Scott Curtis

COO / Raymond James

Scott Curtis, COO of Raymond James, discusses over 60 years of the company’s success, highlighting that people are at the core of everything Raymond James does.

Raymond James is a globally recognized financial services firm that offers trusted financial advice and tailored, sophisticated strategies for individuals and institutions.

The company’s client-first business model has remained strong for decades, helping Raymond James move toward the future with modern strategies delivered through a tried-and-true approach.

Over the years, the firm has become an industry leader, focused on independence, integrity, conservative risk management, and always prioritizing clients.

Honoring a Leadership Legacy

Raymond James is a people-driven, values-based, and future-focused financial services firm. When the company’s founder, Bob James, established the firm in 1962, he says, “We are in a people business, both inside and out.”

Scott Curtis, who has been with Raymond James since 2003 and became Chief Operating Officer in 2024, says the firm remains dedicated to operating with the same strong values that were established at the very beginning.

“I think fundamentally, as an organization, the firm focuses primarily on our wealth management businesses,” he explains, “Our view is the advisors are our primary clients. Our resources and our energy are focused first on supporting them and their businesses and, at the same time, making sure that we’re delivering world-class service for them and their clients.”

“We have made significant advancements with machine learning and automated approval processes that historically relied on human beings. We are leveraging technology to enhance decision-making as we look forward.”

“Our advisors decide who they want to do business with, and they run their businesses the way they choose.” Depending on the community where an advisor resides, businesses can vary. “That’s another philosophy we have in the organization,” Curtis says.

“I think the advisor-focused philosophy is somewhat distinct from competitor organizations, where their perspective is clients belong to the firm,” Curtis explains. “It may seem subtle, but for the advisers associated with Raymond James, a key distinction is we’re not competing with them for their clients. We’re focused on providing support, resources, and capabilities to help them excel and deliver the best possible experiences and outcomes for their clients.”

Curtis explains that the strong, clients-first-focused foundation persisted when Tom James, Bob’s son, took over as CEO. “It was certainly carried on and reinforced by Tom for the forty-plus years that he was CEO and has been carried on by Paul Reilly for the last fourteen during his CEO tenure. I expect the same to continue with Paul Shoukry as he steps into the CEO role in February 2025.”

“The entire leadership team including myself, are all one hundred percent bought in. We believe that’s the appropriate way to run the business and we continue to be optimistic about personal wealth management and helping people achieve their financial objectives and dreams – whatever, those might be.”

Not a DIY Business

“Some people may believe as AI continues to improve and technology advances, individuals will shift more toward a ‘Do it yourself’ approach,” Curtis says. However, Raymond James’ COO is not concerned AI or technological advancements will undermine the important human element of his firm. Instead, they’ll improve efficiencies and strengthen advisor-client relationships and collaboration. “We don’t think the majority of clients will move away from relying on a financial professional for advice and guidance and managing their own finances. Busy clients likely don’t have time to learn everything a well-equipped, experienced, competent financial professional has learned over many years.”

This perspective benefits the company’s approach to business and the advisor-client relationship: “We don’t aim to develop a direct-to-consumer business that would compete with advisors. That’s not our space; twhat’s already well-trodden ground.”

Curtis believes that there is consistent market demand for Raymond James and the vast array of personalized services the company offers. “One reality of our business, especially in the US, is that tax laws change frequently. With a new administration every four years, the rules often shift, making it challenging for individual clients and business owners to stay up to date. The need for financial advice and guidance has never been greater.”

A Collaborative, Full-Service Firm

“If we look at the organization as a whole, we are a diverse mix of businesses. We are a full-service firm. We have wealth management, which is our primary business that accounts for over 70% of the firm’s revenue. But, we’re also a bank holding company.”

