What is resilience? How can your company build it?

Digital article by Martin Reeves, , Kevin Whitaker, and Edzard Wesselink.

It has been known for a long time that pandemics pose a major risk to global health and economies, yet the world was caught mostly flat-footed when COVID-19 started spreading. A few countries were well-prepared for the crisis, but many were not, and some had even scrapped or defunded preparation plans in recent years. As we see time and again, if good times last long enough, it becomes hard to justify investments to ameliorate bad times—efficiency becomes prized over resilience.

Many companies have effectively made a similar choice to value short-run efficiency over resilience, such as by spending down cash buffers on shareholder buybacks and removing operational slack, only to be hit hard during the pandemic. Many companies now express an intention to rebuild their business more resiliently, but it remains to be seen whether they will be able to respond effectively to the current crisis—and whether they will maintain resilient practices during good times in the future.

To help leaders do so, it is worth asking several questions: What is resilience and how does it work? How valuable is resilience in the long run? And how can companies go about building it?

Our quantitative study of nearly 1,800 companies over 25 years shows that resilience in unfavorable periods accounts for nearly 30% of long-term outperformance. We also find that some companies are consistently resilient over time and offer clues about how to build and sustain resilience.

How resilience creates value

At its core, resilience is a company’s capacity to absorb stress, recover critical functionality, and thrive in altered circumstances.

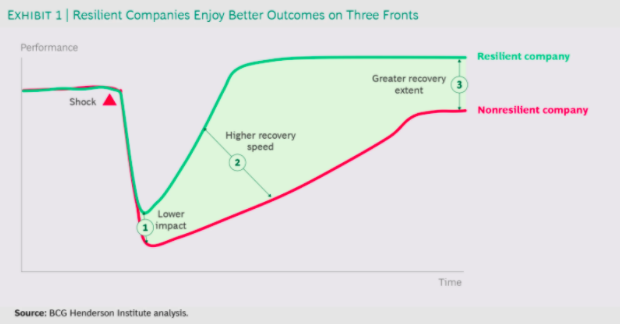

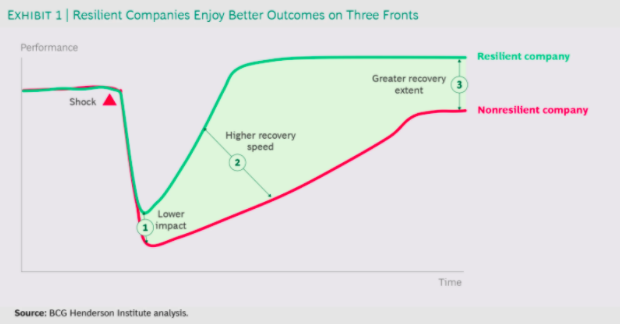

This is needed when a sudden and unfavorable shift in the business environment causes an immediate shock to one or more critical business functions. For instance, when COVID-19 hit, some businesses saw a rapid fall in demand, while others experienced interruptions in supply chains or labor availability. Eventually, recovery ensues, but at very different rates across firms. In the shock-recovery trajectory, resilient companies enjoy better outcomes than their peers on one or more of three dimensions:

- First, the immediate impact of an external shock on their performance can be lower than their peers.

- Second, the speed of their recovery can be higher than peers.

- Finally, the extent of their recovery can be higher than peers.

Measuring these three parameters offers a route to quantify the value of resilience across companies and to compare their strategies.

To better understand the value and dynamics of resilience, we studied the performance of approximately 1,800 US companies from 1995 to 2020.We assessed relative resilience by measuring the relative total shareholder return (TSR) of each company, compared with the average of its industry, during crisis quarters (quarters in which the industry TSR saw a peak decline of at least 15 percentage points [pp] from the start of the quarter).