Dr. Jack Cheng

Founder, President and CEO / AA Metals, Inc.

AA Metals, one of North America’s largest and most respected master distributors of aluminum and stainless steel, is moving quickly upstream in the world metals markets to expand production at home and abroad to protect its customers and operations from the costly disruptions of rising, trade-war tariffs.

When Jack Cheng, the president and CEO of AA Metals, Inc. founded the Orlando, Florida-based company in 2003, the world was a very different place. Globalization, driven by the spectacular rise of China’s economy, was re-arranging the world metals market and consolidating China as the center of world steel and aluminum production.

Combining hands-on experience in the metals industry that began as a young man in China and the knowledge that comes with advanced degrees in metallurgy and business administration – an interdisciplinary education earned at top universities in both China and the United States — Cheng was able to build an aluminum and stainless-steel distribution empire.

In the time since he spotted his opportunity to create AA Metals as a student at the University of Kentucky through the creation of a globe-straddling company over the last quarter century, Cheng has maintained competitive costs and high technical standards for customers even as the sources of key metals rapidly expanded and diversified beyond traditional producers in North America.

Today world markets are transforming again. Thankfully for AA Metals, Cheng has bolstered his company against the rising tariff tide.

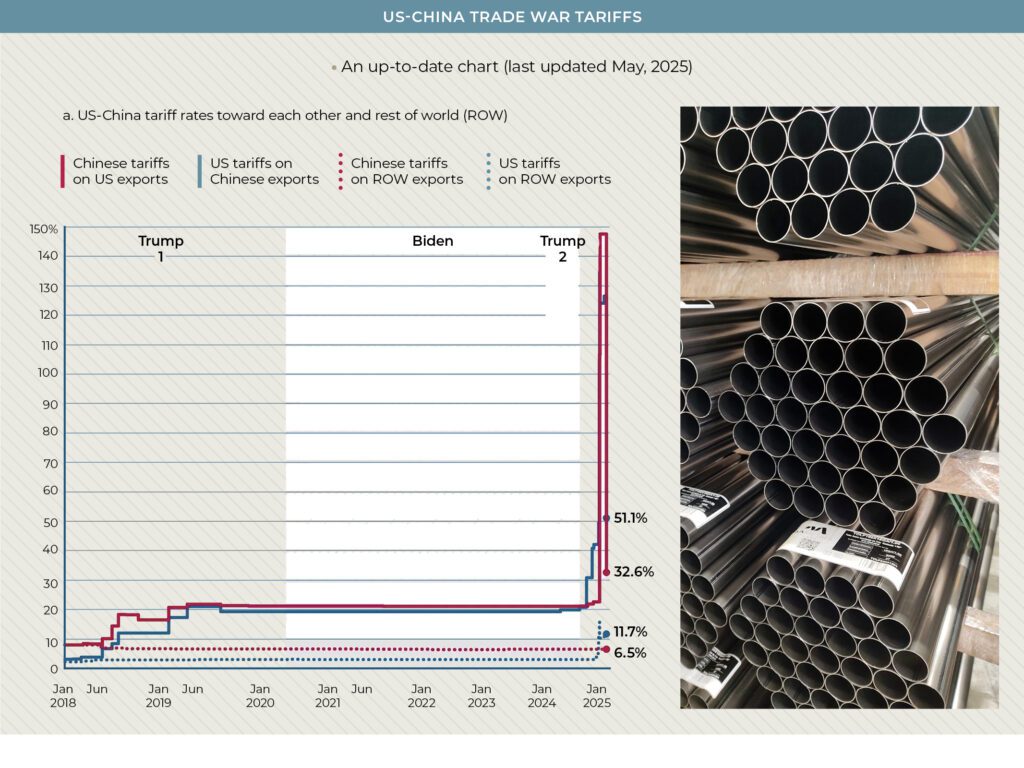

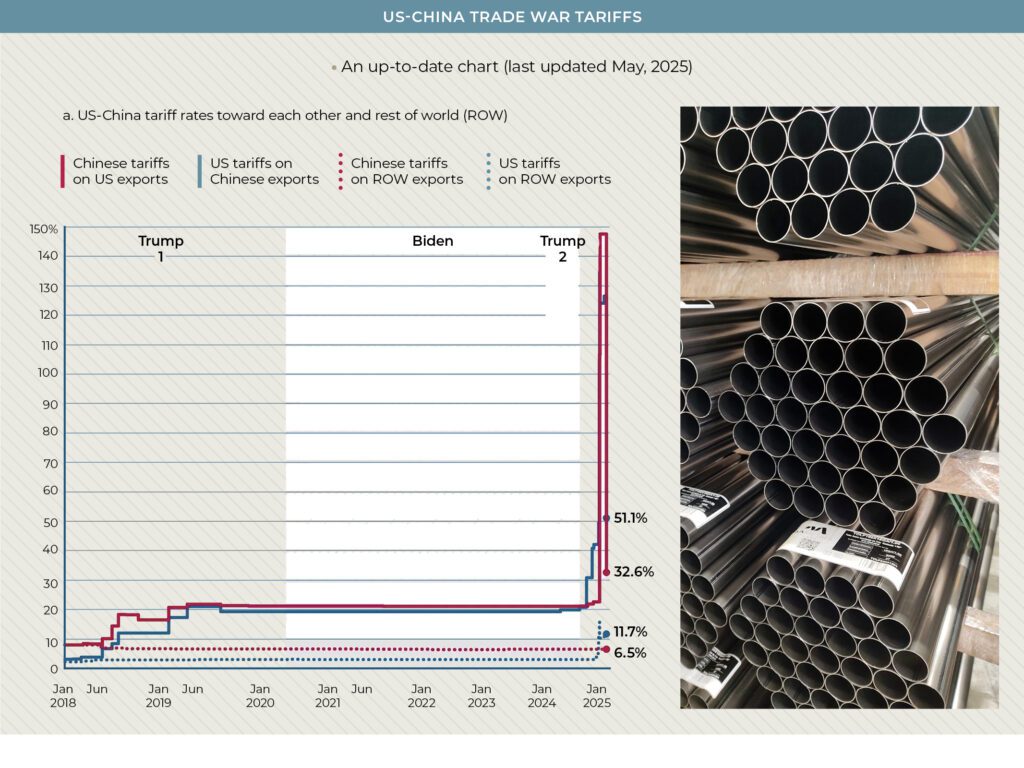

U.S. President Donald Trump made his first efforts to favor domestic production over imports with a round of aluminum and steel tariffs in 2018. This pushed costs higher for metals customers, particularly in North America. In response, AA Metals moved to protect its clients and market share by getting direct access to its own finished aluminum and moved to expand into the steel business too.

“We diversified in case our trading business couldn’t continue, or we’d have to reduce it. So, today we have production facilities, and they are very important for us.”

Expanding Abroad

To that end, AA Metals bought a processing and distribution company in Colombia (AA Metals SAS) in 2018 to serve its international suppliers by expanding its client base into Latin America. In 2019, AA Metals bought Teknik Alüminyum Sanayi AŞ, an ISO 9001-certified, integrated-aluminum producer in Turkey.

