Alternative investments are any investment that falls beyond traditional long-only investments, such as stock and bonds. As alternatives tend to have lower correlations to traditional investments, they are primarily used to diversify an investment portfolio and provide attractive return profiles that may differ from those of traditional investments.

For large institutional investors with a tolerance for illiquidity, alternative investments could include a combination of hedge funds, private equity, alternative credit, and real estate. For individual investors, the alternative investment universe may include all of these, and even vintage cars, rare wines, or fine art.

What are the potential benefits of alternative investments?

Alternative investments can provide an attractive opportunity for investors to diversify their portfolios, dampen the impact of market volatility, and provide attractive return potential to help them pursue their long-term investment objectives in changing economic and market environments.

With traditional investments forecasted to deliver modest returns of approximately 5% per year over the next 10 yearsFootnote1, both institutional and individual investors are increasingly looking to alternative investments to try to meet their diversification and return objectives. This shift is already underway: global alternative assets under management is expected to grow to $24.5 trillion by 2028 from an estimated $16.3 trillion at the end of 2023.Footnote2

What are the key characteristics of alternative investments?

Alternative investments cover a wide range of assets and strategies. Generally speaking, however, they are characterized by:

- Low correlation to traditional investments like stocks and bonds

- Higher return potential than traditional investments

- More esoteric and oftentimes illiquid assets

- Longer lock-up of periods, meaning shares or interests may not be able to be redeemed/sold on a daily basis. This helps allow for exposure to less liquid assets

- Often complex investment structures and risk-return profiles

- Typically, higher minimum investment requirements

- Unique risk profile that should be understood prior to investing.

What are the risks?

With a broad range of investments in the alternative investments category, it’s important for investors to fully understand the unique risks and benefits of this asset class, as well as the various strategies available, before incorporating them into a portfolio.

What can invest in alternatives?

Alternatives are not suitable for every investor. Given their unique risk-return profile and complex investment characteristics, alternatives often are most attractive and more suitable for more sophisticated and higher-net-worth investors.

In addition to meeting minimum investment and suitability requirements, investors should also consider their time horizon, investment objectives and their ability to withstand periods of volatility before considering an allocation to alternatives.

