In brief:

-Innovations in tokenization and decentralization are evolving to meet demands for money and efficient payments in local and global transactions.

-Central bank digital currency has been actively explored to prove security, scalability and resiliency of the systems and technology.

-As key monetary innovators, central banks can create better performing, more resilient payment architectures by leveraging new technology.

– Collaborations include: Bank of Canada, Monetary Authority of Singapore, European Central Bank, Sweden’s Riksbank, and the Digital Dollar Project.

Money as a medium of exchange has seen little innovation since the introduction of paper currencies and cashless transfers in the nineteenth century. However, in the last two years new financial ecosystems driven by technology have uncovered new functionalities for money. In an increasingly digital world underserved by analog currencies, large players like commercial banks and social media companies are creating new ways to transfer value. For central banks to remain future-proof, central bank money must be modernized to meet the accessibility demands of the 21st century.

The time for central banks to act is now. Central Bank Digital Currencies would offer new scope and possibilities for secure and instantaneous settlement, through consumer banks and trusted payment intermediaries.

Tokenization and Central Bank Digital Currencies

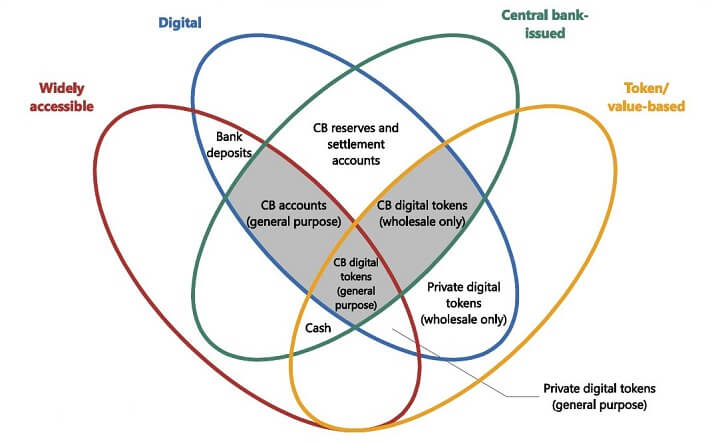

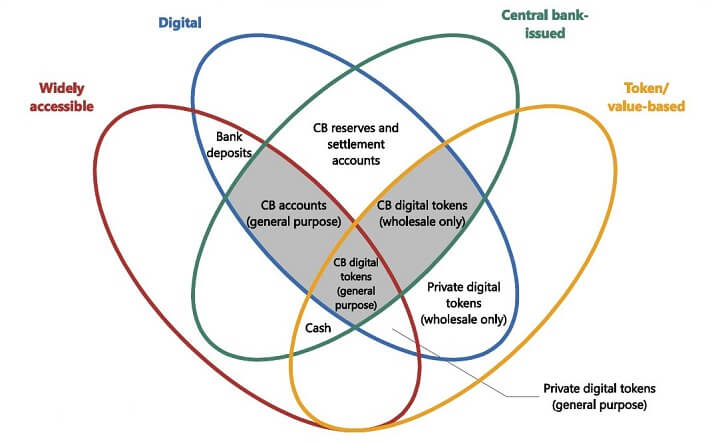

Central Bank Digital Currencies (CBDC) utilize tokens, or digital representations of value, and function in the digital realm the same as hard currencies. Tokenization and decentralization are critical to meet new demands for money and establish more direct, transparent and efficient payment systems. Tokenization has emerged as a format to represent goods, assets and rights. It offers new financial utility and attributes, promising greater flexibility and liquidity. CBDC or tokenized central bank money leverages the decentralized and secure advantages of blockchain. Enabling peer-to-peer transactions, CBDC offer a more resilient payment infrastructure, reduce transaction costs, enhance information sharing capabilities and facilitate data reconciliation. Blockchain enabled payment solutions have been rigorously tested by central banks across North America, Europe and Asia.

Digital medium of exchange

Just like the paper money in your wallet, CBDC is backed by the stability of central bank reserves and issued with the same trust attributes needed for CBDC to exist side by side—not replace—current forms of currency. Additional advantages include portability for use anywhere, anytime, and the ability to embed the rights and obligations of the bearer into smart contracts. CBDC expand access to money and promote financial inclusion, while also addressing critical security, scalability, and privacy concerns in payments.

The readiness of blockchain enabled payment solutions has made significant progress. Blockchain now addresses residual concerns about scalability and inter-operability and therefore offers the foundation for advancing towards select real-life applications and implementation plans.

The greatest benefits of CBDC are to be found in the broader context of reshaping payments relations and rests in the integration of assets and currency on a single ledger in the combination of tokenization, decentralization and secure information sharing. CBDC attracts payment applications in retail, wholesale and cross-border transactions. Considerations differ largely dependent on local circumstances and preferences. The adoption of CBDC will depend on set policy objectives.

Central banks can play a major role in shaping the new landscape since they maintain the unique—and essential— convening power needed to bring together disparate players in the financial sector. This will minimize fragmentation in the market and establish a strong foundation.

Success factors include:

Governance. Driving the necessary governance structures, rules and putting policies in place.

Growth & protection. Ensuring economic growth alongside security for consumer protection.

Control. Supporting the adoption of progressive approaches to currency control and use.

(Courtesy Accenture. By John Velissarios, Security Lead – Global Blockchain Technology)