Laurent Bresson

President and CEO / GHSP Inc.

As GHSP begins its second century of business, the changes that transformed it from a small-town Michigan foundry into a world leader in automotive shifter mechanisms is changing again. As the auto industry adds electric vehicles to traditional product lines, GHSP is embracing technological innovation to supply customers with a new generation of components for powertrains and driver-control systems.

When you ask Laurent Bresson what impressed him about GHSP, Inc. when he was appointed President and Chief Executive Officer in May, one thing stands out the most in the long list. “It’s the history,” he says. “You look at the company and it has 100 years of history.”

Founded in a former electricity and water company building in the town of Grand Haven, Michigan in 1924, it began operations as a maker of stamped and cast parts for refrigerators and pianos. It celebrated its centenary last year.

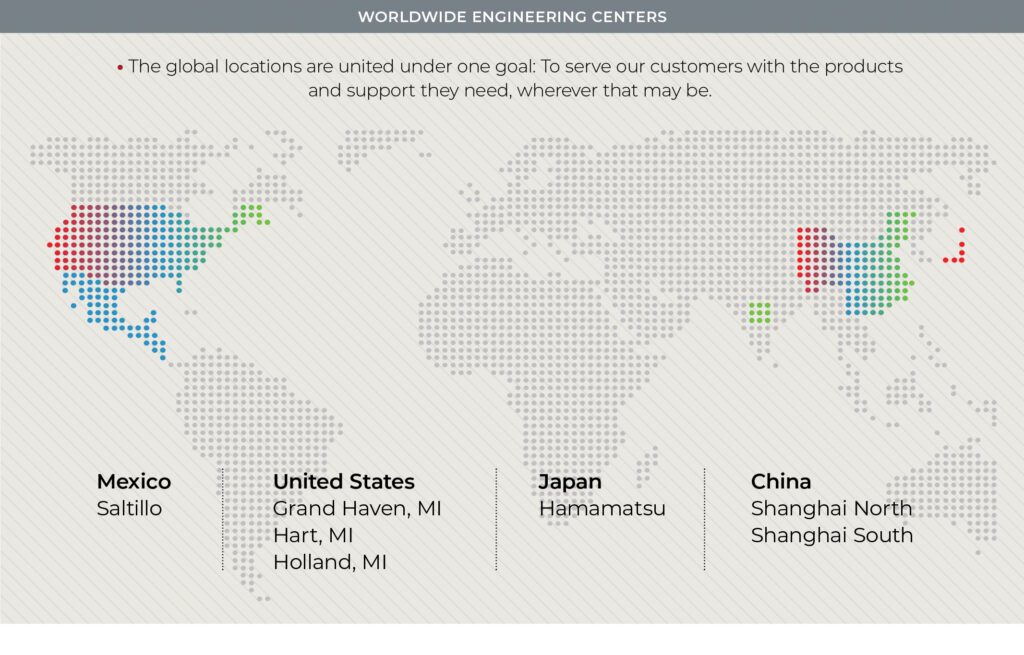

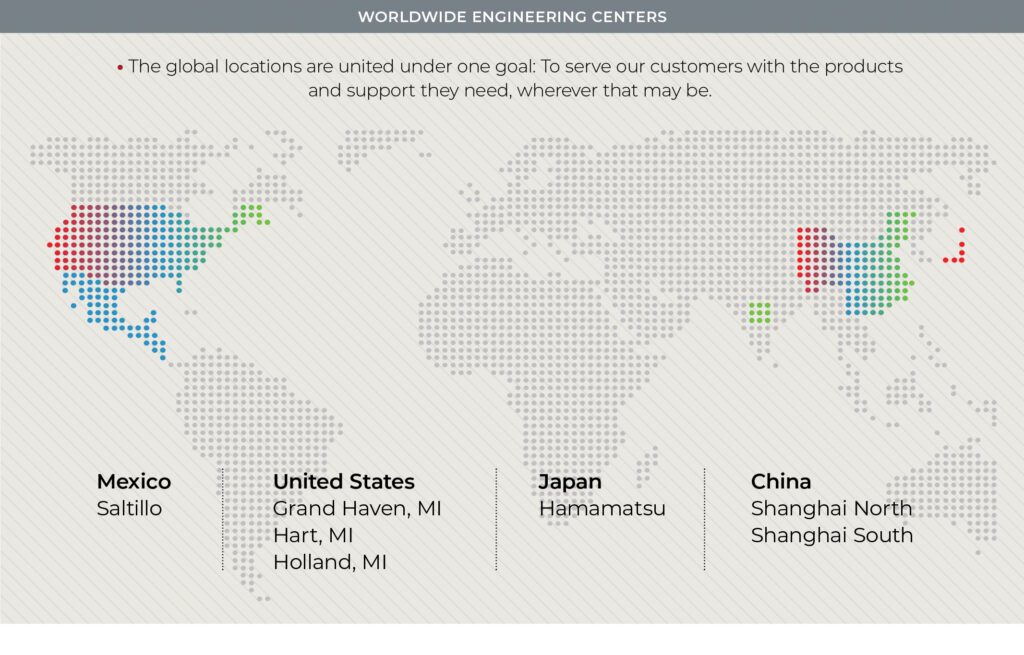

Today, it is at the cutting edge of powertrain and driver control technology and has facilities and offices in the United States, China, Mexico, Japan and India.

