Francesca Luthi

Executive Vice President and COO / Assurant, Inc.

Assurant, Inc. provides protection services for consumer electronics, appliances, homes, and automobiles in North America, Latin America, Europe, and the Asia-Pacific region. Working with major brands, the 133-year-old, Atlanta, Georgia-based company is building on its history by using cutting-edge technology to speed development of new products, adapt to new markets, maintain high levels of service for partners and clients, and boost returns for investors.

Francesca Luthi has been with Assurant, Inc. for 13 years and every year has been one of rapid change. Today she’s Executive Vice President and Chief Operating Officer, the senior tactical leader for the 14,200 global employees of a nearly $12-billion-a-year global insurance company.

Since she joined the company in 2012, Assurant has moved out of health and benefit insurance and refocused its business to become a leader in the protection of consumer electronics such as cellular telephones and other inter-connected devices. Assurant has also purchased new businesses to gain access to evolving technology. As a publicly traded company, it has achieved its success – and delivered growing returns – under the watchful eye of investors.

Since joining Assurant, Luthi has served as chief marketing officer, chief administrative officer and chief people officer. In the fall of 2023, she was made COO, taking an even more central role in a company whose sales, marketing, claims, workplace, data and client-management systems were undergoing nearly constant change.

“When I joined the company, it was a very different entity,” Luthi told CEO-NA.

In the succeeding 13 years, Assurant underwent a comprehensive business transformation, buying and selling new businesses to create the company she helps run today under the leadership of President and CEO Keith W. Demmings.

“Consumers are getting less patient, not more patient. So speed of delivery is really really critical for us.”

“At each juncture there was an opportunity really to look at how the business was evolving and at the growth opportunities that we saw before us,” she said.

According to Luthi, that transformation has involved a fundamental shift from a reliance on business-to-business (B2B) relationships to business-to-business-to-consumer (B2B2C) activities in their two business segments: Global Lifestyle and Global Housing.

This has been essential as Assurant’s own business partners in the mobile telephone, connected device, automobile, homeowners and renters’ industries demand access to new services and data-driven analytics and as their clients demand service in line with the latest on-line technologies and support systems.

“Moving from a B2B player in specialized insurance to moving beyond that to B2B2C has obviously had pretty far-reaching implications to our marketing organization,” she explained. “We’ve brought in that consumer lens, shifting and building-out marketing capabilities.” “Ultimately,” she added, “we are moving towards customer experience and really thinking about how we leverage all the data we see to optimize the most critical moments in the customer journey.”