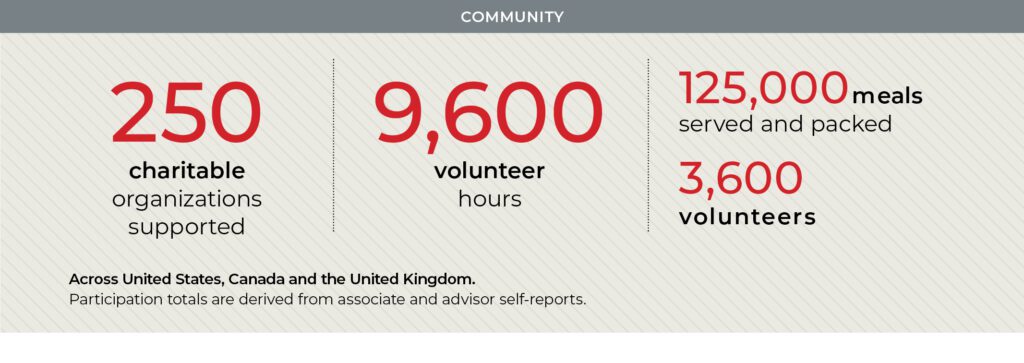

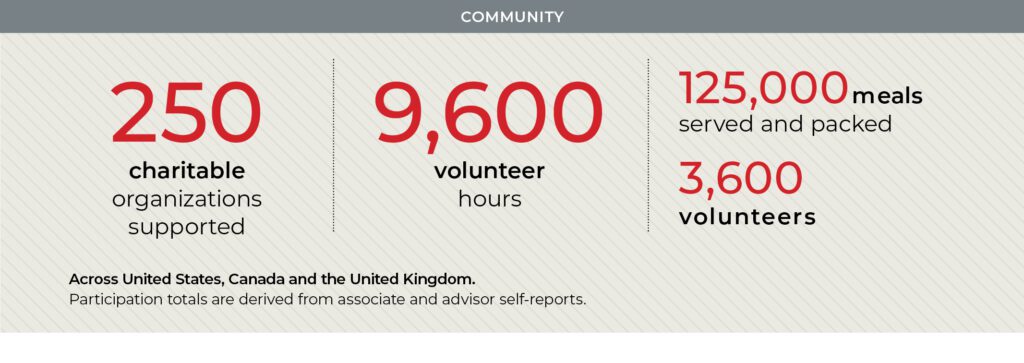

The company owns and operates two banks, Raymond James Bank and Tri-State Bank, which are essential service providers for Raymond James’ advisors and their clients. The company also has successful; Investment Banking, Fixed Income, Capital Markets, Public Finance, and Institutional Investment Management businesses – a diversified mix that provides opportunities for collaboration.

“In my twenty-two years at the firm, I’ve seen significant improvements in collaboration across our businesses,” Curtis says. Often, the company may be serving the same client in more than one of the businesses. “We are much better and more collaborative about that today than we’ve ever been in the past. Our advanced technological capabilities play a role in that.”

Improving Efficiency Through AI

“Efficiency is a significant focus of ours, continuing to zero in on ‘How can we be more efficient for the advisors?’ And, how can the advisors and their clients be more efficient in their interactions with us?”

To that end, Raymond James is focusing on transforming its processes. According to Chris Butler, SVP of Investment Solutions and Global Wealth Solutions at Raymond James, “It’s really necessary to get that digitization aspect right, we’ve been working on that for many years… We are proud of the fact that now over ninety percent of our volume in the business is all done electronically.”

Butler says AI is also helping Raymond James fine-tune its customer service by making it easier for clients and advisors to give critical feedback. “To hear from people on what we need to do better, and then have a platform that enables us to make those improvements and enhancements, that’s a big part of what we’re working on.”

On top of implementing AI into daily tasks to enhance advisor efficiency, Raymond James collaborates with advisors to design the company’s digital platforms. “It’s not – we develop something and then deliver to them… they help us prioritize and provide critical feedback on applications in development,” Curtis says.

“The fact that you’re expected to, empowered to and rewarded for putting clients’ interests first is a huge differentiator between Raymond James and our competitors. It’s a caring culture, a client-centric culture, a conservative culture, but it’s a growth-driven culture as well.”

