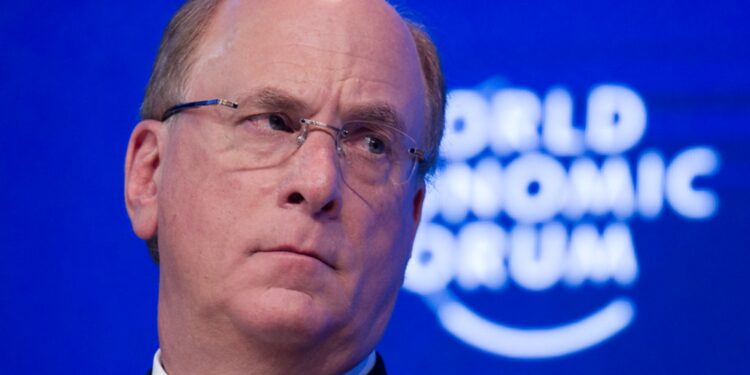

Billionaire Larry Fink has criticized the Trump administration, stating that the turbulent changes in policies and decisions are crippling American consumers and businesses.

Fink stated that the short-term consequences have been severe for businesses, as consumers and investors are hesitating and “pulling back.”

“Talking to CEOs throughout the economy, I hear that the economy is weakening as we speak,” Fink stated, “All of these things have that ripple effect, and we will see over a long cycle whether this ripple effect gets worse or does it stabilize,” he added.

Despite criticism of Trump’s latest moves, Fink acknowledged that highlighting reciprocal tariffs could positively impact the U.S. economy. “Right now the president is focusing on tariffs, but when he talks about reciprocal tariffs, actually, that may bring down tariffs over the long run,” he noted.

“Could we have one quarter or two quarter of a flattening of our economy as we try to reset the economy? Absolutely. But I’m looking beyond that. If we are able to unlock private capital… that will restart and rekindle the next wave of a bull market,” the BlackRock CEO concluded.

Fink also stated that Blackrock’s recent purchase of two ports on the Panama Canal was not a political maneuver to support Trump’s recent pressure for the U.S. to “take back” the canal.

By CEO NA Editorial Staff