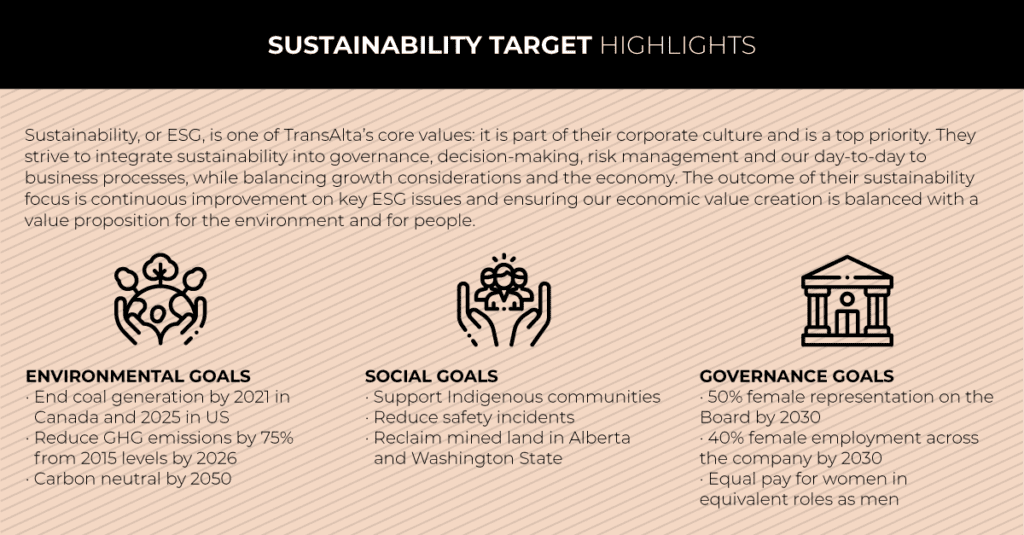

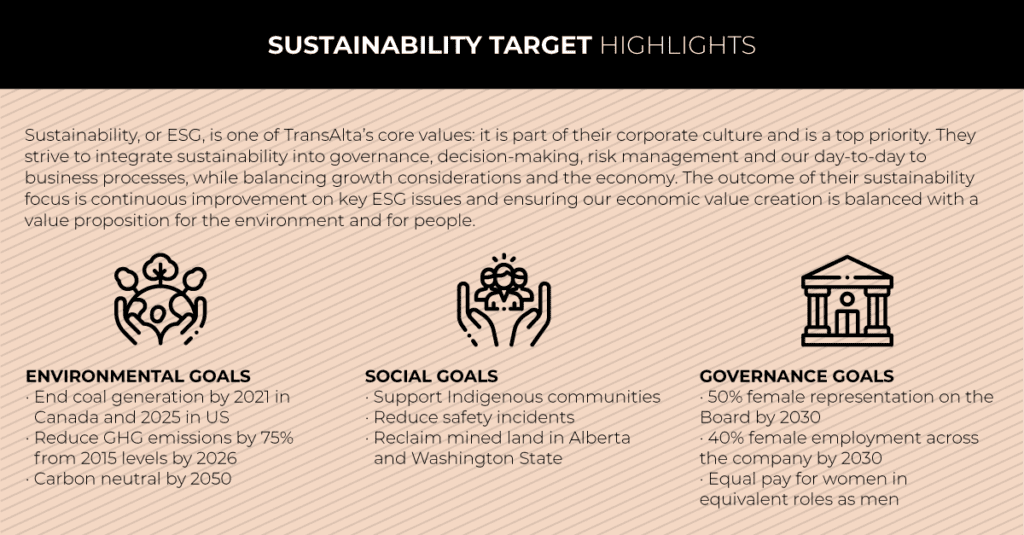

TransAlta is committed to ensuring that its customers receive clean electricity with environmental outcomes aligned with its ESG commitments.

—-

For TransAlta, sustainability is more than a business strategy, it’s a competitive advantage. The challenge ahead for the company, besides securing its expansion plans, is being there for its customers who are also in pursuit of a reduced footprint in their operations.

According to CEO John Kousinioris the company is aware that a growing number of customers are looking for partners capable of helping them achieve ambitious decarbonization targets, which is a key factor for all public companies.

