According to PwC, the mergers and acquisitions trends are showing signs of a rebound, and we can expect a jump in deals by year-end.

Dealmakers are accustomed to facing uncertainty, but the scale and speed of COVID-19 sent shockwaves through the global economy and the mergers and acquisitions (M&A) market. We adapted to the challenges and the changes in ways of living and working. As business went largely virtual, so did deals.

The global fiscal stimulus packages provided by governments to counter the economic downturn have now topped US$10 trillion and triggered strong rebounds across practically every financial market.

Markets recover as investor confidence returns

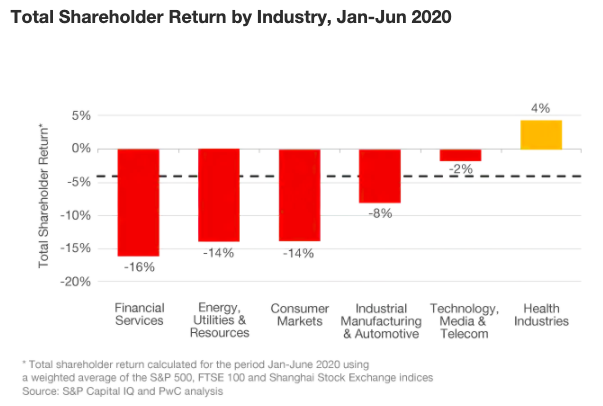

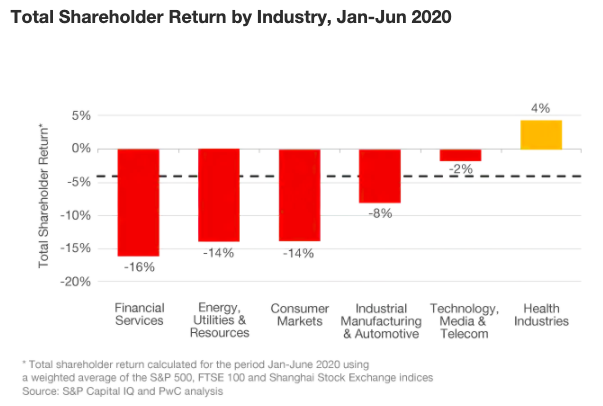

Most industries and regions are now seeing lower share-price volatility than in March and April, and the upward trend of major indices suggests investor confidence is returning. While several major indices are now only slightly below pre-COVID-19 levels, others have surpassed previous records. A comparison of the total shareholder return by industry of the S&P 500, FTSE 100 and Shanghai Stock Exchange for the first six months of 2020 shows how performance has varied widely, both by region and by industry.

The Nasdaq Composite fell close to 25% between 1 January 2020 and its lowest point on 23 March 2020. However, demonstrating the resilience of the technology sector, the index went on to reach successive all-time highs, ending June at 12% above where it started at the beginning of the year. While the recovery in valuations may hinder some take-private deals, this confidence bodes well for other forms of dealmaking.

M&A looks set to rebound ahead of the global economy

The apparent disconnect between the economy and soaring financial indices has led many to question the sustainability of the rally; we believe M&A activity can lend credibility to the longer term sustainability with well thought-through deal valuations based on robust strategic analysis. Dealmakers will price the relative risks and opportunities within each industry and successful transactions will demonstrate greater confidence in the market.

Companies that approach M&A as part of a long-term strategic plan will be in a better position to capitalise on the opportunities presented in this challenging climate. In addition, history shows that those who engage in M&A early in periods of economic uncertainty see higher average returns than those who wait.

Several important indicators are flashing green for a jump-start in new M&A activity:

- Interest rates are at historic lows.

- Record levels of corporate cash and private markets capital.

- Banks are beginning to lend again and alternative capital sources are available.

- Liquidity in bond markets has returned and new issuances have increased.

- Bankruptcies and the number of distressed companies are likely to rise, especially as government support programmes expire.

- A strong US dollar promotes international opportunities for US investors.

Despite these strong fundamentals, volatility appears to be here to stay. Current COVID-19 cases continue to increase in many territories and fears of a second wave remain ever-present. Companies and investors are closely assessing the underlying business impacts, however it is unclear what the longer term effect will be on financial markets and CEO confidence. Additionally, the forthcoming US elections and global trade relations are casting further uncertainty over the future.

Markets will also continue to be affected by wider global megatrends. We have already seen convergence across industries as technology continues to disrupt and fundamentally change many business models. Multinational organisations will also need to learn how to navigate in an increasingly localised world. There is a definite opportunity for companies to seize the moment and use M&A to rethink and adapt their long-term strategy.