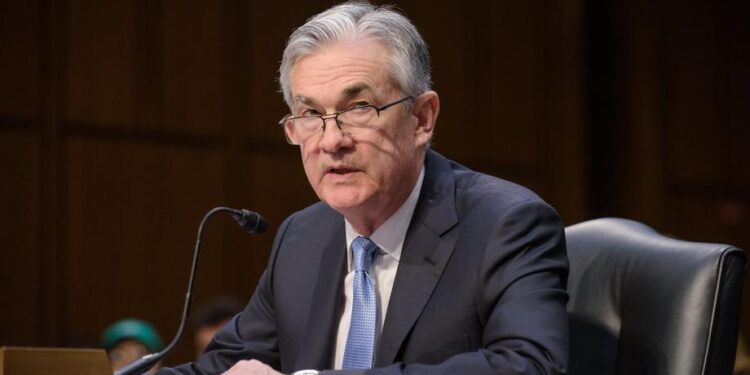

Today’s Federal Reserve meeting is anticipated to maintain interest rates at their current level as policymakers evaluate indications of a cooling economy and the threat of rising inflation due to U.S. import tariffs and escalating tensions in the Middle East.

Ahead of the meeting, Fed officials have expressed their desire for clarity regarding the economy’s trajectory toward either higher inflation or slower growth before offering new guidance on interest rates.

Despite the U.S. central bank cutting rates three times in 2024, experts believe the Fed will hold off on making any major decisions today due to the current market outlook, as attention shifts to President Trump’s calls for Iran’s “UNCONDITIONAL SURRENDER”.

Today, Brent futures are trading above $76 a barrel, about $7 higher than they were before the recent tensions between Iran and Israel began.

A survey from the National Association for Business Economics released on Monday indicated that economists expect GDP growth in 2025 to decrease to 1.3%. They also anticipate inflation to finish the year at 3.1%, above the Fed’s 2% target.

By CEO NA Editorial Staff