“One of TransAlta’s core competitive advantages is our differentiated ability to meet their needs with customer-centric energy solutions,” John says. “We ensure customers receive the energy they require, and environmental outcomes aligned with their ESG commitments.”

The firm has transformed over the last century and proved its worth as a solid investment after recording approximately $3 billion in annual revenue last year and more than $9 billion in assets and operations in the three countries where they have operations.

Now, TransAlta has a refocused strategy and financial discipline, and its ready to take advantage of the challenges to come in the industry.

Strong first quarter results thanks to innovative clean electricity strategy

Results of the Alberta Canada based company for first quarter 2022 were solid after reporting earnings of $242 million before income taxes, an increase of $221 million from the same period in 2021.

“TransAlta delivered solid first quarter results for 2022 with contributions from our new contracted assets at Windrise and North Carolina Solar which diversified our portfolio,” said the CEO. “I am also pleased to confirm that we are on track to deliver our objectives under our Clean Electricity Growth Plan.”

Cash flow from operating activities for the three months ending March 31 was $451 million, an increase of $194 million compared to last year’s. Good results were primarily due to favorable changes in non-cash working capital and higher revenue attributable to the North American gas assets and converted gas units and higher revenues in the wind and solar segment.

“We delivered growth in renewable energy to new and existing customers in all three core geographies of our operations. We reached the final investment decision on our 200 MW Horizon Hill project in Oklahoma by signing a long-term PPA with Meta,” said John. “We fully contracted our Garden Plain facility by adding another long-term PPA for the remaining 30 MW of capacity with an investment-grade globally recognized customer.”

John was referring to the recently announced agreement to sell electricity produced from a planned U.S. wind project to tech giant Meta, owner of Facebook. The facility will consist of a total of 34 Vestas turbines with construction expected to begin late in 2022 and a target commercial operation date in the second half of 2023.

“The delivery of clean, low-cost, reliable energy from Horizon Hill supports Meta’s sustainability goals and provides another excellent opportunity to expand our wind fleet in the United States,” says John. The company said the facility will generate annual revenues of $27 million to $30 million.

According to the TransAlta CEO the company delivered growth in renewable energy to new and existing customers in the US, Canada and Australia, the three countries where they have operations.

World-class development

With over 100 years of experience in the power generation industry, the company that once started building a dam is now a top regional player in North America with a diversified asset base that gives it a solid position for developing its future plans. TransAlta operates more than 70 generation facilities including hydro, wind, solar, energy storage, gas and coal plants.

According to the company, the growing portfolio of assets are necessary to maintain a healthy and stable electricity supply and “guarantee a world-class development and operational expertise in generating clean power,” says John, who was appointed CEO last April 2021. He is close to celebrating his first ten years working in the company.

John has an MBA degree from York University and a Bachelor of Law degree from Osgoode Hall Law School at York University. He also attended the Advanced Management Program at Harvard University.

Committed to protecting its people, the public, the environment and the company’s assets, TransAlta is aligned with the top corporate responsibility standards and works closely in its communities.

In Canada the company also has good news to share. “Our fleet remains well positioned to capture the ongoing strength we see in the Alberta merchant market. We also remain focused on growth that creates value for our shareholders as we work to deliver on our 2 GW renewables growth target by 2025,” John said.

Today, TransAlta is one of Canada’s largest producers of wind power and Alberta’s largest producer of hydroelectric power.

Clean Electricity Growth Plan

A growing number of customers looking for partners capable of helping them achieve ambitious decarbonization targets is the reason why the Clean Electricity Growth Plan was created. The program presented last September by TransAlta is a guide to building an additional 2 GW of clean generation by 2025.

This strategy is rooted in two core convictions. First, that the electricity sector will lead a global energy transition toward net-zero leading to significant demand for zero emissions generation. Second, a successful energy transition will rely on an optimized set of existing assets delivering reliable and competitively priced electricity while markets integrate renewables and new technologies.

Regarding future investments, TransAlta’s focus at aiming at 2025 include expanding core focus of onshore wind in North America with customer-centered greenfield development and monitoring new technologies such as energy storage, hydrogen and carbon capture technologies for deployment post-2025.

Continued focus on acquisitions in solar projects and optimizing existing gas generation to maximize value and cash flows to support renewables and storage growth are also among the firm’s investment priorities.