Thomas Warsop

President and CEO / ACI Worldwide, Inc.

As the demand for instant payments continues to surge among consumers and businesses alike, established markets around the world are quickly adopting their platforms and technology to real-time transfer systems that are revolutionizing how money moves in the global economy. Thanks to ACI Worldwide, real-time payments have become the modern benchmark for financial transactions.

When Thomas Warsop signed on last June as Chief Executive Officer of ACI Worldwide, Inc. – the global leader in mission-critical, real-time payment software – he already had a very clear vision of what new path he would explore for broadening the company’s portfolio and international reach: expanding on geographic and service levels as well as on the company’s customer profiles.

“Historically, ACI has focused on the absolute largest financial institutions, merchants and billers around the world, and of course, we are always going to continue to do that,” he told CEO-North America magazine in a recent interview.

“We are very good at what we do. And we have a great installed base, along with very strong customer relationships, so we are certainly going to continue to provide our software and services to these very large financial institutions.”

But in addition to catering to the digital financial transfer needs of the world’s super-big banks and corporations, Warsop said that he saw “big opportunities for ACI with slightly smaller financial institutions as well.”

“In the past, we have tended to focus on what people would call the mega banks around the world, those with at least $250 billion in assets. These are massive organizations, and ACI has a great market presence in that arena,” Warsop said.

“ACI is one of the usual suspects when people think about what are the best partners, the best software solutions to use, the most reliable, most scalable payment software solutions.”

“But if we look at the next tier down – institutions with assets of between $50 billion and $250 billion – we are still dealing with really big financial institutions. Up until now, ACI had not focused very much on that tier, which happens to be the fastest-growing segment of the bank market worldwide.”

Warsop, a seasoned executive and financial services technology expert who had already served as ACI Interim President and CEO since November 2022 and who has been the ACI board director since 2015, went on to say that another key opportunity he sees for ACI Worldwide is moving past just providing software and becoming a full-service application business for the brand’s key customers. “Traditionally, we have sold most of our products as term licenses and they were run by our customers. And, again, we’ll continue to do this because we are good at it,” he said.

“More and more businesses today are recognizing the benefits of running payment systems in the cloud.”

“But now, we are also able to offer our products as a software as a service model (SaaS), which we can run on behalf of customers. And as we move into that smaller, $50-to-$250-billion customer range, these clients are much more likely to want to take advantage of a SaaS.”

Because of ACI’s extensive international experience and accumulated knowhow in what he described as “the epicenter of the digital and real-time payments revolution,” and because ACI’s market-leading software platforms are currently being used by so many of the world’s leading corporations and financial institutions, Warsop said that ACI can continue to grow its pipeline by tailoring real-time payment programs to the specific needs of the world’s non-mega banks and institutions.

“We’ve already implemented several customers over the last 12 to 18 months, and we see a major opportunity worldwide in this field going forward,” he said.

“All of our sons and daughters have grown up in a world where they didn’t have to choose. They had what they needed. It was really cheap to borrow money to buy something if you couldn’t really afford it. But that’s not true anymore. And it’s not going to be true, so we’re going to have to make choices. The same holds true for a public company CEO like me.”

And while he admitted that ACI is “still in the early stages of this shift,” Warsop said that the company “is in a strong position to capitalize on the rapid expansion of the global electronic payments market.”

Also, ACI has the capital backing and a solid growth record to convince investors to bank on its continued successes.

