Five years ago, Obsidian Energy was founded aiming to become a top player in the oil and gas industry and prove they could reemerge stronger, leaner and more capable than ever.

The company once named Penn West Petroleum was starting a deep transformation that affected every aspect of the business giving the new management the opportunity to assess and find the right balance between production growth, debt repayment and return of capital to maximize stakeholder value.

And so far, everything is working fine for the Calgary Alberta based company.

Obsidian Energy achieved a consistent income in the second quarter of 2022 thanks to higher commodity prices and production volumes, reporting a net income of $23.8 million ($0.29 per share), which represents a small change from the $23.2 million ($0.32 per share) in 2021.

Most analysts are seeing a lasting investment opportunity in Oil and Gas companies and those working in Canada’s oil sands will certainly have a growth opportunity. Obsidian Energy is now under the leadership of Stephen Loukas, who was appointed Interim President and CEO in December, 2019 and elected to the Board of Directors following the 2018 annual meeting.

ACQUISITIONS MOVING FORWARD

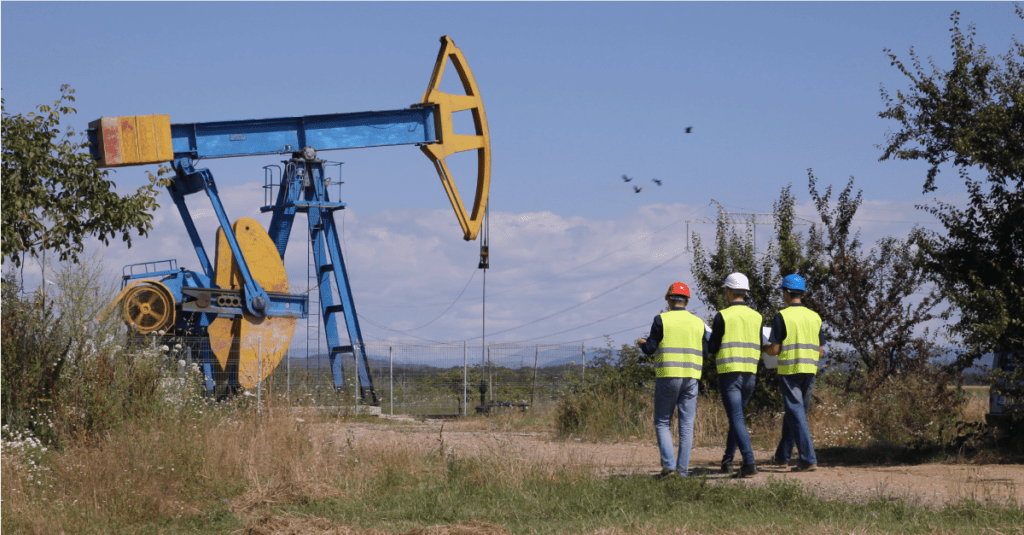

With fields along the Western Canadian Sedimentary Basin, a region which is the largest deposit of crude oil on the planet, Obsidian Energy is moving forward in its expansion plans taking advantage of their key developments in the Pembina Cardium, the Peace River oil sands and Alberta Viking.

Just last November, the company closed its acquisition of the remaining 45% interest in the Peace River oil partnership through a subsidiary. “With full ownership and the current favorable commodity price outlook, we are executing a four well development drilling program,” said Stephen after the deal was signed.

Also, in the first quarter of 2022 the company announced the purchasing of 23 sections (14,720 acres) of prospective oil sands rights from the Alberta land sale in the Peace River region. Obsidian Energy has also identified 28 potential Bluesky locations and 14 potential Clearwater opportunities on the new land, creating a contiguous land position with a compelling value opportunity to complement the recent drilling activity.

Stephen’s experience in corporate transactions, capital markets and leadership has been a key factor during this process. The company also announced last January the reconfirmation of its syndicated credit facility, with no changes made to its revolving period. The structure is expected to provide a stable capital source, operational liquidity and a long-term maturity profile.

SIGNIFICANT PRODUCTION GROWTH IN THE OIL AND GAS INDUSTRY

According to the company, Obsidian Energy’s development program in the first half of 2022 resulted in significant production growth, from the Willesden Green, Pembina and Peace River assets and the Peace River Oil Partnership production late in 2021. Stephen is convinced the firm is building on its 2021 success with encouraging results. “I am particularly encouraged by the results across our Willesden Green, Pembina and Peace River areas as this points to the depth and diversity of our portfolio and allows for significant optionality across our future development programs,” he says.

The company’s development program for 2021 was complete with all 35 wells on production. In the 2022 development program over 20 wells have been rig-released with eight wells on scheduled production. Seven additional wells started production activities in the first half of the year. For the company, net operating costs reflected higher repair and maintenance activity levels motivated by rising global oil and gas prices. However, they are expected to decrease going forward due to the full year impact of lower cost new well production.

With prices rising and a growing concern on how the Russian invasion in Ukraine is going to further impact markets, analysts are advising investors to move into oil companies.

Just last May, Stephen Loukas acquired 15,000 shares of Obsidian’s stock, purchased at an average price. The head of the company now directly owns 645,350 shares.

RESERVES VALUE INCREASE

According to Stephen, the 2021 reserves results speak of the strength of the company’s assets and technical teams. “We had an active year with the expansion of a very successful

capital program as well as the acquisition of the remaining interest in the Peace River Oil Partnership in November 2021,” he says.

The firm also reported that higher commodity prices increased the company’s reserve values and volumes across every category. “Additionally, our low finding and development costs generated exceptional value for our capital and in combination with the quality of our asset base we replaced more than double 2021’s production with new reserves,” he notes.

As a result, Obsidian Energy now reports a total proved plus probable reserve value increased by $621 million to approximately $1.8 billion at the end of the year. Stephen explains that due to the combination of the drilling results and continued cost efficiency gains, Obsidian Energy achieved its fifth straight year of greater than 100 percent reserve replacement on total proved 1P reserves and total 2P reserves, excluding acquisitions and dispositions.

During the first quarter of 2022, Obsidian Energy also completed the last substantial component of its inactive legacy portfolio decommissioning. In 2022, the company anticipates abandoning over 300 net wells and over 500 km of pipelines during the rest of year, a move aimed to further demonstrate its commitment to reducing the decommissioning liability. Stephen also underlines Obsidian Energy’s commitment to making a positive impact in the communities in which the company operates and live, minimizing the impacts of operations on the environment and building stronger relationships with external stakeholders. Just like other operators in the region, Obsidian Energy must adhere to regulations and approvals from numerous regulatory agencies at every phase, from construction to shutdown and reclamation.

THE NEW CHAPTER

A Securities and Exchange Commission investigation on Penn West Petroleum in 2015 resulted in something that was beyond a deep restructure for a company that was finding a way to move forward. The timing couldn’t be worse after the oil industry was facing a new crisis with prices collapsing 59% in only seven months, from June 2014 to January 2015. In June 2017, the company officially changed its name to Obsidian Energy. According to the new firm, the transformation experienced affected every aspect of the business and led them “to redefine the company and where and how it grows from here”.

And the opportunities ahead are looking as strong as the stock forecast by analysts. In 2021 the U.S. imported more than 3 billion barrels of crude oil and petroleum products, equal to 43% of the country’s consumption. The same year more than 96% of Canada exports went to the U.S., consolidating a safe regional market that will keep the Canadian oil and gas industry working hard to secure better results. Obsidian Energy is aware of that and is ready to write a new chapter in its history.

Click here to read the full August – September 2022 Publication