CEO Hiten Shah hit upon a plan to help suppliers and customers alike as change swept across the manufacturing world.

Hiten Shah landed upon the idea for MES in 2007 when a customer of his sales firm asked if there were some casting manufacturers from India that Shah could evaluate.

Coincidentally, he had recently met with such manufacturers to provide items to Tianyang and happily made the match between the customer and the client. “Eventually, the customer said, ‘Look, this is a good product here, but we don’t want to manage the logistics. Can you manage the logistics?’” Shah explains.

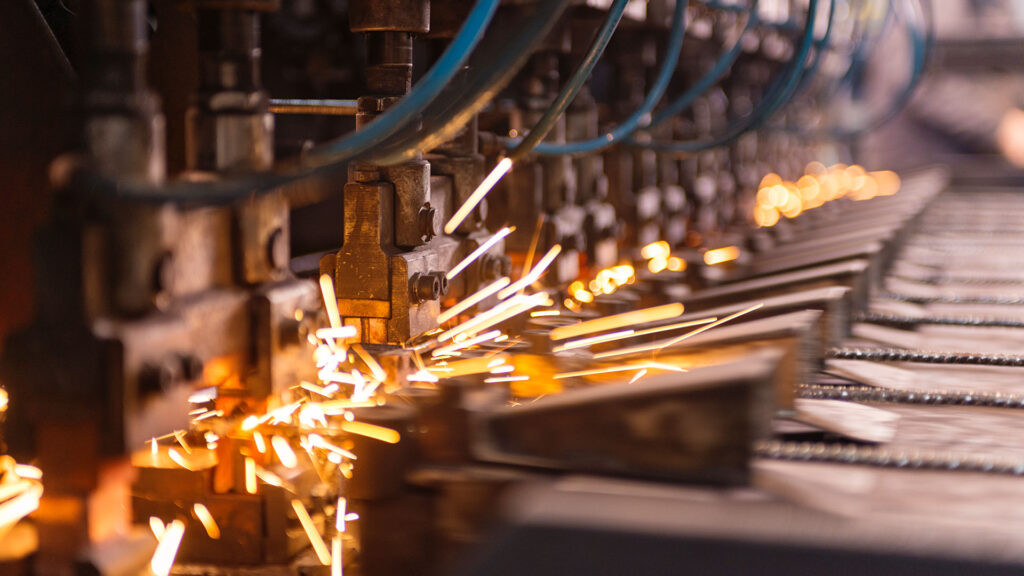

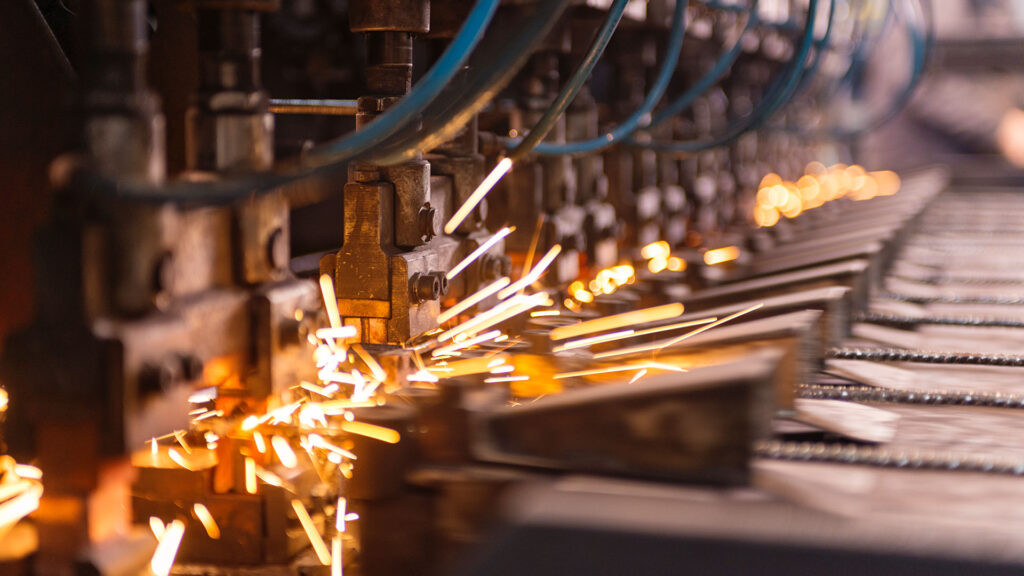

MES, Inc. is a full-service provider of global manufacturing and supply chain management services headquartered in Columbus, Ohio, with offices in China, India, Poland, and Mexico, and warehouse facilities in Ohio, California, Poland, and Mexico.