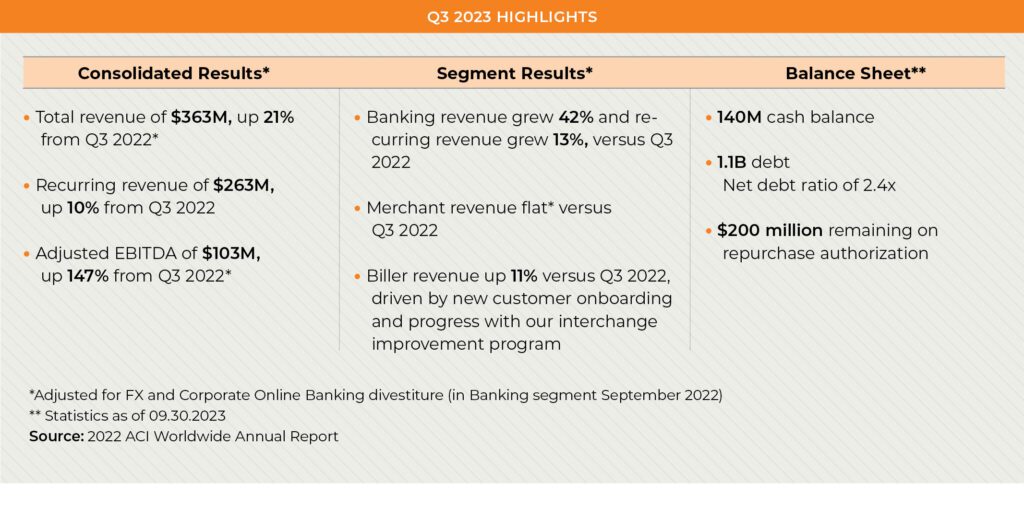

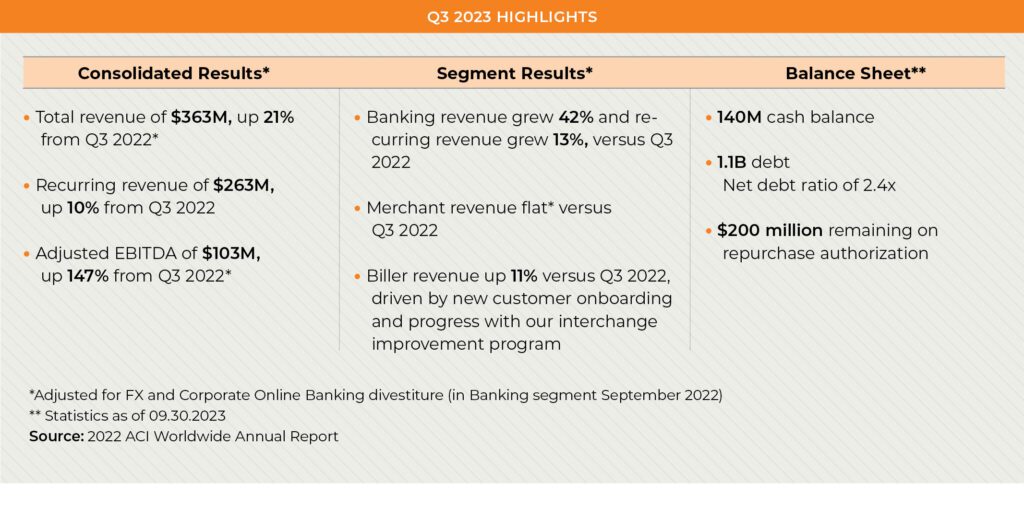

Last year, ACI Worldwide delivered organic revenue growth of 7 percent over its 2021 figures, and third quarter revenues for 2023 totaled $363 million, up 21 percent compared to the same period in 2022.

“Our proven, secure and scalable software solutions enable leading corporations, fintech companies and financial disruptors to process and manage digital payments, power omni-commerce payments, present and process bill payments, and manage fraud and risk,” Warsop said.

“We combine our global footprint with a local presence to drive the real-time digital transformation of payments and commerce.”

Moving forward, Warsop said that ACI will now strive to do more in terms of sitting down with its customers and helping them think through how to best use all the real-time payment tools that the company has available, as well as the vast expertise that it has developed to accelerate the accomplishment of their strategic objectives.

“While we still have more work to do to fully capitalize on the opportunities ahead, we have a strong roadmap and are continuing to execute it. We remain on track to achieve our previously stated guidance for revenue growth and adjusted EBITDA, and we will continue to maintain a disciplined approach to capital allocation and portfolio management.”

“Just by changing the way that we interact with our large customers and prospects, it’s already opening up new channels, new opportunities and ways for us to better tailor the investments that we’re making to fully meet the needs of those customers and prospects,” he said.

“There are tons of untapped potentials for ACI as a strategic partner, in addition to the very clear way that we participate. We are very important to the payments ecosystem around the world.”

And no other company on Earth is better equipped to take on the rapidly expanding, constantly shifting real-time payment market, he added. “ACI has grown up in the payments space,” he said.

“We use partners for various aspects of our business, but we directly attack our goals and challenges with our sales and customer support teams. And then in the other areas where we may not be as well-placed at the moment to attack directly, we partner.”

