On Wednesday, Federal Reserve officials approved a quarter-point rate cut, reducing their benchmark lending rate to a range of 3.75% to 4%, the lowest level in three years.

The decision received only two dissents: one from Fed Governor Stephen Miran, who favored a larger, half-point cut; and another from Kansas City Fed President Jeffrey Schmid, who preferred to keep borrowing costs steady.

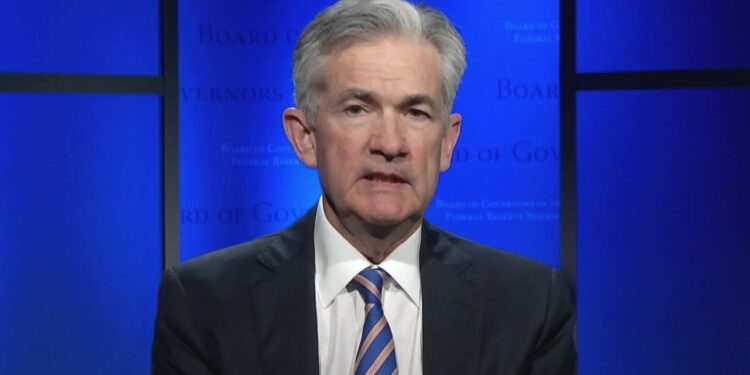

After the announcement, Fed Chair Jerome Powell cautioned the U.S. that the upcoming interest rate cut might be delayed longer than the market anticipates.

He stated, “What do you do when you are driving in the fog? You slow down. I don’t know how that is going to play into things. The data may come back. But there’s a possibility that it would make sense to be more cautious about moving.”

Powell said that a further cut in the policy rate at the December meeting is not guaranteed; in fact, the Fed considers it unlikely.

Today, U.S. stock futures paused as Wall Street absorbed Powell’s easing prospects of an additional interest-rate cut. Dow Jones Industrial Average futures fell 0.3%. Contracts on the broad benchmark S&P 500 and Nasdaq 100 hovered around the flat line.

U.S. Treasury Secretary Scott Bessent stated this morning, “The decision by the Federal Reserve yesterday – the decision to cut rates by 25 basis points, I applaud, but the language that went with it, tells me that this Fed is stuck in the past. Their inflation estimates have been terrible so far this year… Their models are broken.”

By CEO NA Editorial Staff