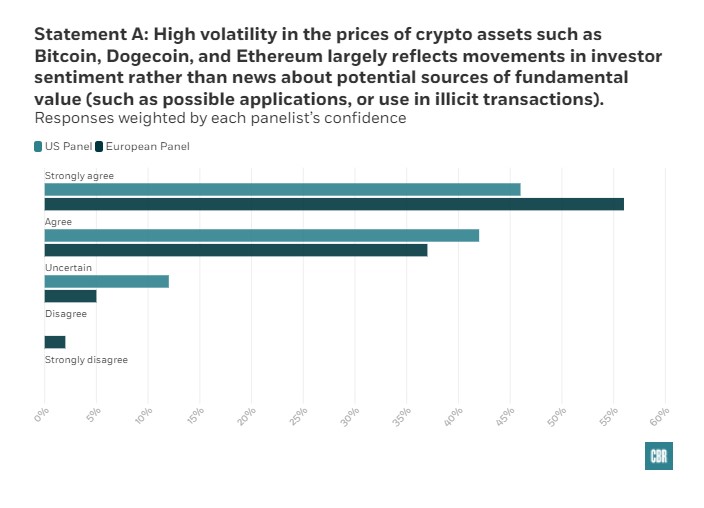

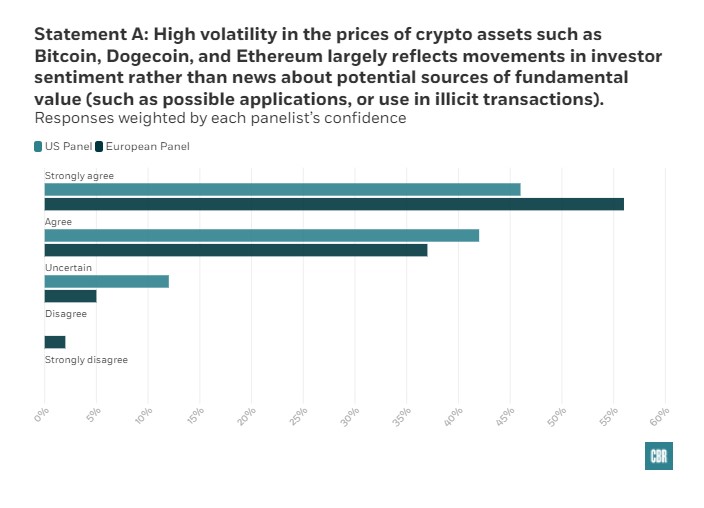

Cryptocurrencies are famous for exposing investors to wild price changes. Bitcoin, for example, appreciated more than 70 percent during the first quarter of 2021, but on May 19 of that year, dropped by 30 percent in the course of the day before recovering some of its value. Do such dramatic climbs and falls reflect changes in fundamental information about crypto assets? Or are they driven by investor sentiment? And as cryptocurrencies become more salient to the financial system, does their price volatility pose a risk to broader financial stability? To explore these questions, Chicago Booth’s Initiative on Global Markets polled its US and European experts panels on the roots and possible consequences of crypto’s ups and downs.

Judith Chevalier, Yale

“I would also have agreed if the question asked about the value of gold bullion.”

Response: Agree

—

Darrell Duffie, Stanford

“Despite use cases such as remittances and illegal payments, total dollar volatility seems out of proportion to the value of such services.”

Response: Strongly agree

—

Christian Leuz, Chicago Booth

“Clearly speculation drives much of the volatility, but there’s also evidence that hashrate, network size, or more traditional pricing factors matter.”

Response: Uncertain

—

Jan Pieter Krahnen, Goethe University Frankfurt

“There is a rising risk of contagion into the regulated banking sector if crypto assets become part of the asset universe held by banks.”

Response: Agree

—

Lubos Pastor, Chicago Booth

“Perhaps one day, but today we are still very far from such a situation. Moreover, regulation is already happening, at least in Europe.”

Response: Disagree

—

Richard Schmalensee, MIT

“If they become a serious risk, one would hope that regulations would be changed.”

Response: Uncertain

—

(Courtesy Chicago Booth. CBR – IGM Poll)