Chris Butler / SVP of Investment Solutions and Global Wealth Solutions / Raymond James

Deliberate, Responsible Growth

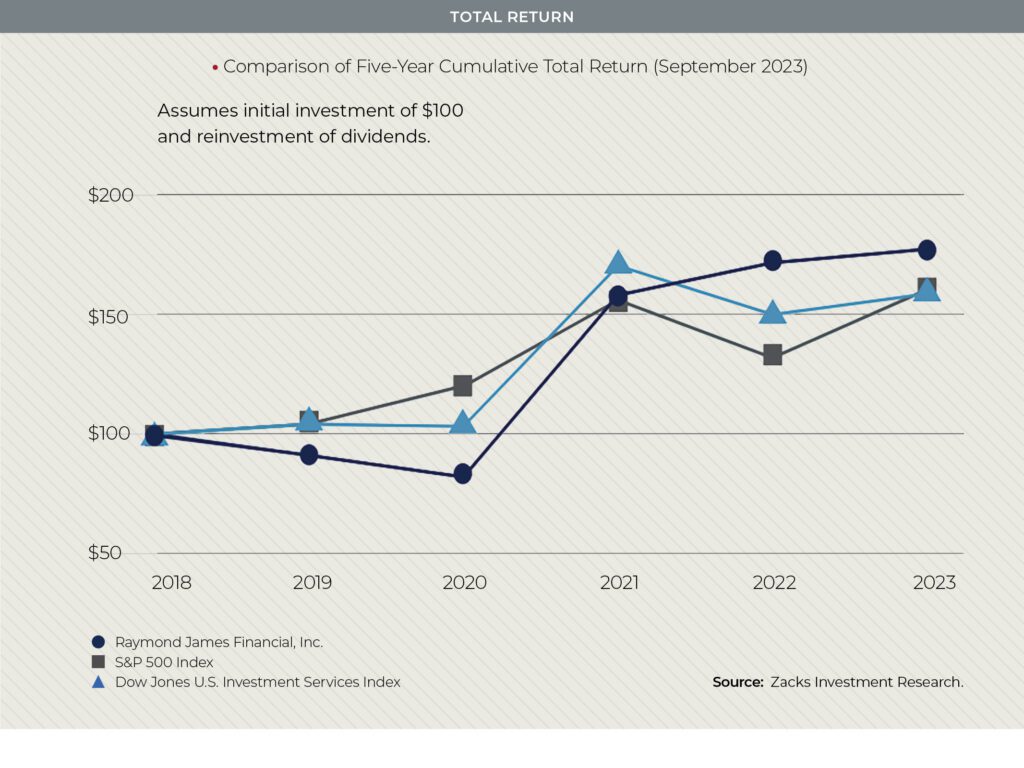

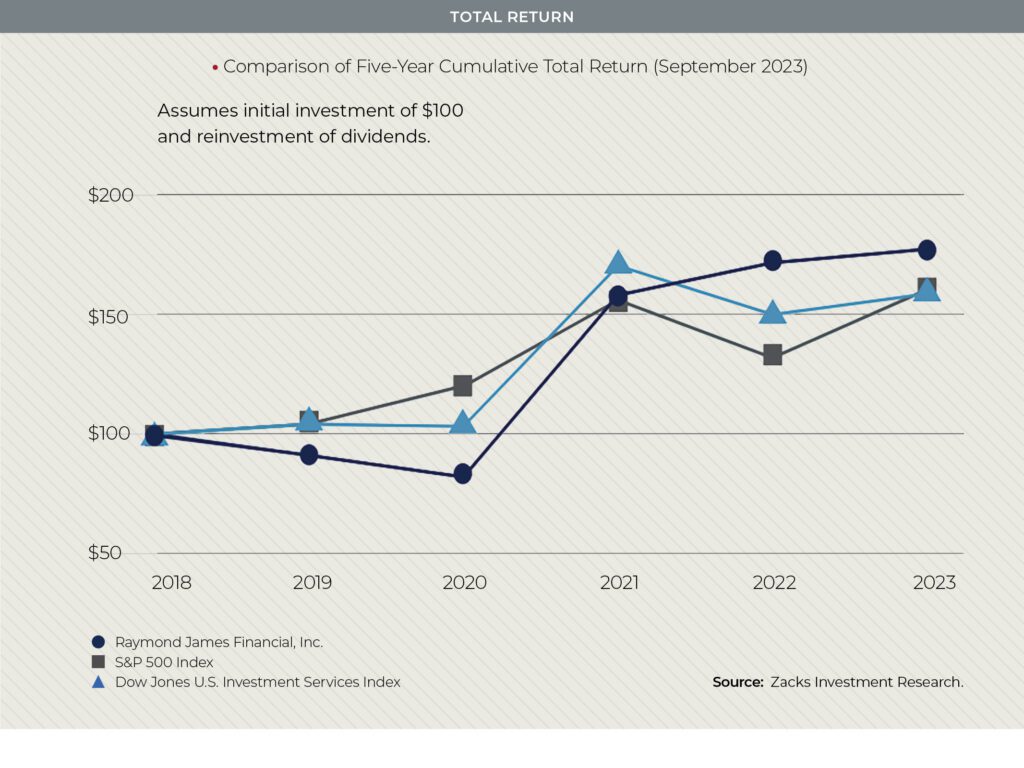

In October 2024, Raymond James reported record annual net revenue of $12.82 billion, marking a 10% increase compared to the previous year.

When asked about the company’s plan for long-term growth, Curtis says, “A little over six years ago, when I became the Head of Private Client Group, our senior leadership team put together a strategic vision for 2030, which is now only five years away.”

At the time, the Private Client Group was administering just under $1 trillion in domestic client assets, “The firm was founded in 1962, so we thought, ‘Okay, it’s taken us almost sixty years to get to $1 trillion – let’s put a stake in the ground and over the next ten years let’s double that and get to $2 trillion.’”

“We’re still focused on achieving or exceeding that $2 trillion objective by 2030, and, I’m happy to report we’re well on our way.”

The COO says the plan’s success has benefited from favorable equity markets. “We’re actually slightly ahead of schedule, but you never know what’s going to happen over the next five years.”

Curtis believes that revenue and income directly result from the company’s actions. “If we successfully provide excellent support and resources for advisors, those we want to stay with Raymond James will remain with the firm and continue to bring additional client assets. This, in turn, will enhance the company’s positive reputation, attracting other successful advisors who may be interested in affiliating with us.”

“We will continue to grow at a deliberate pace, not one that is focused exclusively on growth – we are focused on responsible growth.” Curtis notes, “If our assets continue to grow at the rate they have – just north of 10% compounded annually, we’ll achieve that objective… However, our focus is on first ensuring we execute every day keeping in mind that strategic vision.”

Preparing for Rainy Days

