Peter Mallouk

President & CEO / Creative Planning, LLC

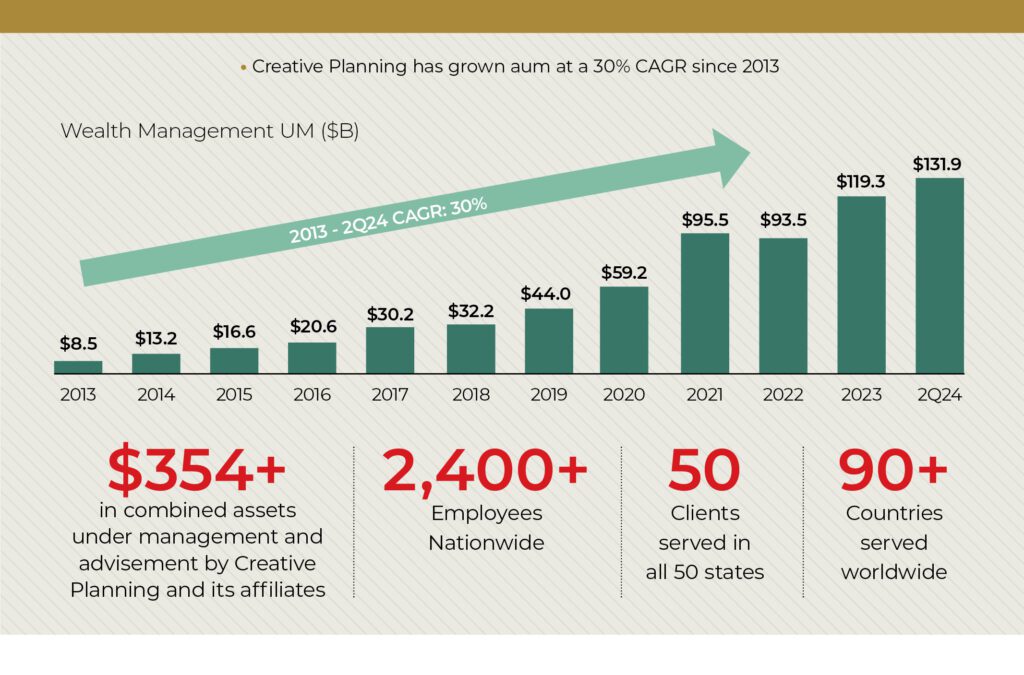

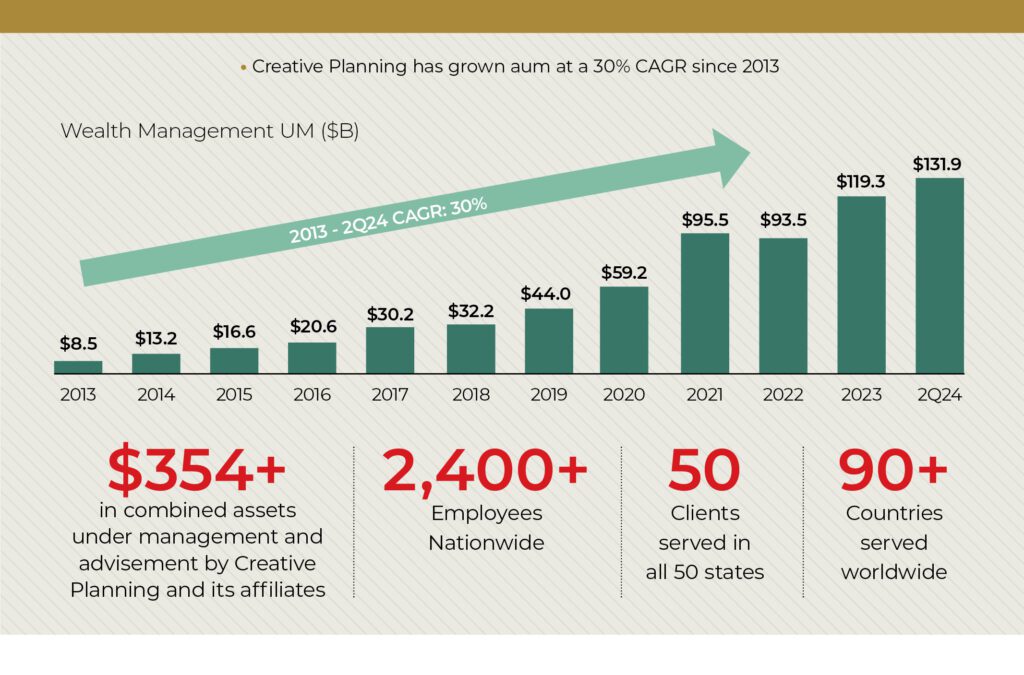

Creative Planning LLC takes an independent, full-service approach to asset management, offering wealthy investors financial, estate, trust and tax planning in one place. Regularly ranked among the top U.S. independent financial advisors, its assets under management have grown to more than $354 billion from about $34 million in 20 years.

When Peter Mallouk became Chief Executive Officer of Creative Planning in 2004, the wealth-management industry was very different than it is today.

Most management was conducted through banks and brokerages which received commissions or divvied up profit-sharing linked to success in selling or trading their own financial products.