Teknik’s full-cycle smelting, casting, rolling annealing and finishing lines are drastically reducing AA Metals’ dependence on the trading of increasingly-tariff restricted imports from China. With about 350 employees, Teknik’s rolling mill produces about 120,000 metric tons a year.

When Trump ratcheted his anti-import crusade even higher at the start of his second term earlier this year − slapping historically enormous tariffs on imports of aluminum and steel, even from traditionally favored markets such as Canada − AA Metals was less vulnerable than many of its competitors.

In 2021 AA Metals purchased Chance Aluminum Corp., an ISO 9001-certified domestic U.S. producer of common alloy and aluminum foil in Williamsport, Pennsylvania. Chance Aluminum has about 65 employees and expects to double that number during the next two years.

“Six or seven years ago we were mainly just a distribution company − a mass distributor of imports,” Cheng said. “Now, we’re moving upstream, so we’re producing our own products.”

“We think it is very important for us to have a domestic, U.S. production facility, especially for the tariffs and those kinds of situations,” he added.

Adapting to Tariffs

This expansion upstream not only helped AA Metals maintain its position in U.S. and foreign markets during the supply-chain disruptions caused by the Covid-19 epidemic, but it bolstered it further against the second Trump Administration’s protectionist policies drove up trade barriers worldwide.

“This has positioned us strategically,” Cheng said. “Turkey has free trade with Europe, so the European market is a major one for us.”

Meanwhile AA Metals’ new Chance Aluminum processing facility in Pennsylvania and its existing logistics and warehousing operations at its headquarters in Orlando, AA Metals allow it to continue doing major business in North America and still trade with China, the world’s largest metals market.

“In all the three major aluminum markets − China, the United States and Europe − we have presence,” Cheng added. “This move upstream has become very important for our growth.”

With more of its sales of high-value-added finished products coming from its own plants, AA Metals has bolstered its traditional trading business too, he said. In the past five years the company has seen aluminum-can-sheet coil become nearly half its business.

