CEO Michael Dell is making headlines once again as he takes his company public in an unusual and controversial way.

Michael Dell is a man who is confident in the fact that his bets will pay off.

He founded the company now known as Dell Technologies in his dorm room at the University of Texas in 1984, and by the age of 27 had become the youngest-ever boss of a Fortune 500 company.

By comparison, Mark Zuckerberg was nearly 29 when he first made the list in 2013.

Dell is currently the chairman and CEO of Dell Technologies, which was formed in 2016 when Dell acquired computer storage giant EMC. The estimated $67 billion merger was the largest technology acquisition ever. Yet Michael Dell had already revolutionized the business of personal computers years earlier by selling them directly to customers, adopting just-in-time manufacturing and lean, global supply chains that undercut rivals.

And the man—and the company he leads— continue to evolve.

Dell-EMC returned to public markets on Dec. 28, 2018, nearly six years after Dell took it private in what was then the biggest buyout since the financial crisis of 2008. Shares opened at $46 on the New York Stock Exchange, giving Dell-EMC a market capitalization of $34 billion, according to Forbes.

An unconventional IPO

The December IPO was somewhat unconventional.

Dell-EMC bought back shares that tracked the financial performance of software maker VMware, in which the former held an 81% stake. Buying back the shares allowed Dell to bypass the traditional IPO process, which would likely have involved a grilling by investors over the company’s $52.7 billion debt pile.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5,6″ ihc_mb_template=”3″ ]

Nevertheless, the deal earned the scorn of multiple hedge fund managers, who said Dell’s offer for the tracking stock ($24 billion) was too low. Furthermore, the deal put the CEO back in the bullseye of his old nemesis, investor Carl Icahn, who bought an 8% stake of the tracking stock and threatened to sue if the offer wasn’t either dropped or raised.

Dell bowed to the pressure and offered investors more money—al- though not as much as Icahn wanted—and with Dell-EMC investing heavily in cloud, its FY2018 results showed it is likely to remain one of the top tech companies in the world for some time to come.

A new era

With an estimated net worth of $27.5 billion, Michael Dell is one of the wealthiest people in the world.

His company’s controversial return to public markets show that from his early career as one of the youngest CEOs of a Fortune 500 company until today, Dell is used to getting his way. He was only 23 when the company made its first IPO in 1988 and has become known for both his competitive spirit and enjoyment of the billionaire lifestyle.

Dell is known to be friends with a number of other tech billionaires—Salesforce CEO Marc Benioff is a particularly close ally. The two men participated in a public Fitbit walking challenge in 2014, with Benioff’s team emerging victorious. But Dell is such a fighter (and fitness fanatic) that Benioff later joked that he had attached his Fitbit device to his dog to help him record a greater distance.

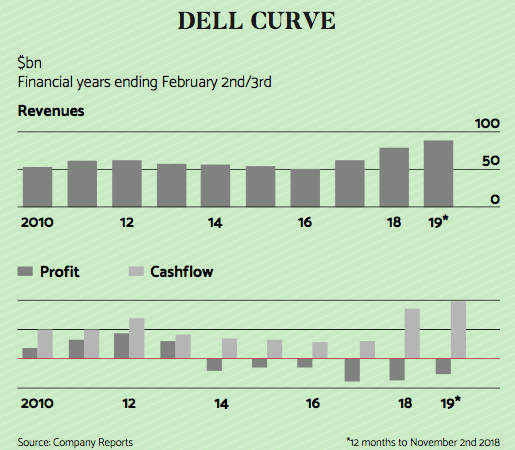

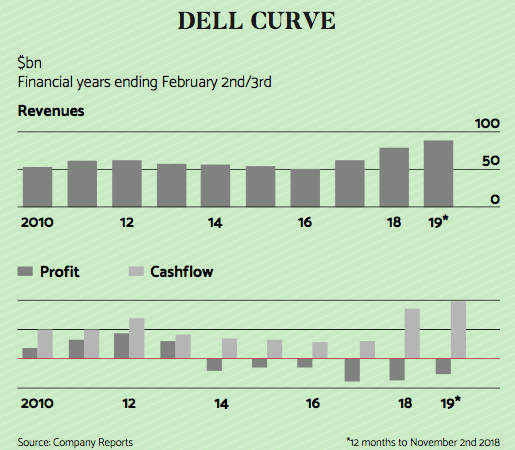

Following its recent IPO, Dell-EMC announced annual revenue of $78.7 billion for 2018, substantially higher than the roughly $62 billion it accrued the year before.

Dell’s hope is that his company’s investments in cloud computing and software, which offer far higher margins than its old PC business, will continue to boost profitability.

Few would dare to bet against him.

[/ihc-hide-content]