1.How to Win Friends and Influence People by Dale Carnegie

Originally published in 1936, How to Win Friends and Influence People is a handbook for navigating relationships. Readers can learn how to avoid arguments, get people to agree with you, motivate others, and make sales.

One quick tip? If you’re trying to motivate your team, try sparking a bit of friendly competition. There doesn’t even need to be a prize. You may find that just by highlighting the top worker publicly, others will suddenly feel more motivation to work harder and get closer to the top spot themselves.

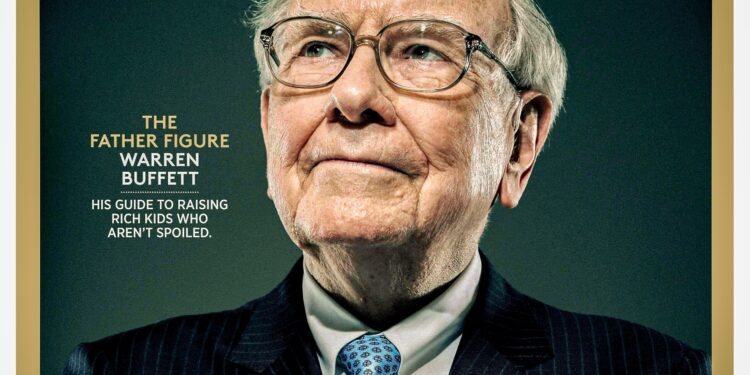

In the HBO documentary Becoming Warren Buffett, Buffett admits Carnagie’s ideas helped him overcome his fear of public speaking, and he regularly recommends the book.

2.The Intelligent Investor by Benjamin Graham and comments by Jason Zweig

If you’re a fan of Warren Buffett, you may be interested in getting into investing, or wanting to improve your investing skills if you’ve already started. Buffett himself recommends this book to help.

Buffett credits this book with changing the way he looked at the stock market. “Picking up that book was one of the luckiest moments in my life,” he said.

The Intelligent Investor shares everything Benjamin Graham knows. He was an investor who became successful after the financial crash of 1929. The book shares how investors should evaluate companies, the three principles of intelligent investing, and how to diversify your portfolio.

3.The Most Important Thing by Howard Marks

Buffett is a fan of two books from Howard Marks: The Most Important Thing and The Most Important Thing Illuminated.

Marks is the co-founder and co-chairman of the investment company Oaktree Capital Management. His book shares his views on how successful investors can read the market in ways others don’t to help them decide where to invest.

4. A Short History of Nearly Everything by Bill Bryson

It’s not all investing advice, though. Buffett has shown he reads much wider, and said how interesting some of the facts were in this book by Bill Bryson.

A Short History of Nearly Everything is exactly what it sounds like. Bryson covers everything from how tiny bacteria work to what caused the big bang, from Einstein’s special theory of relativity to what we know—and have left to find out—about the ocean.

5. Common Stocks and Uncommon Profits and Other Writings by Philip A. Fisher

This book is for those working in investment or simply anyone looking to improve their investment strategy. It shares practical tips like how to determine if a company’s stock is overvalued, how to find the right time to buy, and where to get little-known information about companies when doing research.

Readers can also learn the different types of investors—conservative and high-risk—and which one they are.