“Obviously GHSP is a very resilient company with a long history in automotive,” Bresson continues. “When you have that duration, it means that you have been able to adapt and change with the market.”

Indeed, GHSP survived the Great Depression by adding automobile and railway car parts to its business. It met the economic challenges of the World War II by building anchor windlasses for the explosion in wartime naval construction.

It met the post-war boom by moving heavily into auto parts with a focus on transmission systems. Starting with mechanical shifters, GHSP developed the world’s first cable shifter in the 1978. It was recognized as world leader in shifter mechanisms by 1984, selling to Tier 1 automakers around the world.

“GHSP is uniquely positioned to be an alternative to very large, electronics, and mechatronics companies that are far less flexible than we can be.”

Today change means a move into electronic controls and systems such as shift by wire, electronic transmission controls, electronic smart actuators and pumps as well as electronic control units (ECUs), printed circuit board assemblies (PCBAs) and other high-tech products.

Many of these new product lines are considered mechatronic, another factor that attracted the French-born Bresson.

“I’m actually a mechatronic engineer,’’ he said. “I have experience in both mechanical and electronic engineering, and I like that part about GHSP a lot.”

To compete in expanding market for automotive mechatronics, GHSP had to add new expertise and manufacturing capacity. Experts in software and cybersecurity now share space with traditional mechanical engineers.

GHSP’s factory in Grand Haven for instance, used to be a loud and stifling location of banging presses and forges. Today that same space has been given over to the bright lights, clean floors and mechanical purr of machines making ECUs and other electronic systems.

“If you look at the company, it’s pretty amazing because it started as a foundry,” Bresson said. “What attracted me was the ability of this company to basically re-invent itself. We still do mechanical shifters, but we also do much more.”

One of the factors that Bresson credits with helping the company enter its second century of existence is its family ownership under JSJ, a holding company controlled by the descendants of some of the earliest backers of GHSP. The founders of JSJ made some of the first investments in the company before it took it over completely in 1927 and renamed it Grand Haven Stamped Parts.

Even though GHSP has moved its headquarters to nearby Holland, Michigan, GHSP still has a plant Grand Haven, population 11,200, and JSJ’s corporate headquarters are still there too.

“One of the things that attracted me to GHSP is its ownership, which has the feel of a private-equity or family-office operation,” Bresson explained.

Bresson is a veteran leader of such Tier 1 firms as Mobex Global, where he was President and CEO, and Nexteer, where he was President and Global Chief Operating Officer.

All the same, he is happy to be working at smaller company. Compared with some of the larger auto-industry companies he has worked for in the past, Bresson finds GHSP’s mid-sized profile more manageable and satisfying.

“I really like it because, typically, from $300 million to $1 billion (in revenue) is very manageable,” he said. “You’re going to have 1,000, 2,000 or maybe 3,000 employees, so you can pretty much go to every manufacturing location very regularly and really know what is happening in your company.”

And despite its medium size, GHSP’s long history and solid reputation has allowed the company to maintain it’s close relationships with much larger Tier 1 and Original Equipment Manufacturers (OEMs), Bresson said.

That’s especially helpful as the industry seeks investment to tool up for hybrids, electric vehicles and other new technologies and face political uncertainties about the future of globalized supply chains.

“What attracted me was the ability of this company to basically re-invent itself.”

“Right now, any supplier is sorely challenged,” Bresson explained. “EVs were supposed to grow a lot, and we have invested a lot … but the volumes are not there today.” To deal with that GHSP aims to be “propulsion agnostic” designing and marketing systems that can work with either EVs, hybrids or conventional fossil-fuel vehicles, he added.

Despite being a mid-sized company, Bresson explained, GHSP is helped by its global footprint. Operations in India and Mexico can help with the shortage of workers and high costs in the United States, while Mexican operations can also help deal with North American content rules that are making it more difficult to manufacture in China and export to North America.

At the same time, with established operations in China, GHSP can manufacture components for the growing domestic Chinese EV and hybrid market too, especially for its chief Chinese customer, BYD, the EV and plug-in hybrid manufacturer.

“Out of North America, we are also looking at additional growth,” Bresson said. “We are privileged to have cultivated strong customer relationships in the Chinese market. Our strategic partnership with BYD has contributed substantially to our sales success.”

“EV was supposed to grow a lot and we have invested a lot … but the volumes are not there today.”

Flexibility and Client Focus

Having much of GHSP’s electronics manufacturing and software development in-house allows the company to meet clients’ specific needs. “The con of size when you are a mid-size company is that you don’t have the purchasing power and scale of very large Tier 1 suppliers,” Bresson explains. “GHSP is uniquely positioned to be an alternative to large electronics and mechatronics companies that are far less flexible.”