It’s been two years since the explosion of generative artificial intelligence started to transform Nvidia’s business. Since then, the chipmaker’s revenue has more than tripled and profits have quadrupled.

Nvidia’s fiscal second-quarter earnings report, scheduled for Wednesday, will mark the second anniversary of growth, as the company shifted from being known as a maker of gaming chips to its current position at the heart of the technology industry.

Last month, Nvidia became the first company to hit a $4 trillion market cap, and it’s continued to appreciate in value. Since the end of 2022, around the time OpenAI launched ChatGPT and sparked the generative AI boom, Nvidia’s stock price is up twelvefold. It’s up 33% this year, closing on Friday at $177.99.

Growth is still substantial for a company Nvidia’s size, but it has slowed dramatically. After five straight quarters of triple-digit expansion in 2023 and 2024, growth dipped to 69% in the fiscal first quarter this year. Nvidia is expected to report a year-over-year jump of 53% to $45.9 billion in its second-quarter report, according to LSEG’s consensus of analyst estimates.

Data center revenue in the first quarter accounted for 88% of Nvidia’s total sales, the clearest sign of how significant AI has become to its business. The company said that 34% of total sales last year came from three unnamed customers. Analysts say Nvidia’s top end users are major internet companies and cloud providers such as Microsoft, Google, Amazon and Meta.

“The assumptions and performance of Nvidia really dictates what the market is going to start to price into the AI trade, and that whole AI trade has essentially been driving the market this past year,” said Melissa Otto, head of Visible Alpha Research at S&P Global, which aggregates Wall Street research.

Nvidia makes up about 7.5% of the S&P 500.

Tech’s megacap companies, other than Nvidia, reported quarterly results in late July, updating Wall Street on their investment plans. In all, they’re looking to spend roughly $320 billion on AI technology and data center buildouts this year.

OpenAI, which is still private but has a valuation in the hundreds of billions of dollars, says it will team up with SoftBank and Oracle to spend $500 billion over the next four years on the Stargate project, which President Donald Trump announced in January.

Analysts say about half of AI capital spending ends up with Nvidia. The company’s reliance on the so-called hyperscalers leaves it vulnerable to changes in the macroeconomic environment and in the artificial intelligence industry, which remains hard to predict.

OpenAI CEO Sam Altman said last week that he believes “investors as a whole are overexcited about AI,” and even said it could be a “bubble.”

But don’t expect a pullback yet. OpenAI CFO Sarah Friar told CNBC on Wednesday that the company “constantly” doesn’t have enough computing power.

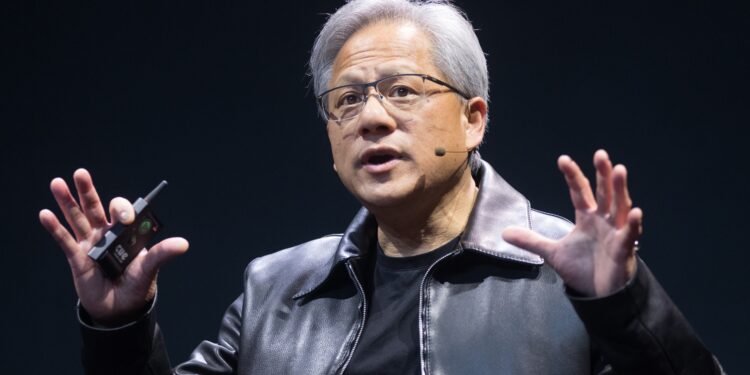

As always, Wall Street will be paying close attention to Nvidia’s guidance and other forward-looking commentary from CEO Jensen Huang. For the fiscal third quarter, analysts are expecting revenue growth of 50% to $52.7 billion, according to LSEG. If Nvidia guides higher and tops estimates for the second quarter, analysts say that kind of “beat and raise” could drive AI optimism even higher.