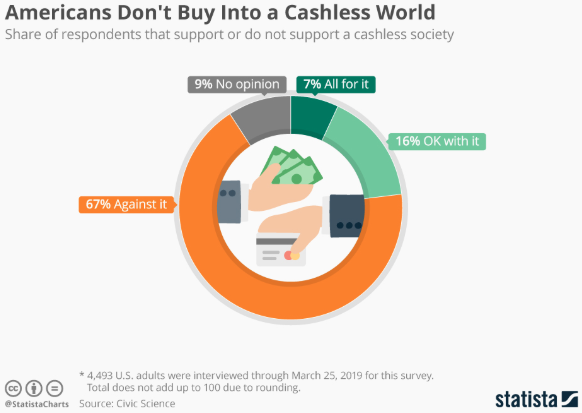

Nearly two-thirds of Americans claimed to be against a cashless society.

Every day more and more mobile payment apps and cashless stores are flooding the market.

Currently, the worldwide mobile payment revenue is expected to surpass 1 trillion U.S. dollars in 2019 and attain a market size of $4,574 billion by 2023 as customers constantly demand easy, hassle-free, digital and cashless payment methods.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5,6″ ihc_mb_template=”3″ ]

In the current scenario, a 2017 Federal Deposit Insurance Corporation survey showed that 6.5% of U.S. households were unbanked, meaning they lacked a checking or savings account, while an additional 18.7% of households were underbanked, meaning they had a bank account but used at least one alternative service like money orders, check cashing or payday loans.

The reasons of cash

According to Bloomberg, there are a variety of reasons Americans use cash.

Even with a steady income, people living paycheck-to-paycheck may not have enough money to keep in an account. Some don’t want to pay the fees; others don’t trust banks or are concerned about privacy.

The homeless are especially vulnerable. If they lose their documents, they often have trouble getting them again. Michelle Jones, 37, who arrived in Seattle in 2001 as a homeless youth, lost her social security card three times and says it was stolen once.

The benefits of cashless stores

Electronic payments save employees the time it takes to collect, store and transport cash. Theft is less likely. Customers typically move faster through checkout lines because they don’t need to count out their cash and wait for change.

The retailers and restaurants that don’t offer cash options often cater to wealthier customers.

“The tech solutions that are coming up are innovative and amazing but they haven’t reached our customers in numbers where we think that it’s okay for businesses to stop taking cash,” says Darren Liddell, director of program innovation at The Financial Clinic, a New York nonprofit that teaches clients how to manage money. “I suspect that there will be a time in America where we’ll start to have those conversations. I just don’t think we’re there yet.”

[/ihc-hide-content]