M&A activity is accelerating. With valuations marching higher and so much capital in play, companies must pay close attention to the fundamentals to create value. PwC breaks down the details.

By many indications, the next six to 12 months could be busy ones for mergers and acquisitions. Companies anticipating economic fallout from the global coronavirus pandemic have an accumulated war chest of more than $7.6 trillion in cash and marketable securities—and interest rates remain at record lows. Pent-up demand may kick in as the availability of vaccines increase the trifecta of CEO, investor and consumer confidence. For companies facing imminent distress, consolidation may be inevitable. For others, dealmaking may be the best, and fastest, way to fill urgent gaps in the skills, resources and technologies they need to create value down the road.

Headwinds do remain. Ongoing waves of COVID-19 continue to trigger lockdowns. High unemployment is likely to moderate demand for products and services. Global trade tensions, regulatory pressures and a presidential transition in the US create uncertainties. A strong pipeline of IPOs offers owners an alternative to M&A deals as an exit path. And the economic recovery will likely be uneven across different sectors and regions.

Yet overall, the prognosis for dealmaking in 2021 is marked by opportunity and transformation—and competition for some companies could be fierce. The pandemic and recent geopolitical developments have already led most companies to the same conclusions, pushing both deal volumes and values higher in the second half of 2020, particularly for digital and technology assets. Many stock market indices, including the Dow Jones Industrial Average, NASDAQ Composite, S&P 500, Shanghai Stock Exchange and Nikkei 225, are at or near all-time highs. IPOs are buoyant: DoorDash, for example, closed its first day of trading 86% above its initial list price and Airbnb closed its first day up more than 112%.

Following a turbulent year in dealmaking, 2021 is likely to be marked by growing polarisation in asset valuations, the acceleration of deals in digital and technology, and increasing attention to environmental, social and governance (ESG) matters.

With rich valuations and intense competition for many digital or technology-based assets, dealmakers may feel compelled to take a more proactive—even aggressive—approach to acquire assets they want. Less desirable assets could see distressed sales at lower valuations, particularly assets in sectors more adversely impacted by COVID-19 or with business models that are no longer viable given the structural changes taking place.

Other factors expected to have a knock-on effect on deal valuations and M&A activity include an increase in restructurings and the continuation of a hot IPO market, particularly the use of special-purpose acquisition companies (SPACs) to raise capital.

M&A activity and valuations

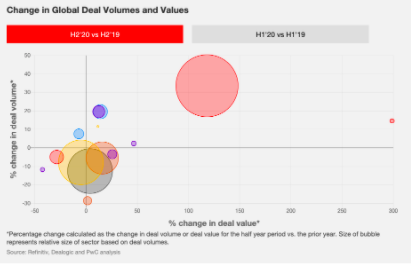

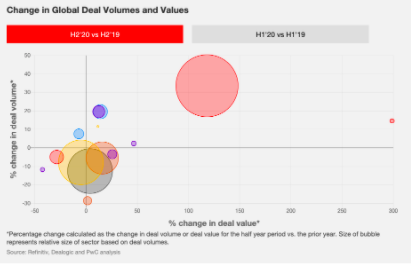

The valuation of assets remains one of the biggest challenges to M&A success—especially when deal activity accelerates and competition heats up, as we saw in the second half of 2020. Dealmaking rebounded from June 2020 and remained strong through to year-end across all regions. In the fourth quarter of 2020, deal volumes and values were up by 2% and 18%, respectively, compared with the same quarter the prior year. Across Asia-Pacific, EMEA and the Americas, M&A activity increased by between 17% and 20% during the second half of 2020 compared to the first half of the year.

A significant increase in the number of announced megadeals—defined as deals with an announced deal value in excess of $5 billion—contributed to the increase in deal values in the second half of 2020. There were 32 megadeals in the third quarter of 2020, with an additional 25 megadeals in the fourth quarter. The combined deal value of the 57 megadeals announced in the second half of 2020 amounted to $688 billion. In contrast, there were 27 megadeals in the first half of the year, with a combined deal value of $226 billion.

The technology and telecom subsectors have seen the highest growth in deal volumes and values in the second half of 2020 compared with the second half of 2019.

Review a full breakdown by sector here.