The company sources manufactured components from the above countries along with Taiwan, Vietnam, and Malaysia, helping North American OEMs in managing the entire outsourced manufacturing process and delivering the top quality components they require in a timely and efficient manner.

“Within about eighteen months, I saw an opportunity to build a supply chain company rather than a sales representation company, which is what I was doing before,” Shah recalled. “We saw that there were millions of dollars in trade happening.”

The result has been a success story that surpassed even Shah’s expectations. Columbus Business First has listed MES among its 50 fastest-growing companies in Ohio for seven consecutive years between 2011 and 2017 while the company has made Inc. Magazine’s Inc 500/5000 each and every year since 2012.

Simplifying the supply chain

Shah noticed that the challenges facing Original Equipment Manufacturers (OEMs) and Tier 1 companies (the principal supplier of components to the manufacturing company) in terms of the sheer number of components they had to manage, otherwise known as high-mix, low-volume products, had left firms stretched to the point that many were struggling to manage their supply chains.

“They are doing very well in managing their core components, or high-volume platforms,” he explained. “For example, they might have a commodity with a $100 million spend, about 60-70% of which is stuff they buy in high volume, yet the other 30-40% is a high mix sourced from literally hundreds of suppliers. They end up with a really fragmented supply chain on their long-tail products, things like die casting, zinc casting, iron forgings, and plastics. So we really focus on that.”

To make the supply chain process even more efficient, MES owns and manages the inventory of the products until it is released to the customer, which helps them financially. Shah also describes how, while leadtimes are usually between six and seven weeks in North America and Europe, MES is capable of executing much quicker turnarounds and product launches, setting a goal to always be within three days of a customer’s location, aided by the presence of warehouses in the US, Mexico, and Poland.

A unique competitive edge

As such, Shah believes MES has a unique competitive edge in its marketspace, offering end-to-end solutions for its clients that not only include finding suppliers, but also carrying out quality audits and inspections, the consolidation of shipments, just-in-time inventory and warehousing, and local value-added operations, such as painting, powder coating, and machining.

“Some firms may just have a sales representative business, with which they help you find suppliers in, say, China and ship directly to customers, but they don’t solve the inventory issues,” he explained. “Some buy products from there but they don’t have the analytics to manage the inventory amid volatile demand patterns.”

According to Shah, the market currently looks so promising that he believes MES can double its size in the next five years. The company plans to do this by focusing on three key metrics: on-time delivery and customer ratings, quality parts-per-million (PPM), and inventory in ODSI, each of which MES is constantly working to improve. Broadening its use of predictive analytics and business automations for supply chains are also a key part of its strategy for the future.

“When we put our board of advisors in place in 2009, we were a very small company, and we focused on how we would define success,” Shah recalled. “We’ve had benchmark levels across all three metrics for the most part. Over the next eighteen months, our biggest priority is to prepare our quality team, our supplier partners, and our systems and processes to gear up for more automotive work, more demand-in-quality work, so we can ensure that quality levels are world-class.”

Ultimately, Shah sees three key mission purposes that MES is increasingly built around: creating win-win solutions for customers, providing an exciting and challenging environment for its team members, and developing quality suppliers across the globe, many of which the company has long-term contracts with and whom it encourages to adopt similar performance criteria, allowing not only the suppliers, but also, in Shah’s view, MES, to just get better.

“Essentially, we are only as good as our suppliers,” Shah insisted. “We spend a lot of time mentoring them, auditing them, providing feedback. We encourage them to visit our customers, and our customers to visit our suppliers. Our alignment with our supply partners is absolutely vital, and we are only as good as what they do in terms of the quality, the capacity, the responsiveness, and the lead times as far as production.”