Increasing health-care productivity can lower medical cost inflation.

Text by Shubham Singhal and Erica Coe

Two steps —increasing healthcare-sector productivity and improving healthcare-market functioning to better balance the supply of and demand for health services— would likely produce sufficient savings to lower medical cost inflation to the rate of GDP growth.

Productivity improvements are the lifeblood of all industries, enabling them to deliver better products and services while reducing or carefully controlling prices. In the past few decades, for example, innovation enabled manufacturers to drop the average prices of laptop computers and cell phones by a substantial amount. In both cases, the sharp drops in price occurred despite dramatic technological advances that gave consumers significantly enhanced functionality.

Productivity improvements have also helped a wide range of other industries —from airlines to wealth management services— lower prices. Be- tween 2001 and 2014, for example, the average fee for wealth management advisory services decreased 13%.

If the healthcare industry had been able to achieve comparable productivity improvements, prices for consumers would often be much lower, while payors and providers would be able to maintain wages and margins. For example, if health insurance premiums had followed the same trajectory that wealth management advisory fees did between 2001 and 2014, the average annual premium for a family of four would have been US$6,155, instead of US$16,834, in 2014. In reality, very few areas in healthcare have seen costs decrease to any real degree. Innovation in healthcare has created a range of new treatments, services, and technologies, but often at high prices not always commensurate with the benefits delivered.

In short, healthcare innovation has not led to the types of productivity improvements that have enabled other industries to deliver “more for less.” Between 1999 and 2014, labor productivity (defined as real value added per worker) increased by only 6% in healthcare— but by 18% in other service industries and 78% in manufacturing. In most years during this period, productivity in the healthcare industry actually declined at the national level. Only in 2008 did the industry experience a comparatively large (2.9%) year-on-year in- crease in productivity. (The slowdown in hiring during the Great Recession may have led to a temporary boost as output grew faster than employment in the sector. Our experience suggests that in some regions of the country, 2008 was the only year between 1999 and 2014 that saw an increase in healthcare productivity.)

Calculating productivity changes in healthcare requires agreement on how the intended “output” should be defined and how the underlying costs needed to produce it are measured —two formidable yet surmountable obstacles. us, comparisons of productivity gains between healthcare and other industries are inexact. Nevertheless, our experience indicates that healthcare is far behind other industries —and indeed its own potential. Healthcare organizations that develop the ability to define and measure both their target output and associated costs will likely have a distinct advantage over competitors, because these are the first steps to improving value for consumers while minimizing costs.

If healthcare productivity is to rise —even if only to the level achieved by other service industries— two things need to happen: both payors and providers need to radically alter their business models, and we, as a society, will want to consider adopting “smart” regulations.

BUSINESS MODEL CHANGES

Too often today, healthcare delivery is based on outdated approaches that rely heavily on overly expensive labor and care venues. Alternative approaches are possible, though. For example, ambulatory surgery centers (ASCs) have radically redesigned the provider business model for operations by using a smaller capital footprint, better asset utilization, and higher labor productivity. ASCs capitalize on the fact that when surgeons and facilities perform a high volume of specific procedures, care quality improves and productivity increases. ASCs have prices that are, in many cases, close to half those at most health systems and for consumers, the benefit is clear: more for less.

Diagnostic laboratory chains, retail health clinics and dialysis companies offer other examples of how the provider business model can be redesigned. We have found, for example, that the lab chains are able to provide most tests at about half of what a typical hospital charges. (We recognize that some of this variation is a result of differences in the complexity of the diagnostics.) They do so by offering consumers convenient, local collection centers and by shipping the samples to much larger centers for analysis. The larger centers gain the benefit of scale and are better able to balance fluctuations in demand, thereby enabling not only better labor capacity utilization but also more efficient use of capital. ere is no reason to believe other new entrants will not find ways to offer other traditional hospital services in outpatient settings —at a much more attractive price point and, potentially, with increased convenience for consumers.

IMPROVE MARKET FUNCTIONING

In well-functioning markets, demand-side and supply-side incentives are balanced. Think again of consumer electronics: the combination of engaged consumers making informed choices and a competitive market of providers has led to a steady stream of product innovations and frequent price reductions. However, balanced incentives are rare in healthcare. Instead, misaligned incentives —between patients and providers, providers and payors, and among different providers— all too often result in increased costs without any related benefit to consumers.

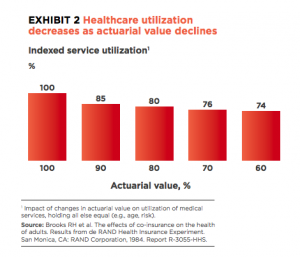

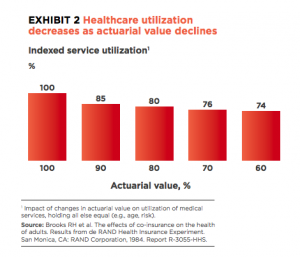

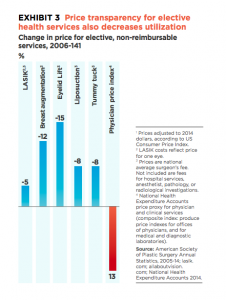

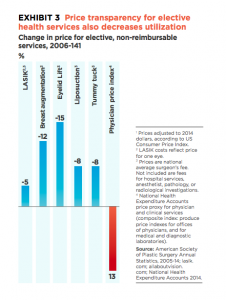

On their own, both demand-side and supply-side incentives can be effective in healthcare. Considerable evidence shows, for example, that utilization decreases when consumers pay more out of pocket. Even a 10% increase in consumers’ share of costs (a 10% reduction in actuarial value) decreases utilization by 15%. Similarly, the pressure of engaged consumers paying full costs in a price-transparent market has led to declining prices for elective procedures, in some cases by double digits.