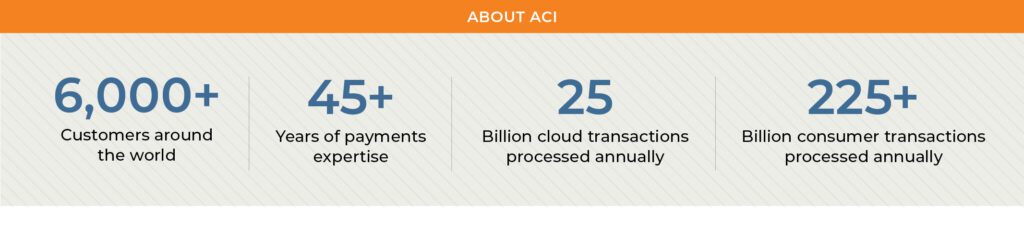

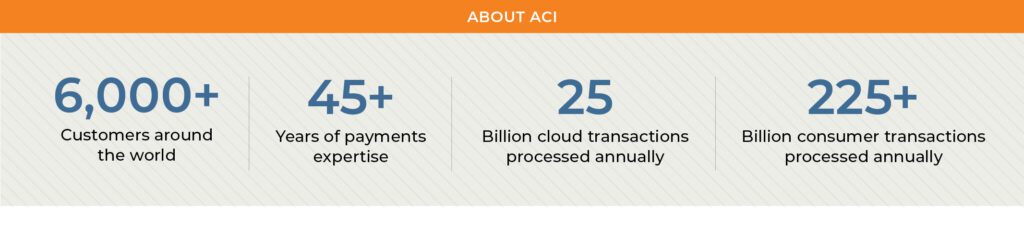

“For the last 48 years, we’ve been a key player. We have tremendous expertise, really all over the world, with customers in 93 countries. And we are able to help those international customers do what they need to do to meet the needs of their respective customers, but also to take advantage of opportunities and to stay compliant, making sure that they can handle the volumes and so forth. There are very few organizations – maybe none – that have the breadth of expertise, experience and the rock-solid product base that we do.”

Notwithstanding, having such a broad international base does pose some logistic and operational problems for ACI Worldwide, Warsop said. “We constantly must think about where the discontinuities and regionally specific variables are happening, both from a product perspective and an industry perspective, as well as from a geopolitical macroeconomic perspective,” he said.

“What we do is at the absolute core of our customers’ businesses. While we have more work to do to fully capitalize on the opportunities ahead, we have a strong roadmap, and we’re ready to execute it.”

Currently, ACI’s software facilitates about one-third of all real-time payment schemes in the world. “That’s really important because if you look at the way money moves, particularly in lesser developed parts of the world, it tends to be mostly via cash. And cash is extremely inefficient,” Warsop said.

He went on to say that this excessive and antiquated use of cash for transfers “tends to slow down the growth of economies as they develop, and it’s also very inconvenient for consumers.”

Moreover, he said, cash and other payment methods tend to be very expensive and convoluted compared to real-time payments. On the other hand, real-time payments are account-to-account direct transfers that can easily be made from a mobile phone or other electronic device nearly instantaneously at extremely low costs.

Still, although the U.S. Federal Reserve launched a FedNow real-time payment platform earlier this year, the program has been slow to catch on in the United States, Warsop said. “But over time, it will create a very different and much more efficient way to move money,” he said. “We’ve already seen this in other parts of the world, where real-time payments have taken off.”

Currently, Warsop said that India is the world’s largest real-time payments market, with 86 billion transactions last year, followed closely by Brazil, where payment volumes through the state-run Pix real-time platform are now almost five times greater than those for debit and credit cards combined.

“We treat are partners in a very special way. We create educational opportunities for them. We want them to understand not just our business, not just our products, but our culture and how we work together. And by the way, we want the same coming the other direction.”

In fact, the emerging economies of India, Brazil, Thailand and China currently account for approximately 80 percent of real-time payments globally since highly popular mobile wallets in these regions are built directly into instant payment infrastructure.

But for all its efficiencies and financial benefits – both for the sender and the intermediary – Warsop noted that there are currently very few cross-border payments being conducted through real-time platforms.

“That is where the real-time payments will really, really get interesting,” he said, using the example of remittances from the United States to places like India and Mexico, both with economies that are heavily dependent on revenues from ex-pats that are sent back to relatives.

“I’ve been doing this for a long time, and I believe very much that there’s only a handful of things a human being or a team can focus on at a time. If you try to do too many things at once, typically, you end up doing a mediocre job at a lot of things. But if you can focus on a few things, you can do a great job at those things.”

“Imagine if these remittances could be sent electronically, in real-time rather than through a MoneyGram or Western Union. What if people could just make an instantaneous transfer at low cost between the United States and India or the United States and Mexico?” he said.

“It is going to happen. The technology’s already there.” But Warsop said that technology’s not the problem. “The problem is regulation, and we simply have to get through it and make sure that the regulators on all sides of that are comfortable. Then the real change in international money movements will take place.”

Once that is accomplished, Warsop said that the use of real-time electronic payments will explode exponentially, increasing global demand.

“We are very excited about it. We’ve been making significant investments in real-time payments over the last several years and we are the leader in facilitating real-time payment schemes around the world,” he said.

By focusing on new cutting-edge technologies that offer real-time payments with built-in fraud prevention and other security features, Warsop said that ACI will continue to be on the forefront of the instant transactions market.

“We will continue to win business, and volumes will ramp,” he said.

“I think it all boils down to something that one of my mentors once said to me a long time ago, which is that you should always expect what you inspect.”

Warsop concluded by saying that at ACI, “we always work as a team.”

“You have to attack both opportunities and challenges as a team,” he said. And by knowing the ACI Worldwide has outstanding products, unparalleled expertise, a very strong market position and solid, long-term customer relationships, Warsop said that the company will inevitably maintain its market leadership, along with new growth opportunities in the years ahead.

“We already have the trust of our customers and partners, and we are very profitable, generating a lot of cash,” he said, “so we are attractive from an investors’ perspective.”