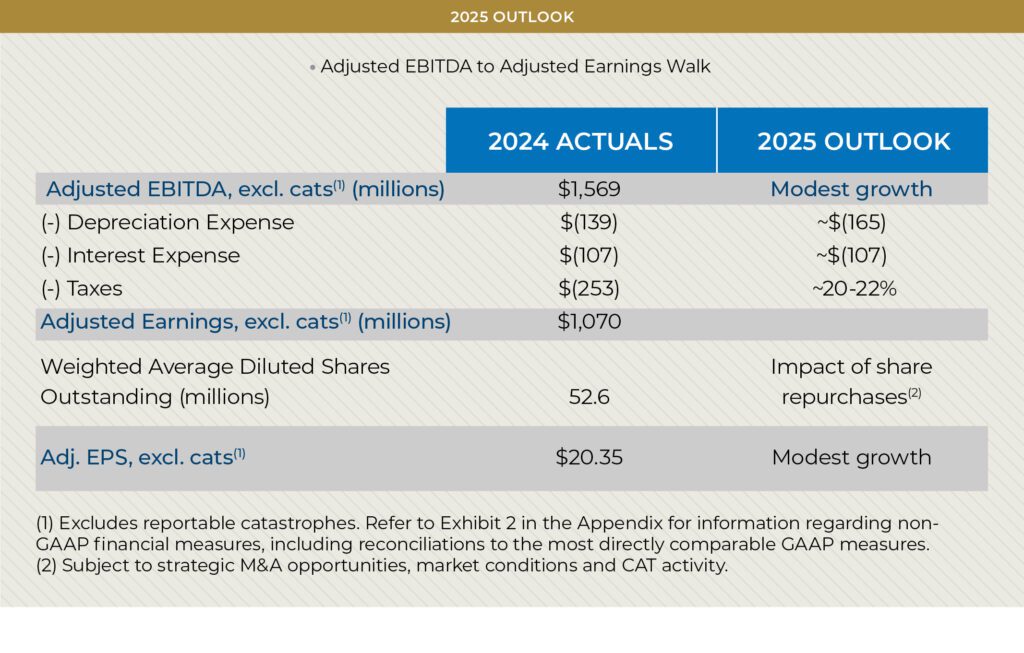

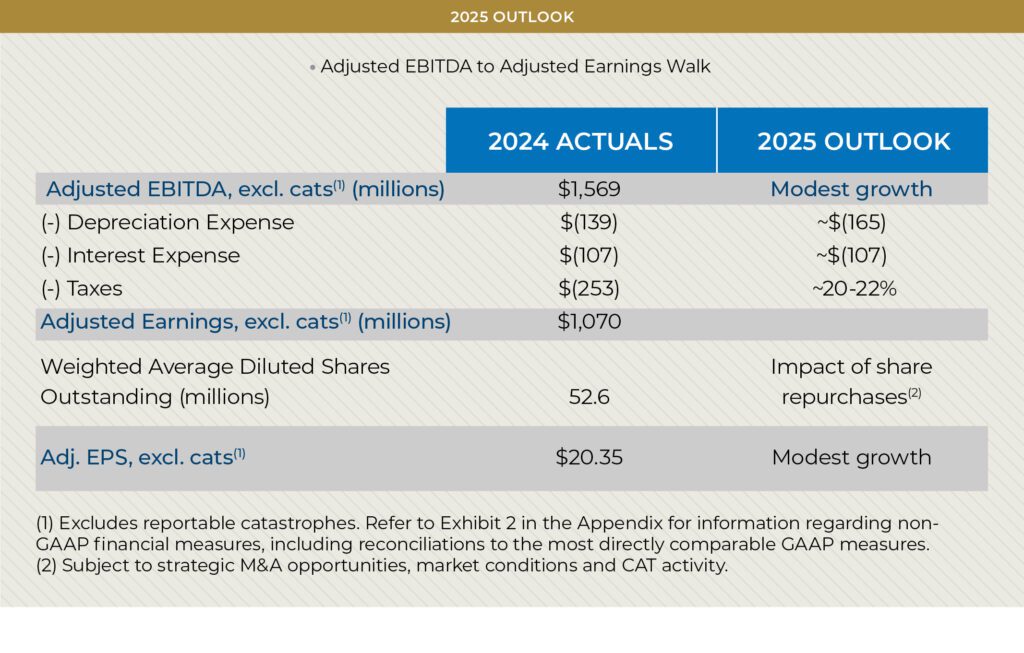

Luthi’s tenure has seen much success. In 2024, Assurant reported adjusted earnings before interest taxes depreciation and amortization (EBITDA) excluding losses from catastrophes jumped 15% compared with 2023 to $1.57 billion.

Profit, or net income according to generally accepted accounting principles (GAAP), rose 18.3% from a year earlier to 760.2 million as total revenue increased 6.7% to $11.9 billion.

Over the past six years, adjusted earnings per share (adjusted EPS) have more than doubled to $20.35, excluding reportable catastrophes, which outpaces the average for the property-and-casualty-insurance industry. Assurant’s business segments have generated dividends of about $4.5 billion since 2019.

Assurant’s stock price has more than doubled in the same period.

Long-term performance is also impressive. Dividends per common share have increased at Assurant every year since 2004.

Luthi’s direct COO responsibility for such areas as data, customer experience and artificial intelligence (AI) has helped Assurant’s success by controlling costs, leveraging data, expanding markets and streamlining customer interactions.

Her responsibility for Assurant’s human resources has also contributed to the company success.

Change, Luthi believes, offers great opportunities, but it isn’t always implemented in the best ways. New technology can increase productivity, but it can also create bottlenecks. Data insights can be transformative, but data alone can be a distraction.

“At the end of the day. It’s not only about the tools, it’s what do the tools enable.”

Her role as COO is about making sure the company’s public face and internal parts – it’s employees, systems, values and relationships – work together.

According to Luthi, it’s not about change for change’s sake, but about efficient integration.

“I have a broad mandate: from our enabling centers of excellence, including data, customer experience to AI and many of the supporting functions,” she explained.

“If you think about HR, change communications, sustainability and our sourcing – the third-party vendors and real estate – ultimately, that’s where the rubber hits the road,” she added.

“So, when I think about that mandate, it was really around ensuring that at the end of the day we take things to that next phase and really look at how our data, digital and AI strategies help evolve our operations – but do that in partnership with HR.”

The key challenges here are how to integrate new tools and data into the existing systems, training and retraining employees to use the new technology, and leveraging the data and efficiencies created by the new technology to provide a better customer experience, Luthi said.

“You can definitely drive a lot of efficiency through digital innovation,” she explained, “but you may also add friction.”

For instance, Luthi pointed to problems customers may experience with new technology, such as getting stuck in an Interactive Voice Response (IVR) system “loop”. In such cases, the new system may be cheaper than traditional customer service channels and even reduce or automate repetitive tasks for employees, but if it’s working in a way that irritates customers or reduces the capacity to provide customer service, it’s probably not the right solution.

“We’re looking ultimately at the customer and employee outcomes that we’re trying to drive,” she said. All of these efforts are aimed to improve Assurant’s digital, technological and AI “maturity”, she explained. This includes the ability to make sure the adoption of new technology is done with knowledge of the entire employee-customer experience.

“We have deep partnerships with many of the leading consumer brands who are vested as much as we are to deliver better experiences for their end customers.”