Examples of popular alternative investment strategies

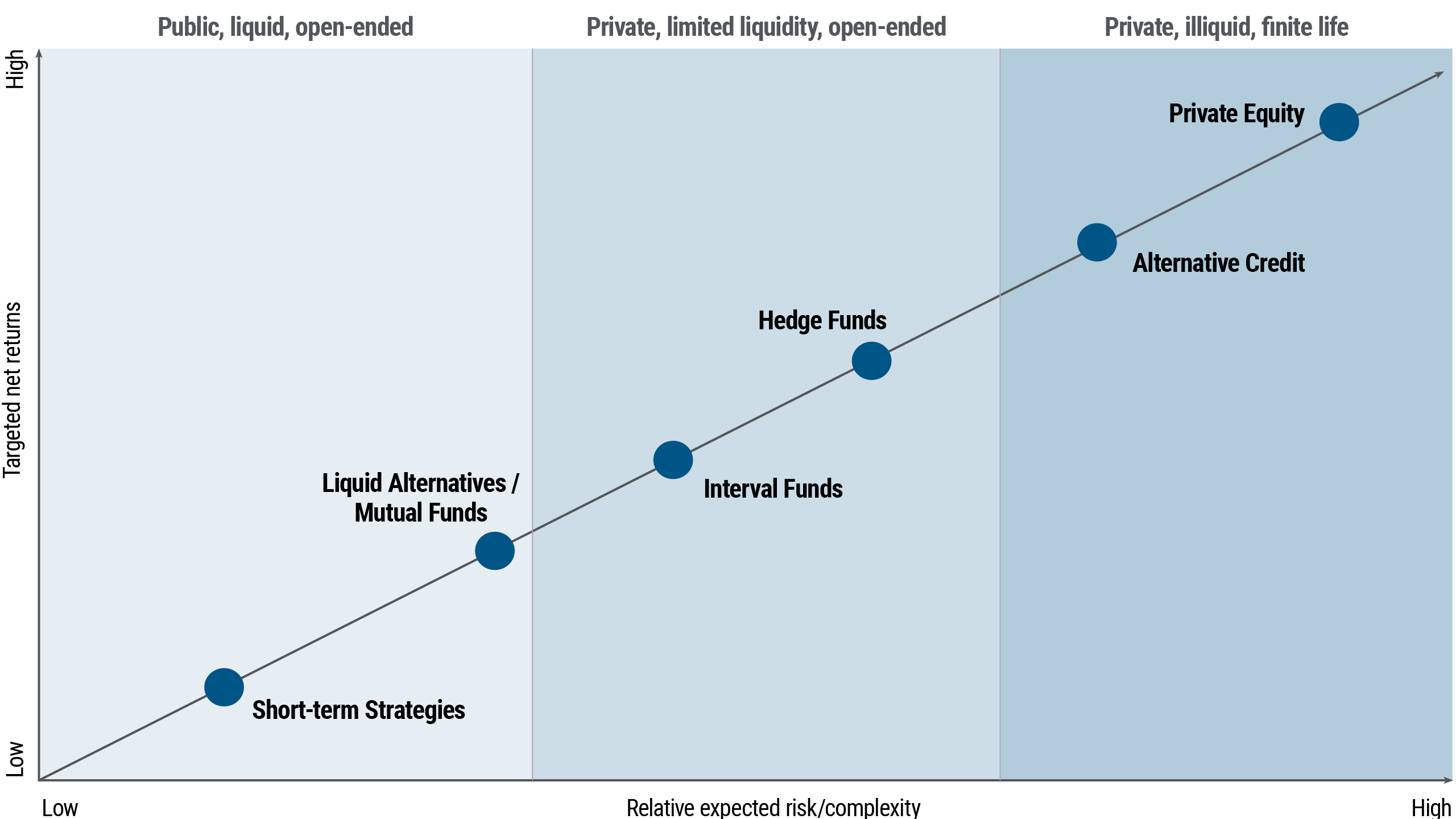

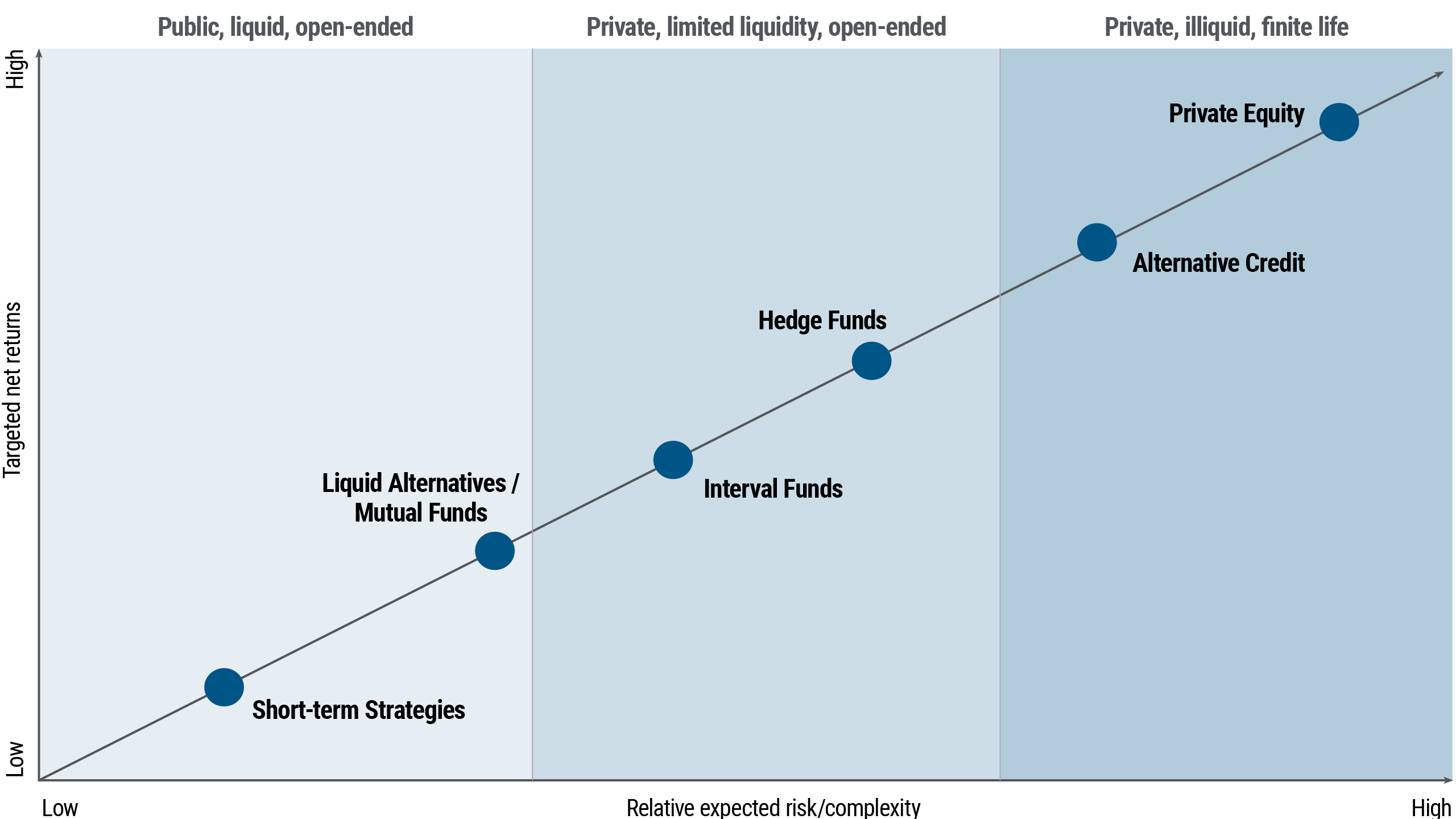

Alternative investments have grown in popularity over time. Today, alternatives include a spectrum of strategies, each designed to support a unique objective and with a different risk-return profile. Below are some of the most common alternative strategies.

Private Equity

Private equity investments (typically accessed through a limited partnership) take an ownership position in companies or securities that typically are not listed on a public stock exchange. The goal is to add value by providing capital to help new businesses grow and to help restructure existing businesses with operational inefficiencies but offer the potential to generate significant long-term gains.

Alternative Credit

Alternative credit investments refer to illiquid financing provided to borrowers that cannot access public credit markets or require non-standard, customized terms. Categories of lending within alternative credit include direct lending, mezzanine, distressed debt, and specialty financing.

Venture Capital

In exchange for an equity ownership stake, venture capital investors provide funding for early-stage start-up firms they expect to grow substantially. The goal is to guide the firm with the intent of selling it either through acquisition or an initial public offering.

Real Estate

Real estate has evolved into a multi-faceted asset class that includes publicly listed and private real estate investment trusts (REITs) and private commercial real estate debt. Real estate not only has a low correlation with equities, but is often viewed as a hedge against inflation.

Hedge Funds

Hedge funds are investment vehicles that use a range of non-traditional strategies (e.g., pairs trading and long-short strategies) in an effort to maximize the overall return potential and diversification of a portfolio. Some of these non-traditional strategies include:

Alternative risk premia

Alternative risk premia strategies seek to deliver attractive returns by earning a “premium” through exposure to recognizable and exploitable risk factors. These strategies generally leverage long and short positions within traditional asset classes.

Managed Futures

Managed futures is a trend following (momentum) investment strategy that uses quantitative signals to define when securities are trending. Often, these signals compare the current (spot) price of an asset to the trailing (historical) moving average of the price and then make investments based on those trends. If the spot price is above the moving averages, then the security is in an upward trend, and vice versa.

Global Macro

Global macro strategies invest across asset classes and markets globally, taking both relative value and directional positions based primarily on broad economic and political analysis. Systematic global macro strategies employ computer models to evaluate and predict market movements, while portfolio managers make buy and sell decisions within discretionary strategies. Below is an example of how PIMCO designs global macro strategies based on targeted investment returns and relative expected risk/complexity for each investment type.