Even in the face of dramatically lower demand and constrained government support, there is a bright light at the end of the tunnel for restaurant brands.

Digital article by Dylan Bolden, , Mary Martin, , Lauren Taylor, , and Ben Eppler

Even in the face of dramatically lower demand, there is good news for many restaurant brands. Digital ordering, delivery, and off-premises sales are up. Our research indicates that digital orders currently make up more than 30% of the market, representing some $100 billion in sales that are up for grabs. Restaurants that invested in digital capabilities have already captured more than their fair share of demand in recent months, enabling them to lead their respective categories. They have also positioned themselves to adapt quickly and effectively in response to shifting restrictions and regulations.

In just six months, the pandemic has accelerated shifts that otherwise would have taken five years to achieve. The evidence is increasing that many of the changes will stick. For the companies that have benefited, the key question is how to hold on to these newfound customers. For companies that are looking to rebound, the most pressing need is to identify the capabilities necessary to capture a share of the shifting market before it solidifies. The answer in both cases lies in combining technology and human strengths to create a bionic company.

A changed landscape

We don’t need to dwell on the impact of COVID-19. As of September, up to 20% of total restaurant units in the US had closed (the National Restaurant Association estimates about 100,000 closures in the six months prior to September), with more closures on the horizon (40% of operators say they won’t be in business in six months without further government assistance).

Although this combination of factors leaves more demand up for grabs for remaining operators, survivors face a much-changed landscape. Regulations have constricted dining room capacity, and dine-in occasions have dropped from about one-third of all occasions to less than one-fifth. We are now seeing some normalization of sales, with the quick-service restaurant segment, in particular, showing positive same-store sales growth. At the same time, signs of another wave of the pandemic, with unknown potential impact, are growing.

There are a few positive trends, including increases in delivery and digital ordering, which of course are interrelated. Delivery’s market share jumped from 7% in 2019 to about 20% in 2020. Across the industry, digital ordering now represents 28% of all orders compared with 10% before the pandemic, with most brands showing increases. For some, the shift has been dramatic. Chipotle’s digital sales mix increased from 20% in the fourth quarter of 2019 to more than 60% in the second quarter of 2020. Wingstop saw similar gains, jumping from 30% to nearly 65% over the same period. App Annie reports that downloads of delivery apps rose 51% from March to April 2020.

And these trends appear set to continue. One-third of restaurants’ digital customers ordered online for the first time during the pandemic. Almost 40% of all customers say that they expect to spend more on pickup or delivery from restaurants in the next six months.

This is good news for brands that capture digital customers because such customers tend to be more valuable. In the quick-service, fast casual, and casual dining categories, purchase frequency is about 50% greater for digital customers than for nondigital customers, according to our research. Not surprisingly, a brand’s digital sales mix is one of the strongest predictors of its performance through the COVID-19 crisis.

Holding on to success

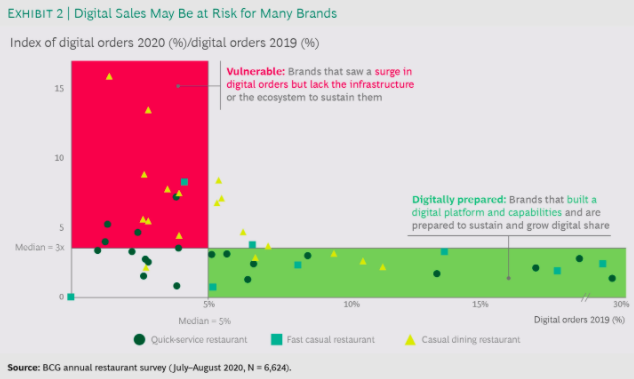

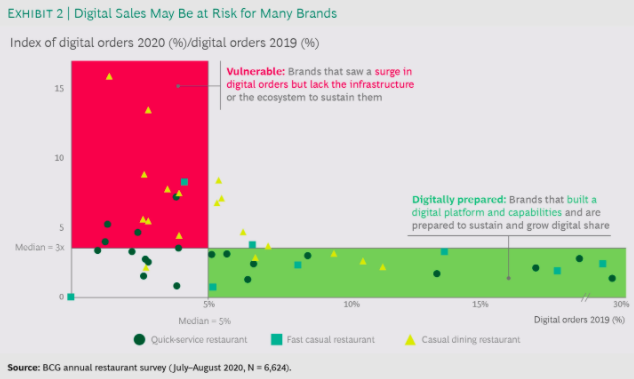

While the rising (digital) tide has lifted all boats, not all brands are equally well positioned to maintain or accelerate their digital sales growth. Some entered the crisis with robust digital assets and infrastructure, while others were behind the curve and have been trying (with varying degrees of success) to catch up. (See Exhibit 2.) For many digitally immature brands—those with less than 5% of digital sales in their total mix prior to COVID-19—digital sales jumped by more than three times when the crisis hit. But without mature digital capabilities, these newfound sales could be at risk when consumers settle into a new reality after the pandemic.

From digital to bionic

Although many businesses in recent years have focused on building digital capabilities, leading companies now realize that taking full advantage of such capabilities as data and artificial intelligence (AI) requires a marriage of digital and human strengths. BCG research in 2019 found that if CMOs are to make the most of advanced technologies, they must have the right technical and organizational success factors in place. For example companies capable of delivering relevant content to consumers at multiple moments across the purchase journey reported cost savings of up to 30% and revenue increases of as much as 20%. But companies that deployed machine-learning-based technologies with active human supervision boosted campaign performance by an additional 15%. We call these companies bionic because they achieve superhuman strength from the combination of technology and human skills.