Raymond James is largely operated using a conservative mentality. “We’re not trying to hit home runs or hit triples,” Curtis notes, “We’re trying to be excellent at what we do every single day by staying focused on advisors and their clients’ needs.”

“We have a long-term perspective, recognizing the actions and decisions that we make today will impact our business years from now. When we approach significant decisions, we think about what those decisions will do for our businesses for the forthcoming years – not just for the next quarter or the next year. That’s benefited us as an organization.”

“That conservatism starts with making sure that we have a rock-solid balance sheet so that when the rainy day comes, we’re well-positioned and not reliant on other organization for our continued growth and success.”

Curtis says Raymond James is better positioned than many of its competitors because of its philosophy and focus. He emphasizes, “We are in control of our own destiny from a financial standpoint. We maintain a very conservative balance sheet, having more than twice the required regulatory capital.” Curtis says the company balance sheet supports the businesses and takes advantage of potential opportunities as they surface “in times of stress.”

A Winning Core Philosophy

When asked to summarize the key business message of Raymond James, their COO says, “I think I’d come back to where we started, which is, the philosophy that Bob James and Tom established for the organization. Which is: putting client’s interests first.”

Curtis explains, “Treating advisors as clients and maintaining a long-term focus while managing the business conservatively” are also essential principles of Raymond James’ operations.

He maintains, “We’re not an organization whose primary focus is to build products and the advisers are outlets through which we distribute those products to their clients – we are quite the opposite. We start with: what are the needs of the clients? Then, let’s assist the advisors with identifying what the best solutions are for them. And we do that in in a collaborative way.”

“In a crowded field, those subtle differences are important distinctions.”