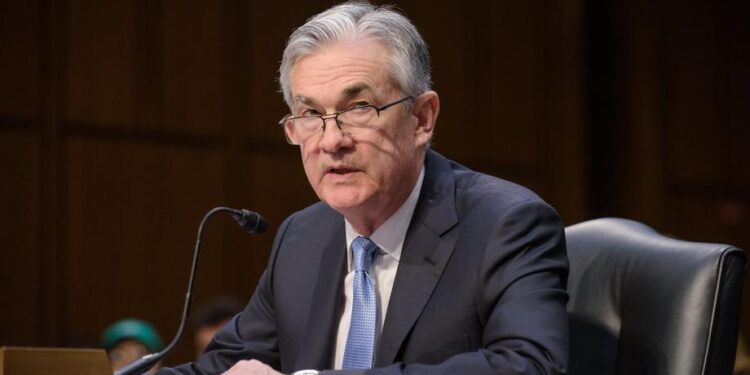

In his address to the nation, Fed Chair Jerome Powell emphasized that the Fed is not rushing to lower interest rates because of the current economic strength in the U.S. The choice to maintain stable interest rates within the target range of 4¼ to 4½ percent was influenced by recent indicators showing that “economic activity has continued to expand at a solid pace.”

Powell stated, “The economy is strong overall and has made significant progress toward our goals over the past two years. Labor market conditions have cooled from their formerly overheated state and remain solid. Inflation has moved much closer to our 2 percent longer-run goal, though it remains somewhat elevated,” adding, “today the Federal Open Market Committee decided to leave our policy interest rate unchanged and to continue to reduce our securities holdings.”

Powell stated that the labor market remains strong, while inflation, which is “somewhat elevated relative to our 2 percent longer-run goal,” has significantly cooled.

Powell attributed a “good part” of the central bank’s higher inflation expectation forecast to tariffs.

At the press conference following his address, Powell said: “I want to avoid commenting, even indirectly, on the conduct of tariffs. You know, it’s not our job, and it’s not our job to comment on the moves that people make. So I wouldn’t want to criticize anything that’s happening or really comment on it one way or another—praise it, for that matter.”

Powell said the Fed would “be watching” for future changes to tariffs and their impact on the economy.

By CEO NA Editorial Staff