And while that arrangement made it easy – and perhaps too easy – for investors to buy or sell securities, getting additional legal, tax or accounting services or seeking counsel on estate planning or charitable giving usually required the investor to seek outside help.

Mallouk, an attorney, began working as an estate planner for Creative Planning in 1999. Founded in 1983, the company, based in the Kansas City suburb of Overland, Kansas, was an asset management unit of a larger financial-services company.

Mallouk felt so strongly that his clients would be best served by a management company separate from a larger financial institution bought control of Creative Planning from its parent and made himself CEO.

“One of the opportunities I saw was to have a firm that was completely independent, that didn’t have any product, didn’t make commissions on any investments,” he told CEO-NA.

“Also, the typical person has to go to a lawyer and accountant and the money manager and all these different people to make very basic decisions,” he explained.

“After human capital, it basically comes down to technology in terms of where we are willing to spend our money.”

“I like the idea of having all of those advisors working together, and we were one of the first, if not the first, firm in the country to put all of those things together under one roof.”

His view of wealth management, according to a 2017 article in the New York Times, put Creative Planning “at the vanguard of a profound shift in finance.”

Indeed, in the two decades since he took Creative Planning in a new direction, the number of high net-worth individuals in the United States and worldwide has more than doubled and the amount of money they hold has nearly doubled, even after accounting for inflation.

This has not only created more and more ultra-affluent investors, but the phenomenon of “the millionaire next door”. That has been a fertile but highly competitive ground for Creative Planning as families and individuals earn more, invest more and demand more from their advisors.

“When you look at other firms that have experience with that millionaire next door and the ultra-affluent client, they tend to have an enormous amount of investment conflict,” Mallouk explained. “They tend to be brokerage houses that have their own investment products and get paid different ways on different investments.”

“Creative Planning doesn’t have any of that,” he added. “We get paid the same no matter what investment we recommend. A client is able to get unbiased advice, and that’s something that’s exceptionally rare in the financial-planning and wealth-management landscape.”

Today, more than 1,600 Creative Planning clients have accounts of more than $10 million, and the average for that group is $25 million. Those clients don’t just include the wealthy, they include the ultra-wealthy, Mallouk said. Among them are 50 centimillionaire and billionaire families, he said.

“Creative Planning has an enormous amount of experience with very complex and sophisticated households,” Mallouk said. And that experience is especially important in the current uncertain political and economic environment, Mallouk said.

“I think that the world has become increasingly complex and hostile, and the markets have also become increasingly complex and hostile,” he explained. “Every time the government changes a tax rule, it can have implications on the estate plan – not just your tax plan but on the estate plan, on the investment plan, on your financial plan.”

Having experience in all these areas has helped Creative Planning win a leadership role in the market.

Today, Creative Planning manages money for investors in all 50 U.S. states from about 100 offices. It also handles management and planning for expats working abroad.

“We understand how to position an investment account in a way for our clients to pay the least tax as possible.”

“I think we’re a leader, if not the leader in the independent wealth-management space,” Mallouk said. “We are one of the largest in a very, very fragmented market.

He estimates that Creative Planning’s more than $350 billion in assets under management accounts for about 1 percent of the independent wealth-management industry, an indication of how competitive the business is.

It’s a market share that he plans to expand. “Our mission over the next three to five years is to become nationally recognized, not just within our industry where I think we’re very well known, but more to the general public. And to do that, we’re going to have to grow,” he said.

Consolidating that growth will depend on new technology needed to speed-up market analysis and client service and keep the different teams with their different skills and databases working together efficiently.

“We’re very focused on implementing technology to make things move faster internally so the client can get the correct answer to a complex problem communicated clearly and quickly,” Mallouk said.

“We have so much experience, and when you go to a doctor, you’re looking for the doctor who has been dealing the issue more than most other doctors.”

This presents some challenges for a company like Creative Planning which is no longer just a small boutique, nor does it have the administrative and tech resources that the banks and national brokerages have.

As a result, the company buys much of its technology off the shelf and works with or outsources some functions to its partners. Still for some of its needs, it has to build its tech itself.

“Because we’re in an industry that so fragmented and the overwhelming majority of our competitors are much smaller than us, the tech stack for our industry has been built for much smaller firms,” Mallouk said.

“We’re in an interesting spot because we’re in such a fragmented industry where some things we are able to use off-the-shelf,” he continued. “Most things we have to customize, and some things we’ve just had to build from scratch. Technology is a must to advance, and basically, we’re going to do whatever it takes.”

In the end, all the experience, all the technology, all the attempts to deal with a hostile economic climate and all of Creative Planning’s specialized and sophisticated expertise is directed at keeping the process as simple as possible for the client.

“Taking complexity and making it simple and creating very quick paths to put someone in a better spot – the demand for that is hotter than ever,” Mallouk said.

And that’s just what high-wealth individuals need, Mallouk said. “If you’re an executive, then you have a lot of moving parts,” he said. “You might have a unique equity-compensation plan. You might have very lumpy tax years. You may have future liquidity events.”

Mallouk believes he has created Creative Planning over the years to serve such investors and their families.

“That’s what our teams at Creative Planning were built for and I think that’s why we attract so many high-net-worth clients,” he said.