For instance, the new tech has to be efficient, but it must also be understandable. If it requires training or retraining of employees, efforts must be made to limit the disruption to customers caused by that retraining, perhaps by making training part of regular daily employee routines rather than pulling them offline for courses. Building client loyalty and attachment also increasingly involves giving clients the tools to assess their service needs themselves without needing to directly contact an Assurant employee by telephone.

“Customers don’t want to be on a phone if they can engage and self-serve more directly,” Luthi said. “So we’ve developed new capabilities to do that. Everything from remote claims straight through processing. It’s everthing from automatically adjudicating various different claims to helping customers self diagnose if their washer and dryer is broken.”

As a B2B2C partner working alongside major brands such as T-Mobile, this means making sure Assurant’s systems seamlessly fit into with theirs.

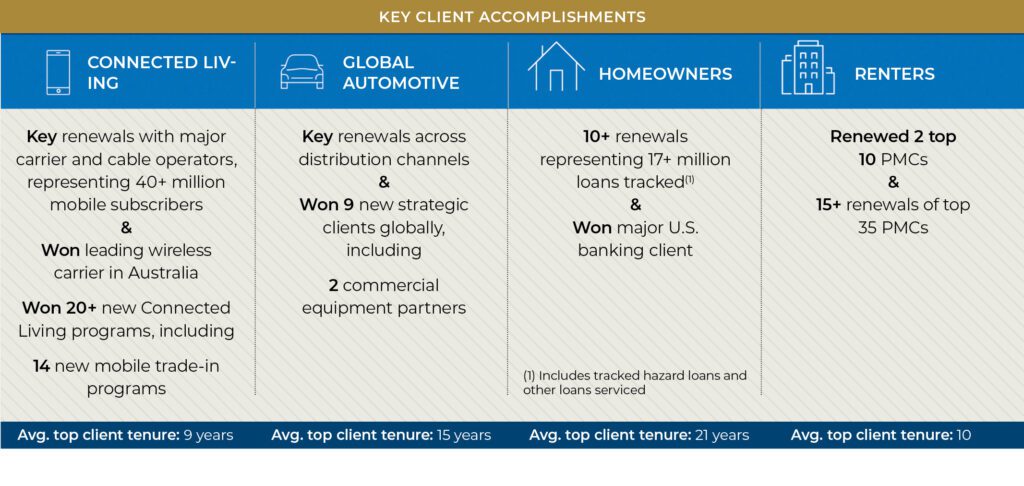

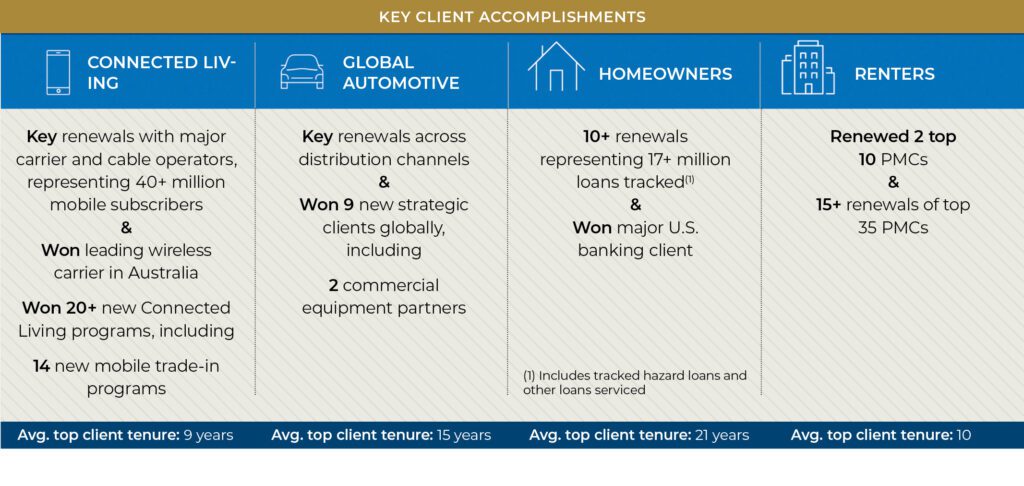

“I think there are a couple of things that have been part of the company’s success over three to five years,” Luthi said. “One is when we think about our business, we are hardwired to solve client and customer problems.” “This year we have made significant progress in extending partnerships and renewing partnerships,” she said.

Assurant has many partnerships of more than 20 years, and the Connected Living division works with seven of the top 10 leading global telecommunications brands. Its auto business works with four of the top five dealer groups, the housing unit works with three of the top five U.S. multi-family, property-management companies and seven of the top 10 mortgage servicers.

In 2024 Assurant received about $4.8 billion in net earned premiums, fees and other income from its Connected Living division, $4.2 billion from auto, $500 million from its renters’ unit and $2.0 billion from its homeowner’s division.

“Ultimately clients and customers vote with their feet and the fact that we’ve had an enduring long tenure and longstanding relationships with our partners and clients does speak to the value that we continue to bring and to the innovation we continue to drive,” she concluded.

“We have a longstanding record of being a public company, recognizing the importance of delivering client value, shareholder value and community value.”