators Bill Cassidy and Tim Kaine in supporting legislation that would re-enroll people in retirement plans every three years, bringing back savers who may have dropped out during difficult economic times. “These innovations show how public policy can expand access to retirement savings opportunities for all Americans,” Duckett stated.

“Guaranteed income isn’t a luxury, it’s a necessity. That’s why we’re committed to expanding access to guaranteed lifetime income solutions, in both the institutional and retail markets.”

TIAA also revealed a strategic alliance with Accenture, delivering professional services that leverage technology and artificial intelligence to streamline and automate processes.

“I’m seeing thousands of employees embrace AI skills and capabilities, showing me that our people are ready to lead in this AI-powered future,” Duckett told AB. “Because ultimately, AI isn’t just about technology – it’s about combining human insight with digital capabilities to better serve our clients.”

Prosperity, Long-Term

Today, TIAA remains firmly committed to its mission of providing a seamless, integrated investment experience centered on a single shared goal: helping clients achieve lasting prosperity.Looking ahead, one of the company’s main objectives is to improve financial literacy for all Americans. As Duckett told Barron’s, her goal is to make sure that “everyone understands the plan and is taking advantage of it.”

A recent joint study by TIAA and Stanford University shows that Gen Z tends to have lower financial literacy than other generations across all eight key areas of personal finance. By leveraging these insights to engage new potential clients, Duckett and her team can enhance America’s long-term financial stability by assisting Gen Z with accessing employer-sponsored plans.

David Nason, CEO of TIAA Wealth Management & Advice Solutions, shares Duckett’s enthusiasm. “We have both an opportunity and an obligation to bridge this knowledge divide by championing financial education and delivering personalized guidance that resonates with everyone’s unique needs and challenges. By doing so, we can empower every American to build a secure financial future and create a more inclusive financial system for all.”