Gen Z and Millennials are eager to jump in and grow their wealth through emerging ETF investments in advanced technologies like Artificial Intelligence (AI) and crypto, finds a new Nasdaq survey.

Conducted in June 2025, the survey titled “ETF Investors Navigate a Changing Economy: Generational, Economic and Social Trends Driving ETF Opportunities,” sponsored by Invesco and conducted in partnership with Morning Consult, explored the current trends and behaviors of retail ETF investors and revealed a market in transition. The report captured investors becoming more personally involved in their investment choices at a time when investments are broadening to include more modern vehicles.

At the same time, investors are demonstrating more sophistication in how they choose to invest, emphasizing the importance of thorough research before taking a position.

“Investors are consulting more sources and content before making decisions, really showcasing that they’re looking to deepen their understanding of where they’re putting their money,” said Giang Bui, Head of U.S. Equities and Exchange-Traded Products at Nasdaq.

Younger Investors Embrace the Future

Gen Z and Millennial investors are showing strong interest in newer, future-focused investments. Nearly half of Gen Z (46%) and Millennials (50%) hold cryptocurrency-themed ETFs—significantly higher percentages than Gen X (38%) and Baby Boomers (12%).

“Younger people see that these investments could allow them to capture longer-term opportunities and higher growth potential tied to the evolution of technology and financial markets,” explained Bui.

The report found that 41% of Gen Z and 31% of Millennials view crypto’s decentralized nature as a form of risk management. Bui noted that younger investors were becoming more aware of the high growth potential for these types of funds. Among the younger generations, 43% expressed interest in AI and machine learning ETFs, while 45% were interested in fintech ETFs.

“We’ve run this ETF report for several years now, and each year we’ve seen that new technology and innovation draws a lot of investor interest, especially for the younger generation,” Bui said. “These investments could allow them to capture longer-term opportunities and maybe higher growth potential tied to the evolution of technology and financial markets.”

Also, according to the report, Gen Z and Millennials plan to be the most aggressive investors this year.

“With the younger generation, they have a longer time horizon until retirement. That allows them to have a higher risk profile and target more growth-focused strategies,” Bui said.

Intentional Information Sourcing

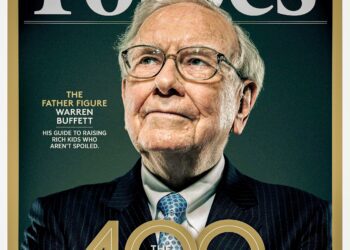

The survey revealed that investors are spending the same amount of time researching investments but are more intentional about sourcing information. Trust in social media dropped 15% since 2022, with investors moving toward established traditional media sources like the Wall Street Journal, Bloomberg, Forbes and Nasdaq.

Notably, interest in long-form articles increased 4% overall, with Millennials and Gen Z driving the trend. At the same time, Gen Z saw a 19% increase in favor of videos over two minutes, while spending less time watching videos under two minutes.

“When you get the content from a vetted source like Nasdaq or asset managers, it offers investors a trusted place to learn and get a better understanding about what they’re investing in,” Bui said. “I think it’s a healthy transition, given the world we live in where we’re having information thrown at us at 100 miles an hour, being able to take some time and read longer-form content.”

The report summarized this shift in investor behavior and attitude: “The FOMO-fueled retail wave of 2021 and 2022 has given way to more measured and mindful investment,”(ETF Investors Navigate a Changing Economy: Generational, Economic and Social Trends Driving ETF Opportunities.)

Key Takeaways for ETF Providers

The report identified several takeaways for ETF providers:

- Tailor communications to investors’ profiles and needs.

- Expand financial education and risk management support for younger investors.

- Monitor how allocations are shifting toward future-focused investments.

- Recognize that investors are moving toward personalized strategies over full-service brokerages.

“Investor education is always important, especially in volatile markets,” Bui said. “ETF providers can position themselves as a trusted source by providing detailed fact sheets, explainer videos and strategy articles, as well as information about market conditions and their potential impact on different strategies and products.”

She added that providers should ensure investors understand how specific ETFs function. “As products become more innovative and bespoke, diving deeper into how exactly an ETF works and what it’s investing in makes a big difference.”