Episodes payments and other bundled payment approaches that reward providers for outcomes rather than volume have also been shown to lower prices and reduce the delivery of unnecessary services, including emergency room visits and excessively long hospital stays.

The State of Arkansas, for example, launched episode payment for attention deficit/hyperactivity disorder and found that the average episode cost fell by 29% in the first year. It also saw reductions in average episode cost for other conditions, although in a few cases its spending remained flat. Another payor has found that the use of episode payments for hip replacements significantly decreased the average cost of that procedure while substantially reducing the post-surgical readmission rate.

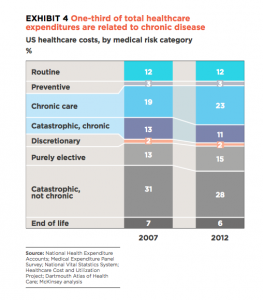

Under the model of “smart cost sharing,” subsidies may be needed to help lower-income individuals afford appropriate routine and elective care. Furthermore, this redefinition of covered benefits does not match most people’s current conception of health insurance, and it is not fully consistent with existing mandatory or essential health benefits. Employers and payors would need to work through mandated benefits requirements, depending on the applicable federal and state regulations. However, the impact of adopting this approach could be profound. Our research has shown that almost 30% of the medical costs covered by commercial plans result from routine, discretionary, or purely elective care. If a payor curtailed coverage for these types of care, the premium reductions it could pass on to consumers could be significant.

Some providers could also benefit from this redefinition of health insurance coverage. Productive providers, for example, could gain market share by offering consumers more attractive pricing, added convenience, and perhaps higher-end amenities for routine, discretionary and elective care. In addition, the providers could partner with payors on outcomes-based payment models for catastrophic and chronic care to earn higher revenues and margins for their more efficient, lower-cost care.

For this redefinition of insurance coverage to succeed, however, certain supportive elements must be in place. Consumers must have effective mechanisms to help them absorb the costs –health savings accounts do not yet meet this standard. Consumers would also need tools to help them understand the benefits and risks of the types of care they are considering, and to enable them to compare quality and prices at different providers. Transparency tools have a long way to go, but evidence is already emerging that when consumers do have access to cost data, they use it. For example, a high proportion of consumers on the public exchanges are comparison shopping for insurance coverage, with many purchasing lower-priced plans.

IMPLICATIONS FOR INCUMBENTS

The healthcare industry is ripe for disruption, and incumbents must be prepared to respond. New entrants have already demonstrated the effectiveness of radically rethinking healthcare business models, and there is no reason to think others will not follow. Incumbents that want to avoid being overtaken by these new entrants must pivot quickly to act like attackers themselves (as Charles Schwab did following the advent of online brokerages—it was able to stave off at- tackers and maintain margins by radically lowering its prices, introducing online trading, and improving customer support).

As payors and providers rethink their business models, improving productivity drastically and quickly must be uppermost in their minds. The first incumbents that can do this will gain a significant competitive advantage. us, radical new ideas should be strongly considered —minor tweaks will not be sufficient in a world where an Amazon- or Walmart-like attacker could materialize.

Some of the changes payors and providers need to make are quite different. Payors, for example, should focus not just on back-office services but also on front-office operations. Digital sales are significantly less expensive than traditional sales. Providers could start with supply chain optimization and better clinical workforce management, but they should not forget the other levers available to them. Both groups should be aggressive in their efforts —in our experience, many of them do not pull these levers hard enough.

There is also a real opportunity for collaboration between payors and providers to reduce complexity and increase transparency and the use of payment for value. In addition, incumbents could collaborate with appropriate public agencies to update the regulatory framework. Smart regulations can ensure that both consumers and medical standards remain protected while enabling the innovations needed to increase productivity and improve market functioning. Collaboration between payors, providers, and public agencies could also help rebalance incentives in the health- care market, enabling that market to operate mo- re efficiently. For example, redefining what constitutes essential health benefits has the potential to benefit all three groups— without adverse im- pact on consumers, who may, over time, see an improvement (i.e., more cost-effective and/or convenient choices).

Finally, payors and providers should remain alert for innovations that advance best practices, as we- ll as for emerging evidence about the value digital technologies can bring. Both of these have the potential to deliver substantially greater improvement than we have estimated in this article.

The time for incumbents to act is now. Simply put, traditional approaches to delivering and paying for healthcare are no longer adequate.