La deuda por préstamos estudiantiles se está acelerando tan rápido que se ha convertido en una carga para la economía de los Estados Unidos y está disminuyendo la propiedad de vivienda entre las generaciones más jóvenes.

Después de que el 69% de los estudiantes universitarios obtuviera préstamos estudiantiles durante 2018, los estadounidenses ahora deben más de $ 1,56 billones en deuda de préstamos estudiantiles, repartidos entre unos 45 millones de prestatarios. Eso es más de $ 520 mil millones más que la deuda total de tarjetas de crédito de EE . UU .

Recientemente, el Institute for College Access and Success estudió los estados donde la deuda promedio por préstamos estudiantiles es mayor, revelando que New Hampshire tiene la deuda promedio más alta por préstamos estudiantiles, seguida inmediatamente por Pensilvania y Connecticut.

Utah was the state with the lowest average student debt, with state graduates owing $19,975. It’s the only U.S. state that’s average student debt was just under $20,000.

Student debt kills the dream of owning a home

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5,6″ ihc_mb_template=”3″ ]

There’s a proven link between decreasing homeownership among millennials and high student loan debt.

Substantial student loan debt has forced many American millennials to shift their financial priorities, especially that of buying a home.

A January 2019 study by the Federal Reserve Bank of New York found that homeownership rates for people ages 24 to 32 decreased by almost 9 percentage points, and that’s because young Americans are seeing themselves pay an average monthly student loan payment of over $350.

The staggering amount of student loan debt could purchase the equivalent of 5-6 million typical American homes, according to reporting from Sarah Friedmann in The Daily Beast.

A September 2017 survey from the National Association of REALTORS® (NAR) found that over 80% of millennials who haven’t purchased a home cited their student loans as contributing to their inability to become a homeowner, while an Apartment List study of 6,400 millennial renters found that “those with student loan debt will be significantly delayed in their ability to purchase a home.”

Lacking basic information

What’s even worst of this situation is the lack of information many students are facing.

According to a new study from Lendkey Technologies, a digital lending partner to hundreds of credit unions and banks, nearly half of borrowers surveyed had no idea what their debt obligations will be once they graduate.

After surveying 2,390 Americans online over the age of 18 who took out student loans from public and/or private lenders during March of 2019, the poll found that 49% of borrowers do not fully understanding the financial burden that awaits them after graduation, as well as what their monthly minimum payment would be once they exit school. Only a small 10% of 18-34 year-olds expressed to know what their exact payment amount would be after graduation.

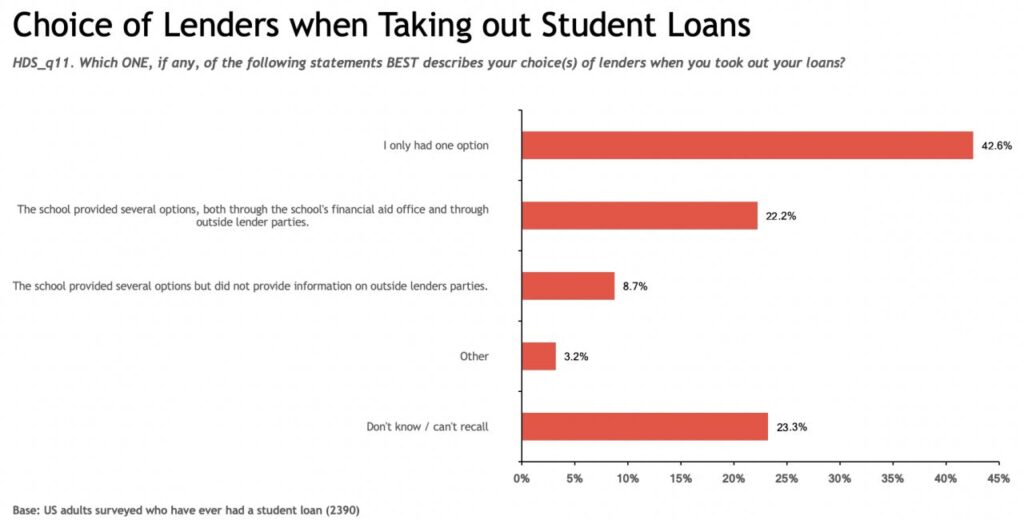

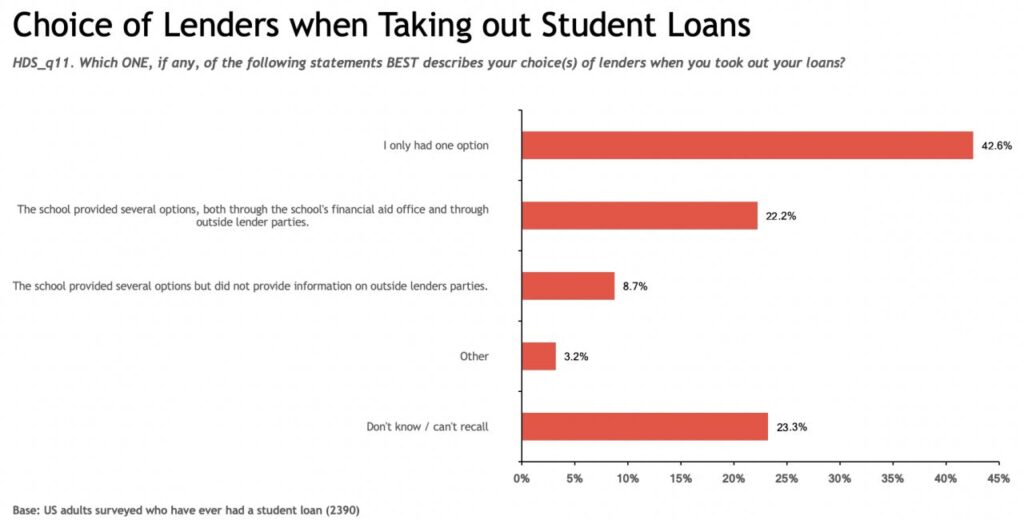

Student borrowers need better financial advice. The Lendkey survey found that just 22% of them say their academic institutions offered them a range of lender options through the school or outside lenders, while over half of students blamed their college or university for failing to provide them with “sufficient” information about the debt they were taking on. Furthermore, more than 40% of students say they were only given a single option.

USA Today’s Susan Tompor reported on March 14 that millennials are “so buried in debt that they can’t buy into the American dream of owning a home.”

La mayoría de los expertos financieros están de acuerdo en que la crisis de los préstamos estudiantiles en Estados Unidos es un problema importante, que se soluciona mejor con un enfoque múltiple para garantizar que los millennials tengan un futuro financieramente seguro que pueda incluir la propiedad de una vivienda, si lo desea, sin embargo, la verdad sigue siendo que El Sueño Americano es difícil de lograr sin pensar en la deuda.

Haga clic aquí para ver las estadísticas de las tarjetas de crédito y la deuda de los hogares en los Estados Unidos a través de Student Loan Hero .

[/ ihc-hide-content]