Despite the Covid and trade-war disruptions, AA Metals is still a major supplier to all the major can makers such as Ball Corporation and Crown Holdings Inc. as well as the major can users such as Pepsi Co. Coca-Cola Corp., AB InBev, the parent of Anheuser-Busch, the Molson-Coors Beverage Company and Heineken N.V.

Becoming the Market Leader

“That puts our name up there, makes us well known in the can-sheet business,” he said. “I think there’s a lot of growth for our company as our business expands from just trading to manufacturing.”

And that move has helped AA Metals consolidate its position as a market leader even as many competitors have foundered in the face of supply chain and tariff-war disruptions.

“Some of our competitors, you know, got out of the business,” Cheng reflected. “One just recently filed for bankruptcy.”

Indeed, AA Metals competitor, Canada’s Sinobec Group Inc. filed for bankruptcy in May, blaming the U.S.-Canada and U.S.-China tariff wars for pushing the company’s finances over the edge.

Cheng believes AA Metals is now the biggest distributor of flat-rolled aluminum products in the North American market.

Expanding U.S.,Turkish Output

Growth upstream helped AA Metals not just survive but also thrive despite Trump-administration tariffs that doubled to 50% from 25% on aluminum products imported into the United States. Cheng now wants AA Metals to expand even further into production.

A lack of investment in Europe, Central Asia and the Middle East over recent years has increased demand for new production capacity, Cheng said. This makes continued expansion in Turkey promising, especially for can-sheet production.

With Trump’s tariffs, getting new production assets in the U.S. turned out to be an even better than expected investment as consumers scrambled to find replacements for finished aluminum products, about 50% of which were imported.

“Today we are more diversified in terms of business. I think it’s more stable,” Cheng explained. “We want to continue to expand our operations in both Turkey and the United States.”

And while tariffs have made some of AA Metals’ traditional import-trading business in the United States inviable, the lack of production capacity in the United States also boosted the potential profit margins on output from its expanding U.S. operations, Cheng said.

As a result, Cheng says AA Metals plans to expand its aluminum foil business in Pennsylvania and refocus its trading business from some of its traditional coil products into steel and extrusions.

Customer & Supplier Loyalty

But just because the world-trading environment has changed does not mean that AA Metals has been forced to abandon suppliers. Long-term stability and profitability at the company requires strong and loyal relationships with both suppliers and customers.

“We do not change suppliers just because of small price differences,” Cheng said. “Changing suppliers costs a lot of money and time to understand their operations and procedures. A strategic supplier is very important.”

Historically, suppliers have been with the company for five to 15 years or more, Cheng added. And with more operations outside of the U.S. and growing demand for product in places like Africa, Latin America and the Middle East, there are new markets for suppliers who have been made less competitive in North America because of tariffs.

Maintaining suppliers is also important for AA Metals’ customers, Cheng added.

“Tariffs made imports extremely difficult to continue, but the domestic doesn’t have enough capacity.”

“I think our business is grounded in operational efficiency. That’s the number one goal. We always try to run a lean operation.”

“Our customers also want a dependable source, and they don’t want to keep changing,” Cheng said. “Some of our customers require that the suppliers be qualified and that can take a long time. For many can-sheet customers, the qualification process for a new supplier can take a year or two.”

Supply-Chain Robustness

Much the same attitude applies to its supply chain. The goal, Cheng explains, has been to increase flexibility in the face of uncertainty and build loyal and dependable partners both internally and externally.

“We foster our employees to have a strategic mindset,” he said. “I don’t consider AA Metals so much like a massive distributor. I consider us more like a supply-chain company.” Rising tariffs may have made his business more complex, but Cheng is committed to making sure that it doesn’t make his clients business overly complex at the same time.

By maintaining a mix of spot and long-term shipping and transport contracts, AA Metals can build both reliability and flexibility in price and delivery for clients. By having executives and teams that understand trade legislation and adapt to rapidly to rule changes, AA Metals can reduce the risk to clients.

And with about $1 billion a year in supply-side purchases, AA Metals is often in a better position than their end customers to handle the finance, logistics and bureaucracy of the increasingly chaotic world metals markets.

“Many of our customers used to buy, import themselves,” Cheng says. “Now they come to us because they don’t want to deal with the complexity of the importing process.”

“We’ve been dealing with tariff changes since 2018,” Cheng concluded. “I think in the beginning of 2018 we were a little panicked, worried, but now we gotten used to it, so nothing is surprising us now.”