Media consumption in Canada has reached a tipping point regarding digital content and traditional media.

Media consumption in Canada has reached a tipping point, as digital video finally reached nearly one-third of total daily viewing time, according to eMarketer’s latest forecast on time spent with media.

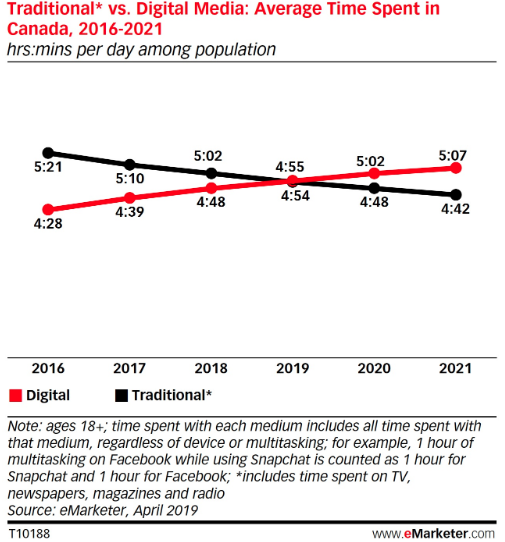

In 2019, adults in Canada will spend an average of 4 hours, 55 minutes on digital devices, compared with 4 hours, 54 minutes with traditional media, such as TV, radio and print.

Consumers’ time spent with digital media, which includes all online activities, will grow 2.6% this year. This growth has been in steady decline since 2011, when eMarketer began its forecast.

Conversely, traditional media consumption will drop 2.5% in 2019, the eighth consecutive year of declines.

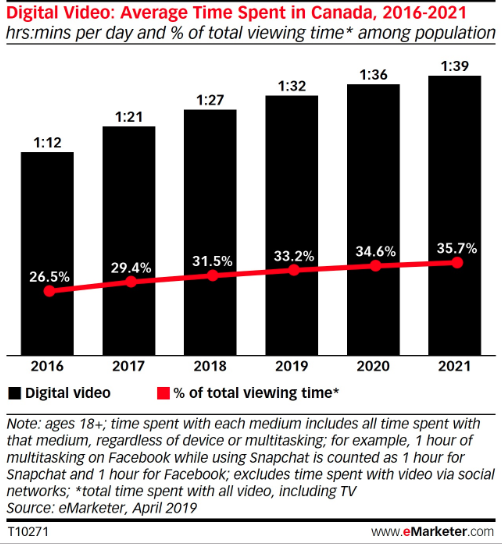

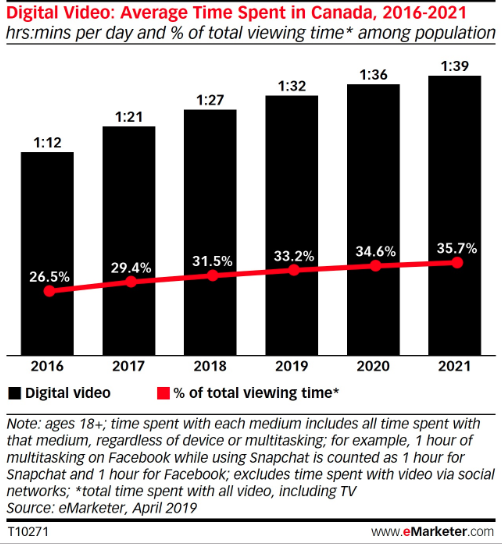

Video is a major driver of growth in digital consumption. In fact, video time is directly replacing TV time. Average daily video time this year will jump by 5 minutes to 1 hour, 32 minutes, reaching nearly one-third of total (digital video and TV) viewing time. Traditional TV time will drop by 5 minutes to 3 hours, 4 minutes.

“More than any other country in our global forecast, digital video time is greatest in Canada in relation to TV time,” said Paul Briggs, eMarketer’s senior analyst on Canada. “This is due to the immense popularity of Netflix and YouTube among Canadians.”

Mobile devices and rich experiences in apps are also key drivers of increased digital time. Media consumption on mobile now exceeds 3 hours daily, on par with TV.

“Mobile’s ascent is not just a device story, it’s a services story,” Briggs said. “Digital services like social feeds are inherently mobile, and video platforms now deliver highly watchable content on smaller screens like smartphones and tablets.”

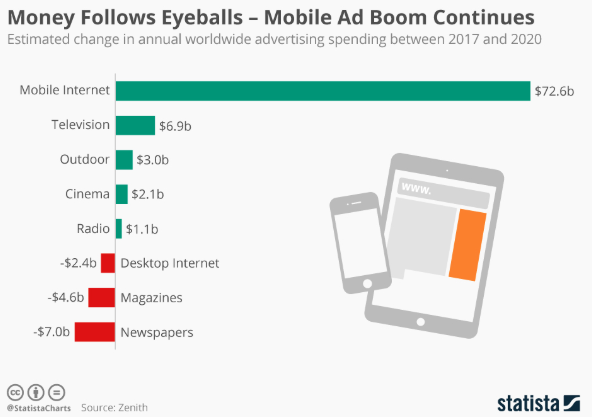

Advertising dollars are following eyeballs. Digital ad spending in Canada surpassed traditional for the first time in 2018. This trend—up from less than one-third of all spending in 2014 (30.8%)—shows no sign of slowing down, due to high levels of brand activation and engagement in digital advertising formats.

The increase in digital advertising has come at the expense of traditional formats, which show slight annual declines. TV remains a large and stable ad market at CA$3.21 billion ($2.48 billion), or 19.5% of all ad spending. This represents modest growth—0.7% this year—though we expect TV spending to decline slightly in upcoming years, as brands divert brand-building budgets in TV to more targeted and measurable advertising via digital channels like social media.

Women rule Canadian media consumption

Women are taking the lead when it comes to media use, consuming more traditional media than men overall, according to the Global Media Intelligence Report 2018.

According to the report, Canadian women are more likely to read magazines (43.3% of women versus 40.5% of men), use a tablet (54.8% versus 49.1%) or a smartphone (88.5% versus 86.9%), listen to the radio (83.3% versus 76.1%) or watch TV (87.6% versus 83%).

Meanwhile, men are more likely to read newspapers (53.4% versus 47.7%), use Smart TVs (35%) and are a tad more likely log onto desktop and laptop computers (85.8% versus 85.7%).

Overall, Canadians aged 45 to 54 are the most likely to listen to the radio (88.4%) and watch TV (93.7%), whereas the 55- to 64-year-old demographic is most likely to read magazines (52.2%) and newspapers (67%).

A significant number – 79.7% – still say they listen to the radio, amounting to more than one hour per day, drawing a clear correlation between the increase in age and an increase in print, radio and TV consumption.

Desktops, laptops and tablets were the most popular source of internet for Canadians, whose average daily use amounted to 3 hours and 43 minutes compared to two hours and seven minutes per day on mobile. However, 87.7% of Canadians own a smartphone versus 85.5% of desktop and laptop owners.

Ad spending worldwide

A major milestone in the world of advertising is happening: Digital ad spending will exceed traditional ad spending in the U.S. for the first time ever by 2023 after big numbers last year.

According to the eMarketer report, North America’s total media ad spend reached $235.23 billion in 2018 – the highest in the world – with Asia-Pacific spending an estimated $211.10 billion.

Western Europe came in third with a spend of $106.73 billion, followed by Latin America ($30.54), Middle East and Africa ($23.91) and Central and Eastern Europe ($18.16).

TV ad spending is expected to decline 2.2% to $70.83 billion in 2019, largely because there are no elections or big events, such as the Olympics or World Cup.